Even with all the junk food controversy, the Big Mac is known and loved by many people around the globe. But did you know that the Big Mac was also an economic indicator?

Read this article to learn about the Big Mac Index, what it means, how it was created, and how you can use it in trading.

Two all-beef patties

Wherever you live – Tokyo, Moscow, Colombo, or Oslo – you can go outside, head to the nearest McDonald’s, and have two all-beef patties, lettuce, cheese, pickles, and onions, all covered with a special sauce and sandwiched between two buns. You can have yourself a Big Mac – roughly 500 calories of joy. Or not, depending on your eating habits.

Big Macs differ slightly from country to country in looks, size, and calories, but the basic formula for the world’s most famous hamburger stays the same.

The Big Mac’s ingredients include some of the most common food products available in most countries. Something that regular customers buy daily in local grocery stores: onions, meat, lettuce, cheese, pickles, etc. So you might call it a ready-to-go basket of goods. That’s why in the mid-’80s, The Economist chose this burger’s pricing as a simple tool for analyzing currencies.

Introducing the Big Mac Index

The Big Mac Index was invented in 1986 by The Economist — one of the most influential magazines on international business, politics, technology, and culture.

With a history of over 170 years, The Economist is rightfully regarded as the gold standard for economic news and world affairs reports. The magazine’s staff includes talented and highly trained journalists.

Throughout its existence, The Economist has introduced several indexes, including the Democracy Index, the Glass Ceiling Index, the Most Dangerous Cities Index, the Commodity Price Index, and the Big Mac Index. Based on the prices of Big Macs in different countries, the Index should give a more accurate currency valuation.

Suppose we have two countries — the US and China. We compare Big Mac prices in these two countries, in local currencies. The difference in prices will give us a Big Mac exchange rate, which often differs from what we get from official sources. Then, we can tell if the currency in question is over- or undervalued.

With the dollar-yuan Big Mac exchange rate, we get a rough proportion of 1:4 – $5.29 for the famous hamburger in the US and ¥25.63 in China. The result gives us an alternative idea of how much the Chinese yuan should cost: ¥4.84 for $1 against the official rate of ¥7.28 for a dollar.

This gastronomic approach is also called Burgernomics. It is based on the PPP theory, which stands for “purchasing power parity” — the idea that exchange rates should move toward equalizing the prices of identical baskets of goods and services in any two countries. In this case, the said basket of goods is a Big Mac.

What does the Big Mac Index show?

While the Big Mac Index can hardly be called a precise tool for indicating a currency value, still, the data can give some unexpected results and ideas.

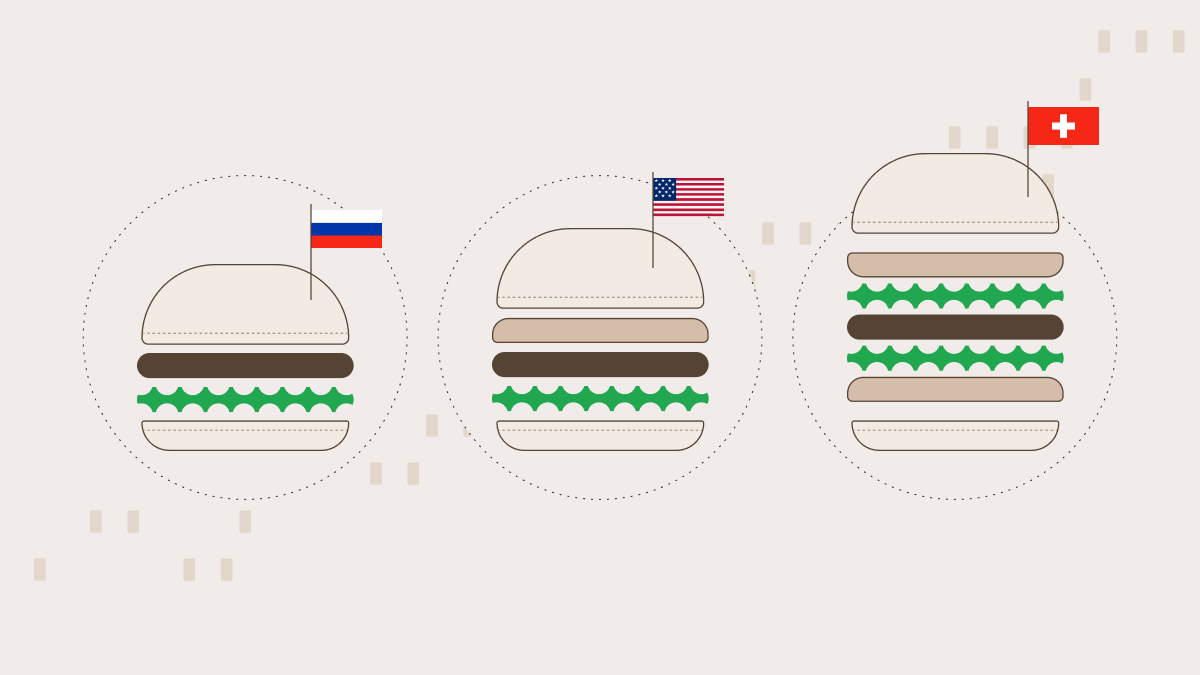

For instance, according to the Big Mac index, the Russian ruble is undervalued by about 59%. As of the latest release, one dollar costs about 85 rubles, while a Big Mac in Russia will cost you only $2.18. From the Big Mac Index perspective, one dollar should cost only 35 rubles.

The burger’s lowest price in the world is in Taiwan, followed by Indonesia, India, Egypt, South Africa, and the Philippines.

Other undervalued currencies include the Turkish lira, the Lebanese pound, the Malaysian ringgit, the Indonesian rupiah, and the Romanian leu.

The Big Mac Index shows that Switzerland’s franc is the world's most overvalued currency. A Big Mac will cost you 8.98 US dollars in Switzerland with a Big Mac Index rate of 1.7 francs per dollar. However, the currency exchange markets show that the USDCHF rate is 0.88. This means that the Swiss currency is overvalued by 49.3%. Again, that is if we choose to simplify the economics, putting all the correlating data and factors aside.

Can we use the Big Mac price comparison for trading?

Despite the funny name, the Big Mac Index and Burgernomics are not just funny ways to fiddle with the economy. They have become a global standard over the years. Today, several economic textbooks and a wide variety of academic studies include them as a useful tool for currency comparison.