Benefits of trading for 30 minutes a day

This trading approach brings some great perks, letting traders strike a balance between work and personal life, improving discipline, and reducing stress. Here are the key benefits of such an approach.

Time optimization: Saving time enables traders to dedicate more time to personal matters and responsibilities, enhancing their quality of life.

Discipline: Limited time helps traders be more focused and organized, increasing trading efficiency.

Stress reduction: This approach helps reduce stress by limiting information overload and minimizing the impact of emotions on the decision-making process.

Balanced lifestyle: Traders can easily combine trading with their personal life, maintaining healthy relationships and hobbies.

Risk reduction: A focused approach to trade selection promotes a more critical attitude toward risks and choice of strategies.

Daily trading routine examples

Establishing a structured daily trading routine is crucial for traders across various styles, whether they engage in day trading, swing trading, or rely on algorithmic strategies. The following examples outline a 30-minute trading routine tailored to each approach, offering a glimpse into how traders can adapt these routines to enhance their daily trading efficiency.

From quick macroeconomic analyses and detailed asset evaluations to adjusting algorithms for current market conditions, these routines serve as valuable frameworks for traders seeking consistency and effectiveness in their trading activities.

For day traders

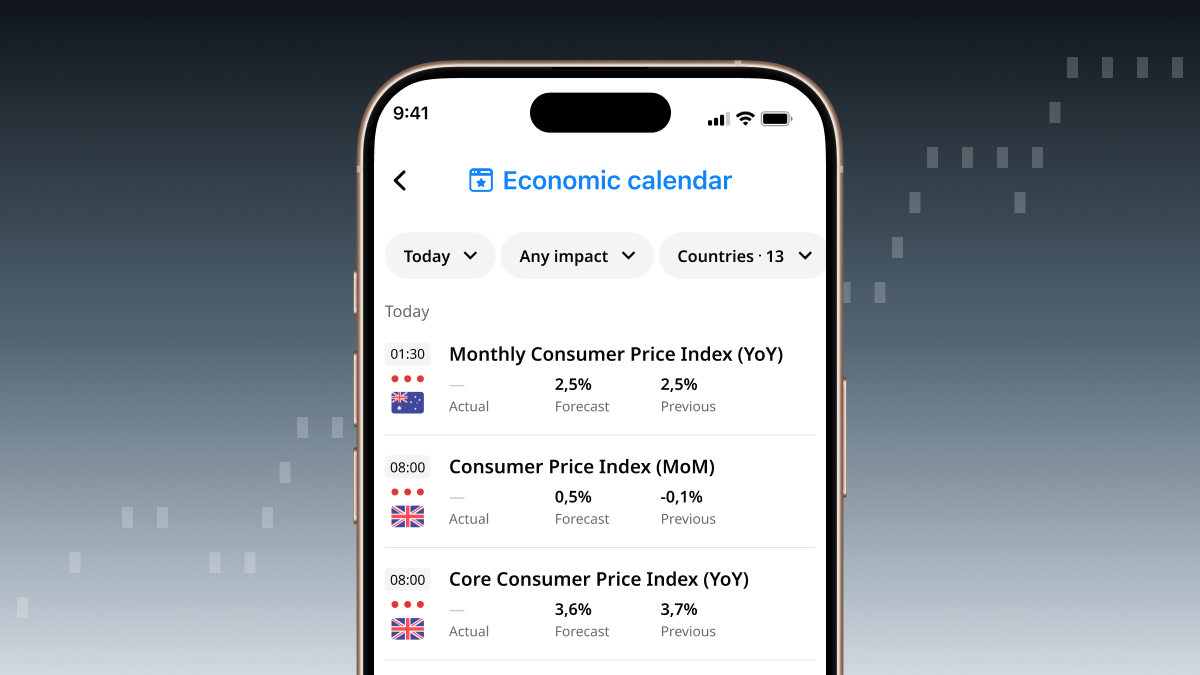

5 minutes: Quick macroeconomic analysis using pre-selected sources and an economic calendar.

15 minutes: Detailed analysis of selected assets, determining entry and exit points for trades.

