The big picture remains bearish for USD despite corrections

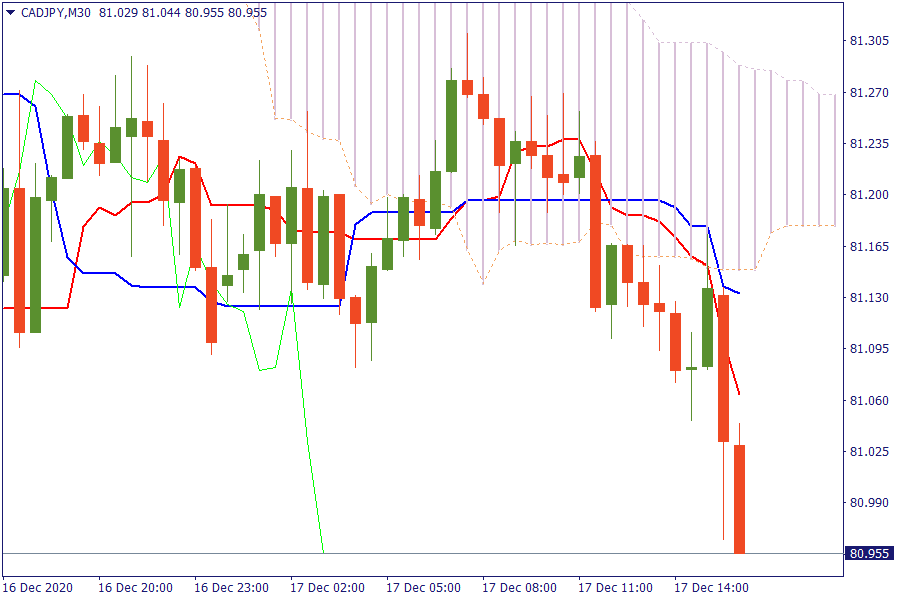

Ichimoku Kinko Hyo

CAD/JPY: The pair is trading below the cloud. Downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

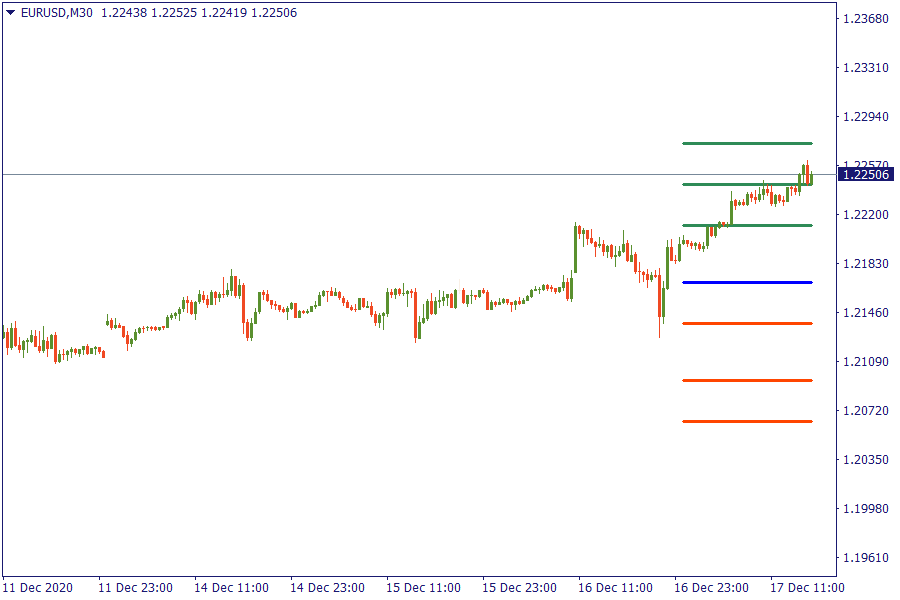

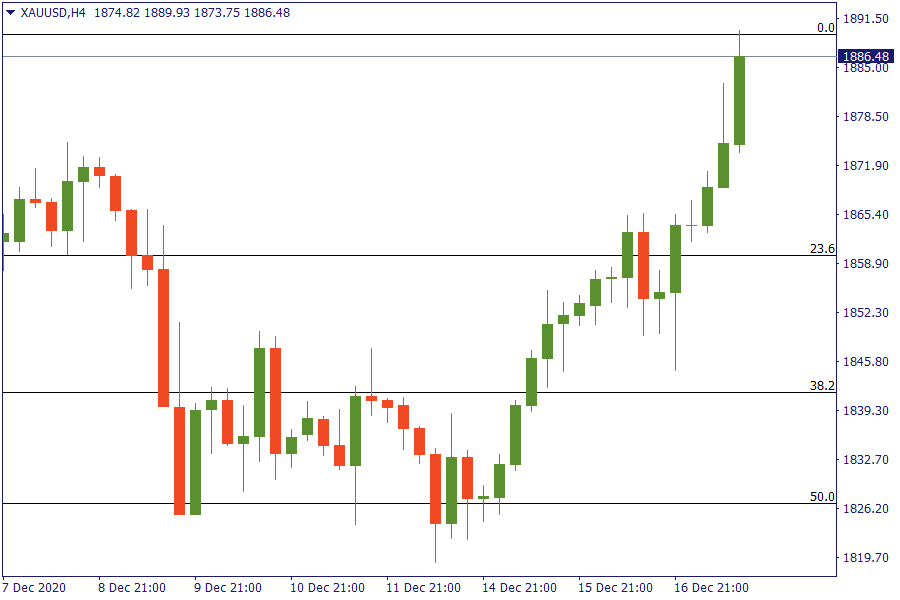

Fibonacci Levels

XAU/USD: Gold is trading strongly higher and achieves a full retracement.

US Market View

The Dollar Index fell to its lowest since May 2018, dropping below 90 as progress on a fiscal stimulus package and the promise of loose Federal Reserve policy for years to come encouraged moves into risk assets and alternative assets. U.S. stock markets are set to open higher as negotiators in Washington and Europe grind toward agreement on a U.S. fiscal stimulus package and an EU-U.K. post-Brexit free trade agreement. After a disappointing 1.1% drop in retail sales in November, the market will be looking to the release of data on jobless claims, housing starts and building permits for any further signs of economic weakness. Crude oil prices also hit their highest level since March, with the weak dollar and U.S. government stockpile data helping them to shrug off fears about the near-term demand trajectory.

USA Key Point

- ADP Canada Nov employment +40.8K vs -79.5K prior

- US Initial jobless claims 885K vs. 818K estimate

- US November housing starts 1547K vs 1535K expected

- The NZD is the strongest and the USD is the weakest