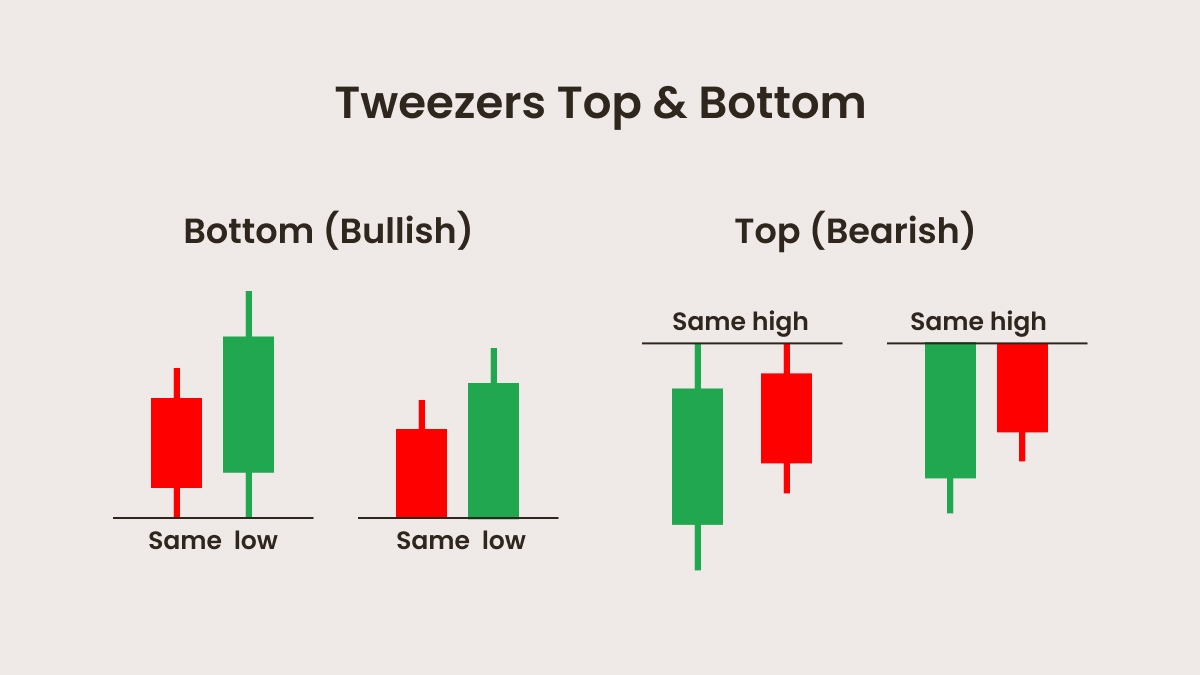

Tweezer patterns form when two consecutive candles print equal, or nearly equal, highs (a Тweezer тop) or lows (a Tweezer Bottom). “Equal” doesn’t have to be an exact match — a small difference of a few pips is acceptable. The similarity can be in the wicks, the open/close levels, or a mix (e.g. the first candle’s high aligns with the second candle’s close). Candle colors also don’t matter; what matters is that there is a shared rejection level.

