Trailing Stop

A Trailing Stop Loss order sets the stop price at a fixed percentage or number of points below or above the asset’s market price. This article will tell how to use a trailing stop loss and how this strategy can influence your trading strategy.

What is a trailing stop?

A trailing stop is a modification of a typical stop order that can be set to a specific percentage or amount of money of the asset’s current market price. For a long position, the trader places a trailing stop below the current market price, and for a short position, the trader places a trailing stop above the current market price.

A trailing stop is designed to protect profits by allowing the trade to remain open and continue making a profit as long as the price moves in the investor’s favor. The order closes the trade if the price changes direction by the specified percentage or amount of money.

A trailing stop is usually placed at the same time as the initial trade, although it can also be placed after the trade has already been opened.

How does a trailing stop work?

Trailing stops only move in one direction because they are designed to lock in profits or limit losses. If a trailing stop loss of 10% is added to a long position, a buy trade will be closed if the price drops 10% from its post-buy peak price. The trailing stop moves up only after a new high has been established. Once a trailing stop has moved up, it can no longer move down.

A trailing stop is more flexible than a fixed stop loss order because it automatically tracks the direction of the asset price and does not need to be reset manually like a fixed stop loss.

Investors can use a trailing stop for any asset class if the broker provides this type of order for a traded market. Trailing stops can be set as limit orders or market orders.

How to set a trailing stop in MetaTrader 5

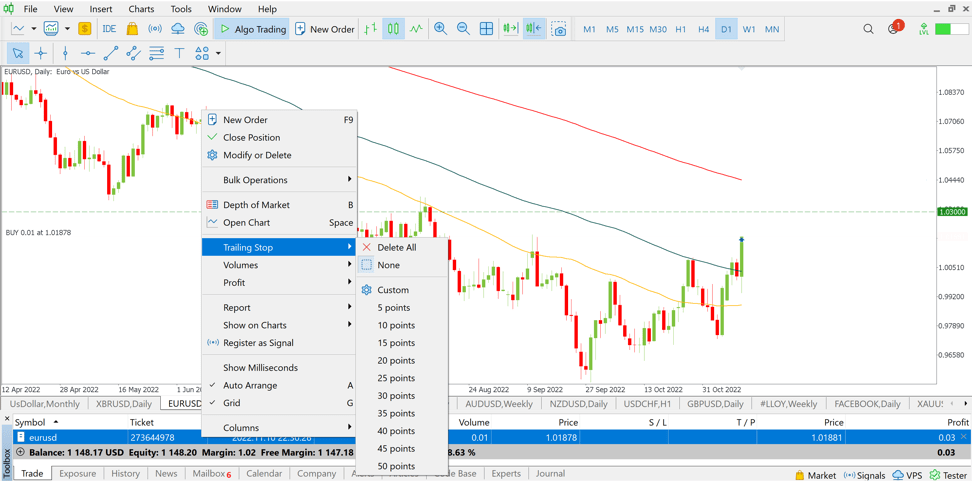

To set a trailing stop in MT5, you need to make several steps:

- Go to the dashboard and choose the trade to set a trailing stop loss.

- Right-click a trade to open the options menu.

- In the menu, click on the trailing stop.

- A new menu will appear where you can select preset stop loss points or set your own value.

- To set a custom value, select a custom option.

- A new window will appear where you can enter your own trailing stop value.

- Enter the trailing stop level and click OK.

Trailing stop pros and cons

Trailing stop pros

One of the biggest benefits of a trailing stop is its flexibility. You don’t have to manually move your stop if your position moves in your favor and you want to adjust your exposure accordingly.

If you leave an underlying stop on an open position that you then do not adjust if your trade is profitable, your position will only automatically close if it returns to where you originally placed your stop. Any profit that you could have made from the position if you had closed it earlier will be lost.

A trailing stop helps prevent this by protecting profits from a successful trade while also minimizing losses.

Trailing stop cons

When you set a trailing stop, you must be careful not to set the trailing step too far from or too close to the market price. If you set it too far, you risk unnecessary losses, but if you set it too close to the market price, you may be closed before your trade has a chance to make a profit.

Example of a trailing stop

Let’s say you think XAUUSD is entering the bullish market, so you decide to buy it at 1650 with a trailing stop at 1600.

Since this is a trailing stop, you will also need to enter a trailing stop. The trailing stop decides how much the XAUUSD should move forward so that your stop moves with it. So, if you set your stop to move every time the XAUUSD moves five points, then it will move to 1605 when the XAUUSD calls 1655, and so on.

Let’s suppose that gold jumped to a high of 1700 before pulling back - your trailing stop would go up to 1650 and would be triggered if the market fell below that price. In this case, your position would be closed at the breakeven level, i.e., without a loss.

Conclusion

A trailing stop is a great feature for saving earnings during trading. Practicing its usage will improve your trading skills.