OIL: $55 in sight - welcome back up!

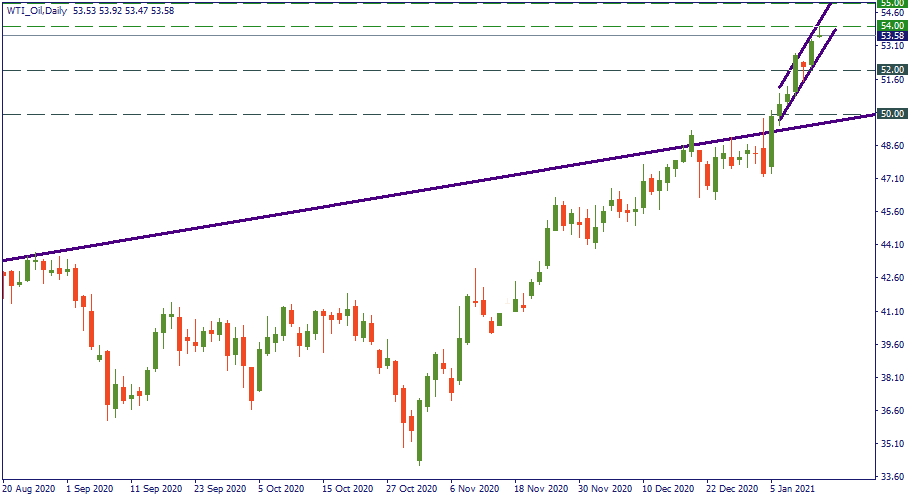

Short term

The short-term view of the WTI oil price performance gives a perfect picture of an upward march. Crossing $50 per barrel in the first week of January, it went straight to $52, made a brief correction, and reached $54 just a while ago. Does it suggest further upside? Yes. But it also suggests a downward correction. To where it may be? Let’s expand the view.

Mid term

The mid-term view shows that after the rise to $42 in August, the WTI oil price plunged to $35 in October. Since then, it has been recovering - and, eventually, exceeding - the losses. The current march from $50 to $55 is as aggressive as the initial bullish reversal in October-November. Back then, no downward correction happened after that. Largely, that’s because the upswing itself was a correction after the plunge. But now, the uptrend we are witnessing is no correction – not in the mid-term, at least.

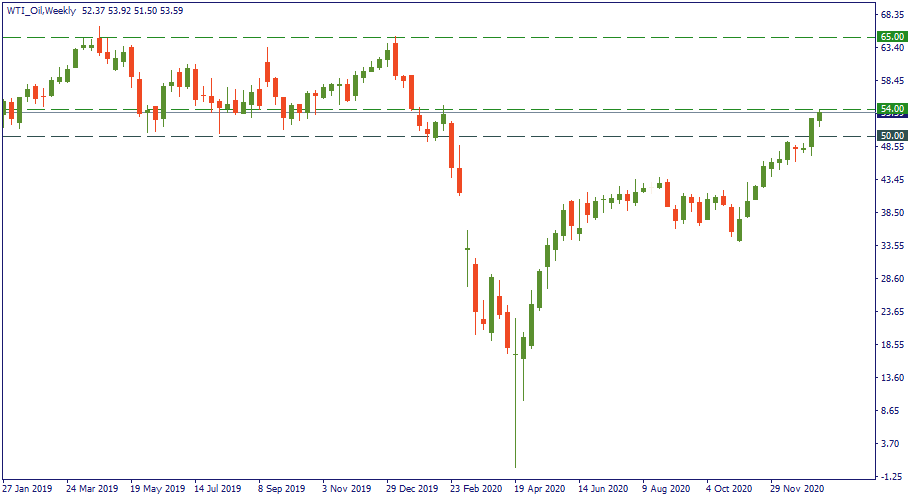

Long term

From the strategic perspective, the price is at the doorstep of the pre-virus levels now. Yes, the oil market can celebrate full recovery. At least, from the WTI oil price point of view. $50 is where it was at the end of 2019 - $50 is what it just crossed a while ago. Therefore, any further upside potential can no longer be ascribed to the strategic recoil to the virus plunge in 2020. $50-$65 is the range of the price performance since the end of 2017 – the price is back here now. For this reason, from the mid-term point of view, dropping to $50 just to cool off is a possibility. But in the long run, whether it will make it to $65 is a question to OPEC and fundamental factors.