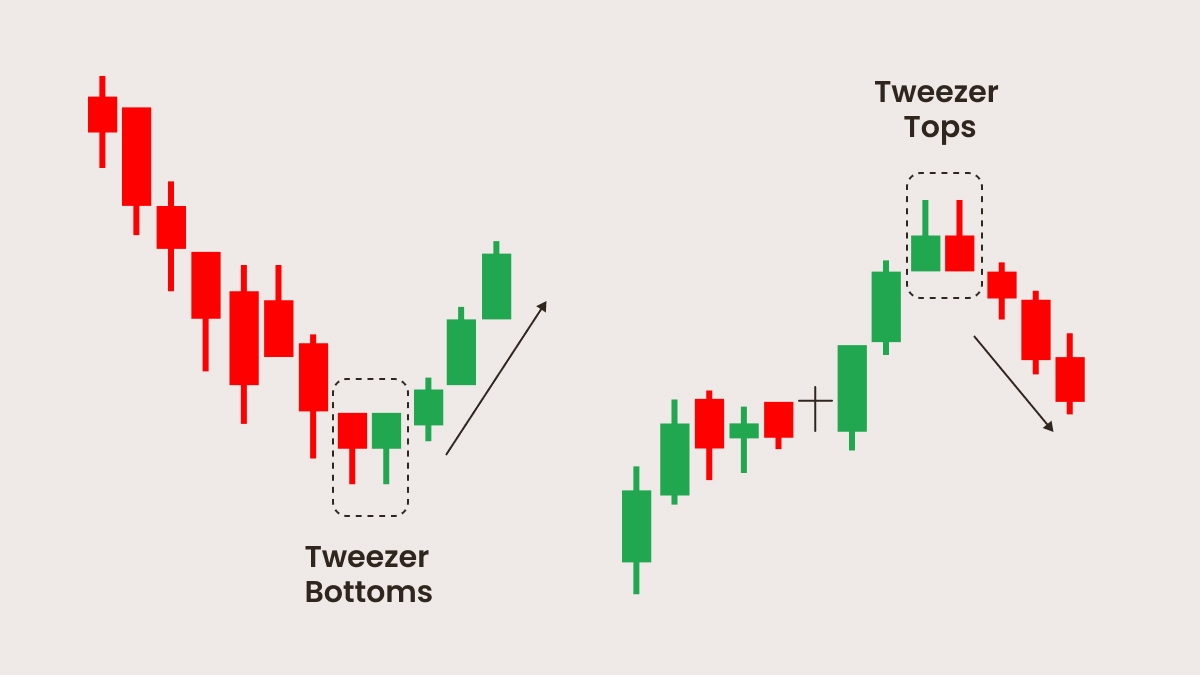

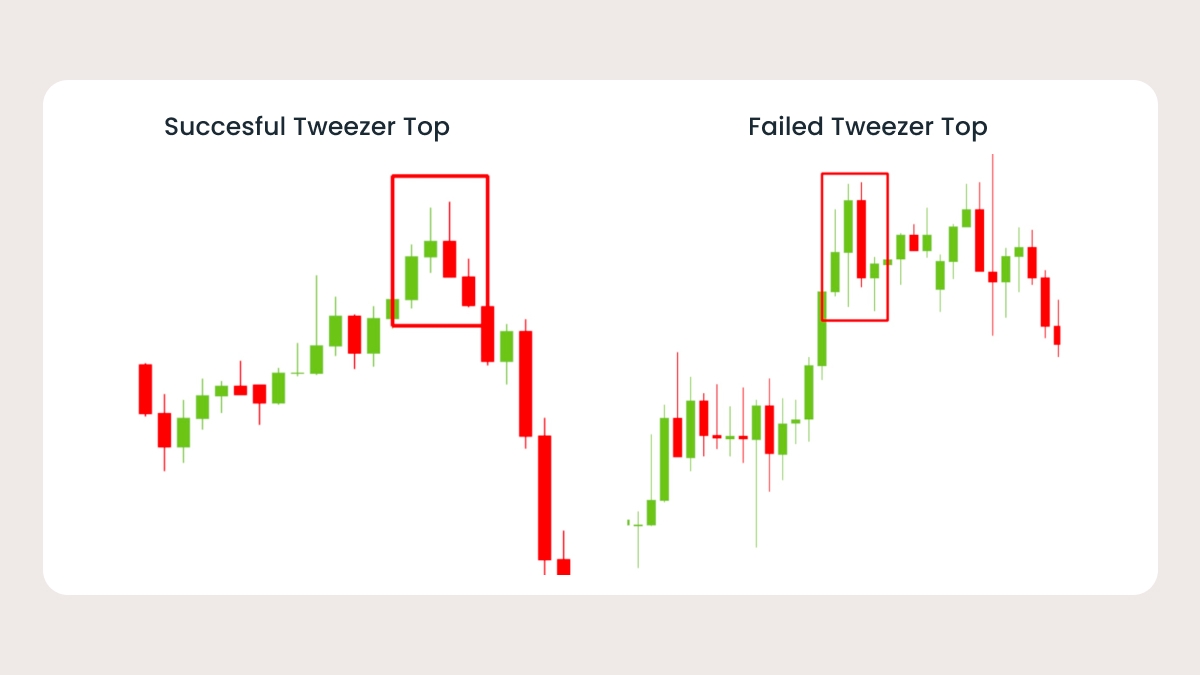

They can appear at the top of an uptrend or the bottom of a downtrend and indicate that the trend is starting to lose steam. The price hits a level, bounces off, and refuses to break through. They don’t mean a reversal is definitely coming, but they’re a strong sign that the price is starting to hesitate. Traders can use other data tools to confirm a reversal.

