Escenario bajista: Ventas por debajo de 0.6560 con TP:0.65 y TP2: 0.6466 Escenario Alcista: Compras sobre 0.66 con TP1:0.6651

2020-01-16 • Actualizada

It seems like everything is getting worse for Australia. Despite a small relief connected with the US-China phase one trade deal, the economy of a country is set under pressure. As a result, the major analytical banks downgrade their forecasts on the performance of the AUD in the first quarter of 2020. As bushfires continue to pull the domestic confidence down and hints on the rate cut by the RBA keep circulating, let’s see how Morgan Stanley and ANZ forecast the further direction of the AUD.

Did you know about the bushfires in Australia? The record-breaking temperatures across the continent set the series of massive fires. According to economists, the fires in the Australian forests have already impacted the overall economic conditions, including employment levels, GDP, retail sales and consumer spending.

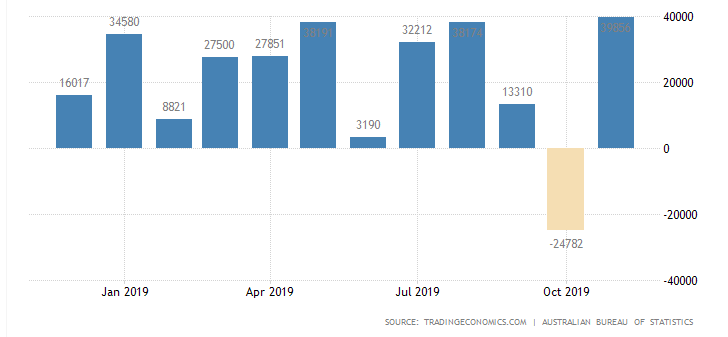

ANZ experts expect the decline in the number of jobs in December, as well as the negative GDP growth rate for the last quarter of 2019 and the first quarter of 2020, mentioning the fire crisis as a major risk. So, will we see a huge drop in employment levels after the surprising blast of 39.9 thousand jobs last time?

Employment change of Australia, quarterly

Sourced by: Tradingeconomics

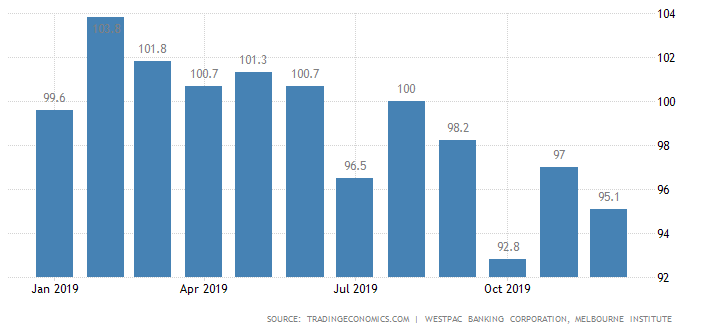

The consumer confidence remains weak with 95.1 in December 2019. The survey shows that consumers prefer to save rather than spend, thus the household saving rate reached 4.8% in the third quarter of 2019, which is the highest level since 2017.

Consumer confidence of Australia, monthly

Sourced by: Tradingeconomics

Morgan Stanley agrees with the negative impact of bushfires, sending the Australian lower in the first quarter of 2020 on the softer domestic situation. It thinks the negative effect of fires on the GDP growth may even outperform the "Black Saturday" outcome, which killed 173 people in 2009.

Following the negative economic data, both Morgan Stanley and ANZ forecast the Reserve bank of Australia to cut its interest rate during the upcoming meeting on February 4. This will be yet another headwind to the AUD.

While there is only the 50% chance of a rate cut priced into the market, Morgan Stanley is sure that it is underpriced. As a result, the Australian dollar may fall down after the announcement. The next focus of economists will be on the release of employment data on January 23. A strong job report may lower the possibility of a cut.

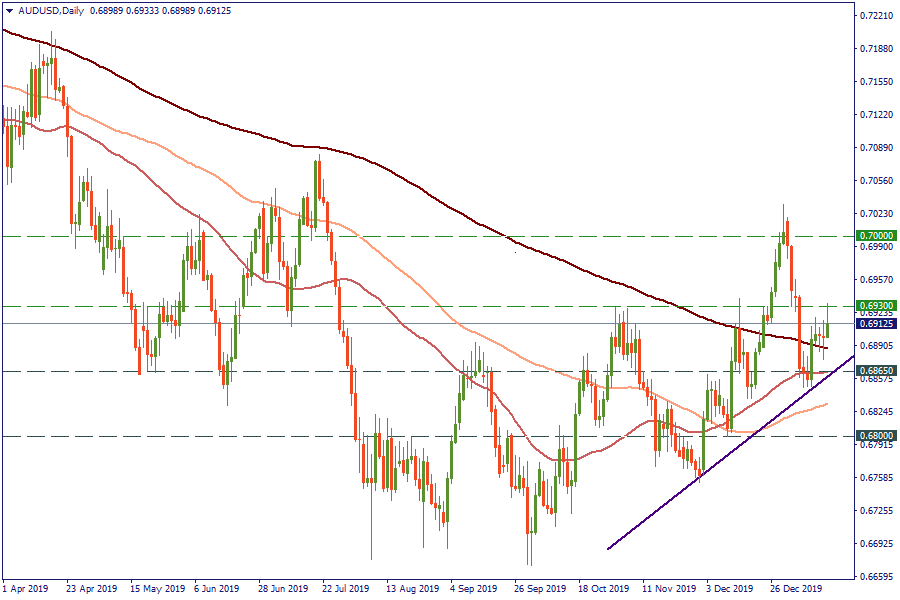

While the AUD/USD pair has got positive momentum on the risk-on environment, sticking above the 200-period SMA, analysts expect the limited optimism. So, the fall towards the 50-day SMA at 0.6865 may happen soon. After that, the next key level will lie at 0.68. If the pair reaches this level in the first quarter we may suggest the ANZ forecast for June 2020 to be correct. The bank sees the aussie at 0.66 in June 2020.

From the upside, AUD/USD is limited by 0.6930 with the following peak at 0.7.

Escenario bajista: Ventas por debajo de 0.6560 con TP:0.65 y TP2: 0.6466 Escenario Alcista: Compras sobre 0.66 con TP1:0.6651

El gas natural es la piedra angular de la economía europea.

Se acerca el fin de año. ¿Qué nos deparará el 2021? ¡Averigüemos qué esperan los principales bancos!

Escenario bajista: Ventas por debajo de 1.0820 / 1.0841... Escenario alcista: Compras sobre 1.0827...

Escenario bajista: Ventas por debajo de 2200 / 2194... Escenario alcista más próximo: Compras sobre 2197... Escenario alcista tras retroceso: Considera compras en torno a cada zona de demanda...

Escenario bajista: Ventas por debajo de 5220 ... Escenario alcista: Compras sobre 5225 (Si el precio falla en romper por debajo con decisión)

FBS mantiene un registro de tus datos para ejecutar este sitio web. Al presionar el botón "Aceptar", estás aceptando nuestra Política de Privacidad .

Su solicitud ha sido aceptada

Un gerente le contactará pronto

La próxima solicitud de devolución de llamada para este número telefónico

estará disponible en

Si tienes algún problema urgente, contáctanos a través del

Chat en vivo

Error interno. Por favor, inténtelo nuevamente más tarde

¡No pierdas tu tiempo – mantente informado para ver cómo las NFP afectan al USD y gana!