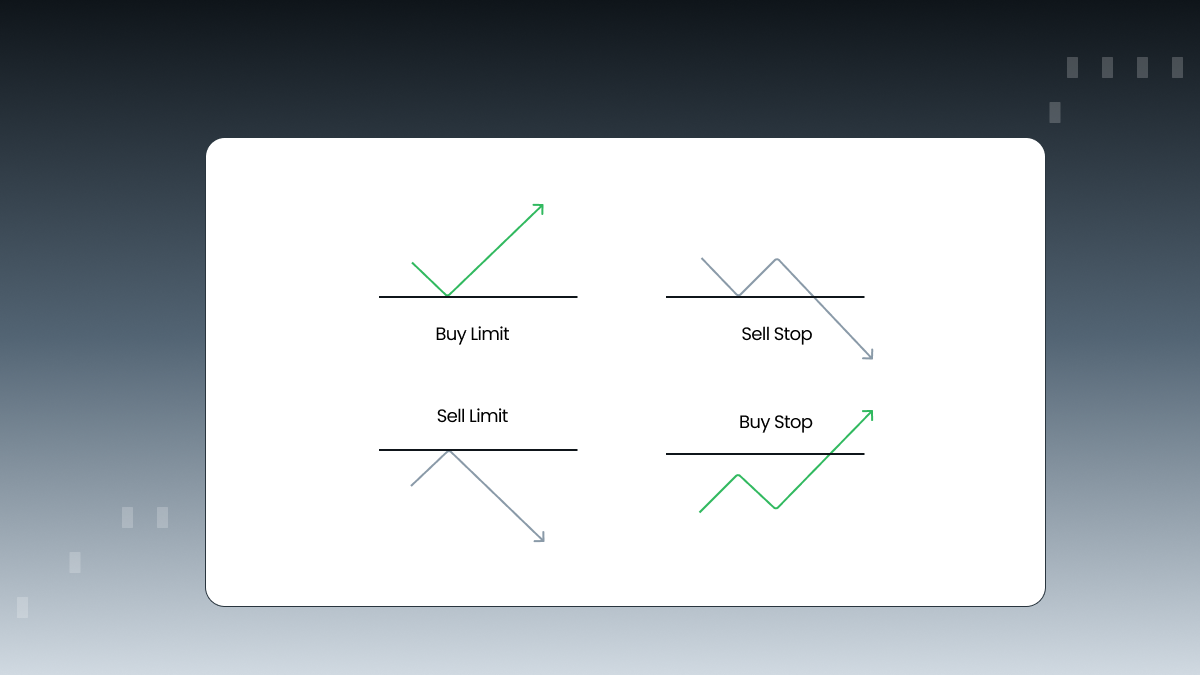

5 minutes: Execution of market trades or placement of pending orders.

5 minutes: Planning for the next day, including strategy adjustments and preparing for the upcoming trading session.

For swing traders

10 minutes: Weekly asset selection based on market analysis, with special attention to trend changes, news, and reports.

10 minutes: Determining position size and entry/exit points for trades.

5 minutes: Monitoring open positions and adapting the strategy to current market conditions.

5 minutes: Analyzing results and adjusting the approach based on the data obtained.

For algorithmic traders

10 minutes: Checking the efficiency of algorithms and analyzing trades from previous sessions.

10 minutes: Adjusting algorithms to current market conditions, including asset adjustments for trading.

10 minutes: Testing new strategies and algorithms, exploring alternative automated solutions to enhance trading.

These examples illustrate how traders with different approaches can adapt a 30-minute trading routine to their daily schedules. We hope this information proves helpful in optimizing your daily trading routine.

FAQ

Is a 30-minute chart suitable for day trading?

Trading for 30 minutes a day can be an effective strategy if a trader can quickly analyze the market and make informed decisions. This approach requires a good understanding of market trends and precise timing, as the short time frame limits the number of possible trades and increases the importance of each choice. However, with the right approach and strategy, 30 minutes a day can be sufficient for successful trading.

What is the strategy for the first 30 minutes of a trading day?

The trading strategy begins with thorough preparation, including analyzing news and selecting assets with high movement potential. Traders then identify target instruments and carefully observe the formation of trends and patterns that indicate optimal entry and exit points for trades. This approach requires quick reactions and readiness to make instant decisions based on market dynamics, with positions being closed within the day with set profit targets and risk limits.

What are the benefits of trading for 30 minutes a day?

Trading for just 30 minutes a day has its perks. It’s perfect for people with busy lives since it leaves room for relaxation and stress relief. Plus, it helps you become more disciplined in your trading approach. The limited daily time keeps you focused, leading to better strategies and potentially higher returns. It also cuts down on unnecessary trades, saving you money. In simple terms, spending 30 minutes a day on trading fits smoothly into your routine. It builds a solid yet flexible foundation for a healthy trading mindset and improves overall market efficiency.

Summary

Achieving success in the markets is possible even with limited time. This article emphasizes the importance of discipline, strategic planning, and effective time management. This approach enables traders to achieve results while maintaining a balanced lifestyle and minimizing stress, making trading accessible and productive for busy individuals striving toward financial success.