The difference between Tweezer Tops and Tweezer Bottoms

There are two types of Tweezer candlestick patterns, depending on bullish and bearish momentum. Both are rejection patterns, meaning that the price hits a level, bounces off, and refuses to break through.

A Tweezer Top shows up after an uptrend and suggests the price might fall. The first candle will usually be green (bullish), showing buyers are still in control. The second candle rises to the same previous high — or very close to it — and then rejects lower. The color doesn’t matter; what matters is the failed push at the same level.

When a Tweezer Top is formed, it means that buyers tried to push the price higher again but hit the same resistance as before. They couldn’t break through, and sellers shoved back harder, pushing the price down. The formation suggests that the uptrend might be coming to an end, and if the next candle is also red, that's a stronger warning that the uptrend might be over.

A Tweezer Bottom works in the opposite way. It appears after a downtrend and hints that the price is hitting a support level and will possibly bounce back up. The first candle is therefore red.

The second candle drops to the same previous low — or very close to it — and then rejects higher. The candle color doesn’t matter here. What matters is that both candles share the same support level.

Tweezer Bottoms tell you that the selling pressure is coming to an end. Buyers then take the lead and outnumber sellers, driving the price up. If the next candle is bullish and breaks above the Tweezer range, it’s a pretty good sign that a bullish momentum is starting to take hold.

| Pattern | Appears after | Matching price | Signal |

|---|

| Tweezer Top | Uptrend | Highs | Bearish reversal |

| Tweezer Bottom | Downtrend | Lows | Bullish reversal |

Tweezers vs. similar patterns

Tweezers are similar to other patterns. The main difference is that they point to immediate rejection at a key price level, while the other patterns show slower, more deliberate reversals.

Tweezer Top or Bottom

Two candles with nearly the same high or low. It’s a quick sign that the price has hit a wall and is starting to hesitate.

Double Top or Bottom

Takes longer to form. You’ll see two highs or lows with a pullback in between, showing a longer tug-of-war before the market finally turns.

Engulfing Pattern

Also two candles, but the second one completely covers the body of the first. It’s more about a shift in control than about matching highs or lows. One side overpowers the other.

Morning Star or Evening Star

Three candles. The first continues the trend, the second shows indecision, and the third confirms the reversal. The direction change is slower than a Tweezer's.

How to spot a Tweezer candlestick pattern

Spotting a Tweezer pattern is very simple. You don’t need to dig into indicators or draw lines or anything like that. You just look at your chart and find two consecutive candles. Look for two consecutive candles. In a Tweezer Top, the highs are equal or nearly equal, and in a Tweezer Bottom, their lows are equal or nearly equal. The second candle has to reject that level (fail to break through). The candle color is irrelevant. What matters is that they both touch the same price level and reject it.

Candlestick charts can be set for different timeframes. On very short timeframes like 1-minute charts, the market moves around a lot due to random activity. This creates a lot of small patterns that don’t really mean anything. A term that traders often use to call this is “noise.” A trend is more likely to be spotted by taking a step back and seeing the bigger picture. Tweezer patterns tend to work better on longer timeframes, such as 4-hour charts, daily charts, and so on, because they’re more likely to reflect what real buyers and sellers are doing and could signal a bigger move.

Just because two candles line up at the same high or low doesn’t automatically make it a strong Tweezer, though. The second candle should show some kind of reaction to the first, such as the price reversing or struggling to break through. It has to be a strong signal that control is switching from buyers to sellers or from sellers to buyers.

A Tweezer pattern also doesn’t mean much on its own. It has to show up at a certain time, either during an uptrend or a downtrend, at a clear resistance or support level. If you see it form in the middle of a sideways range where the price is just chopping around, you should most likely ignore it.

Context matters. Tweezers are far more reliable at strong support or resistance levels, near a trendline or Fibonacci level, and on timeframes aligned with the dominant trend.