The US Dollar is stable this Monday after dropping last week, especially against the Japanese Yen. The decline followed comments from Federal Reserve Chair Jerome Powell, who hinted at slowing down future rate hikes. Today, traders are focusing on economic data from Germany and the US, including reports on durable goods orders and manufacturing. Despite recent losses, the Euro and British Pound remain strong, while the Dollar struggles against the Yen. Additionally, ongoing tensions in the Middle East have added some caution to the markets as US stock futures dip slightly.

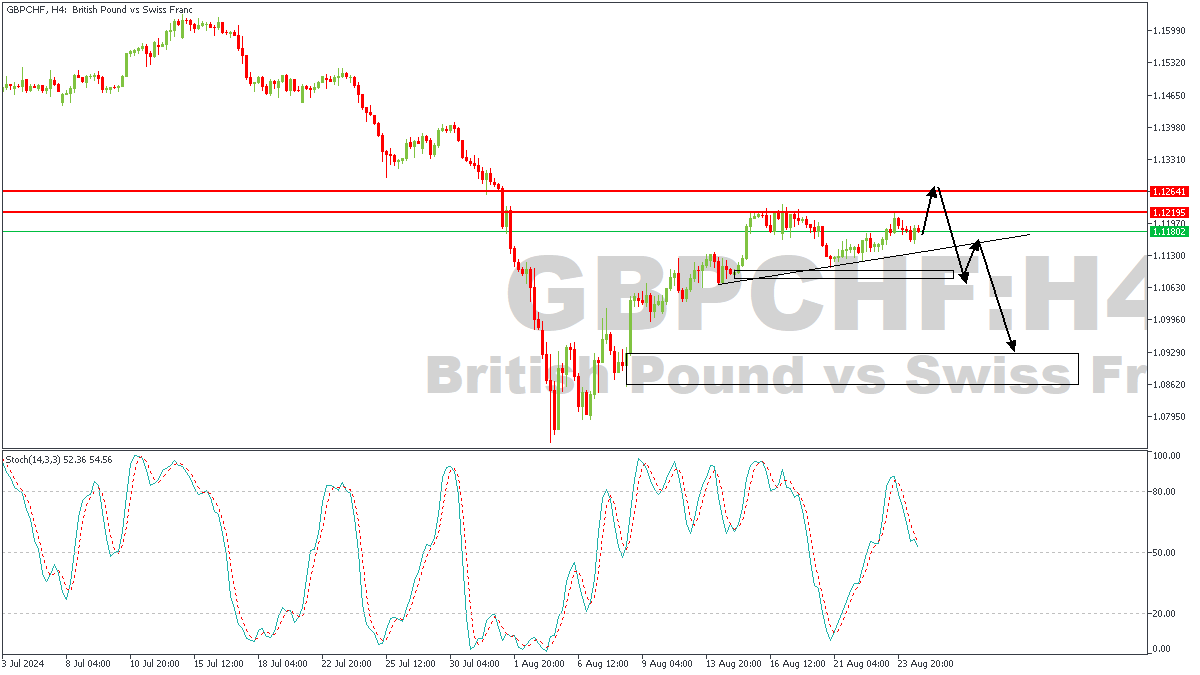

GBPCHF– H4 Timeframe

GBPCHF is currently approaching a daily timeframe pivot as seen on the attached chart. The Stochastic indicator on the daily timeframe also happens to be within the over-bought region (above 70%), leading me to anticipate a bearish outcome from the retest of the daily timeframe pivot zone. However, the break and retest of the trendline support would be crucial to my conclusion regarding this sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 1.09387

Invalidation: 1.13310

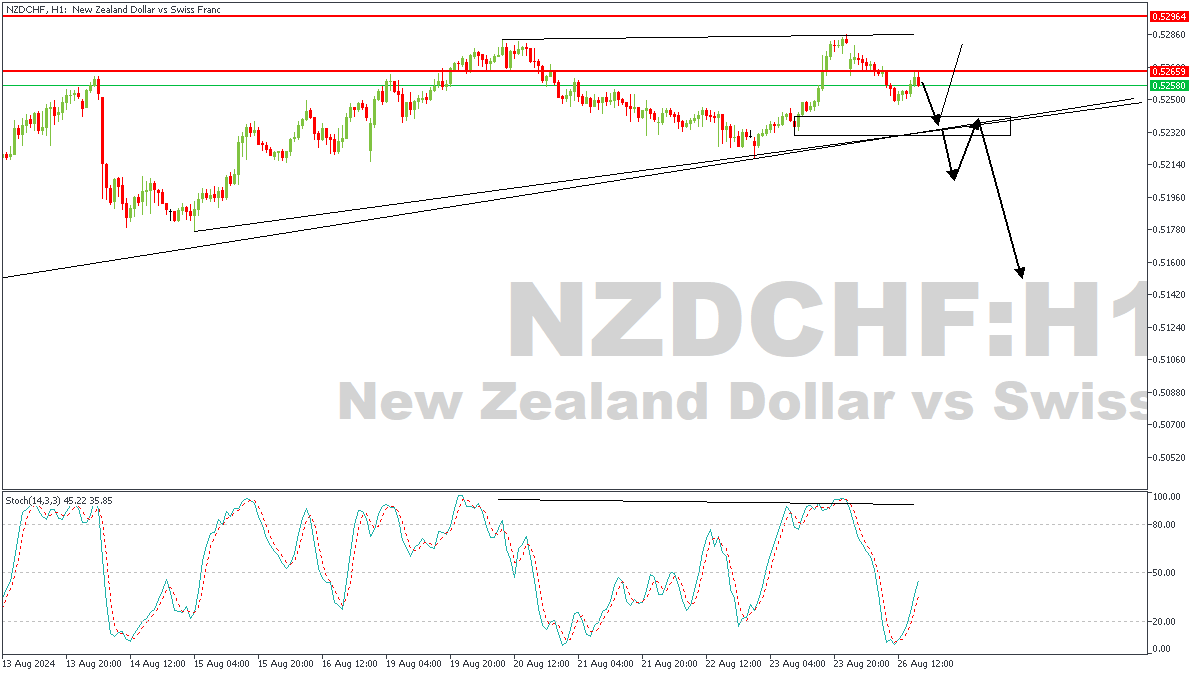

NZDCHF – H1 Timeframe

NZDCHF on the daily timeframe has recently been rejected from the daily timeframe pivot, and seems to be approaching the demand zone at the trendline support. On the daily timeframe, the Stochastic indicator is currently over-bought, with a divergence pattern on the 1-hour timeframe. This is my basis for a bearish sentiment, albeit, a break below the trendline support would be required as my entry confirmation.

Analyst’s Expectations:

Direction: Bearish

Target: 0.51600

Invalidation: 0.52998

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.