The US Dollar (USD) continued to strengthen against other major currencies on Tuesday, reaching its highest level in nearly two weeks, climbing above 101.00. Investors are keeping an eye on important data, such as the European unemployment rate and US employment numbers from ADP, along with speeches from key Federal Reserve officials.

The USD got a boost on Tuesday after the US reported an increase in job openings for August. However, the manufacturing sector remained weak, as shown by the ISM Manufacturing PMI data, which missed expectations. Concerns over rising geopolitical tensions in the Middle East are also influencing markets. Iran reportedly launched around 200 missiles at Israel, prompting threats of retaliation, which has added uncertainty to the global outlook.

In response, the stock market dipped slightly, while the Euro and British Pound both dropped against the Dollar. Gold prices briefly rose due to the heightened geopolitical risk but are struggling to keep momentum, hovering near $2,650 on Wednesday.

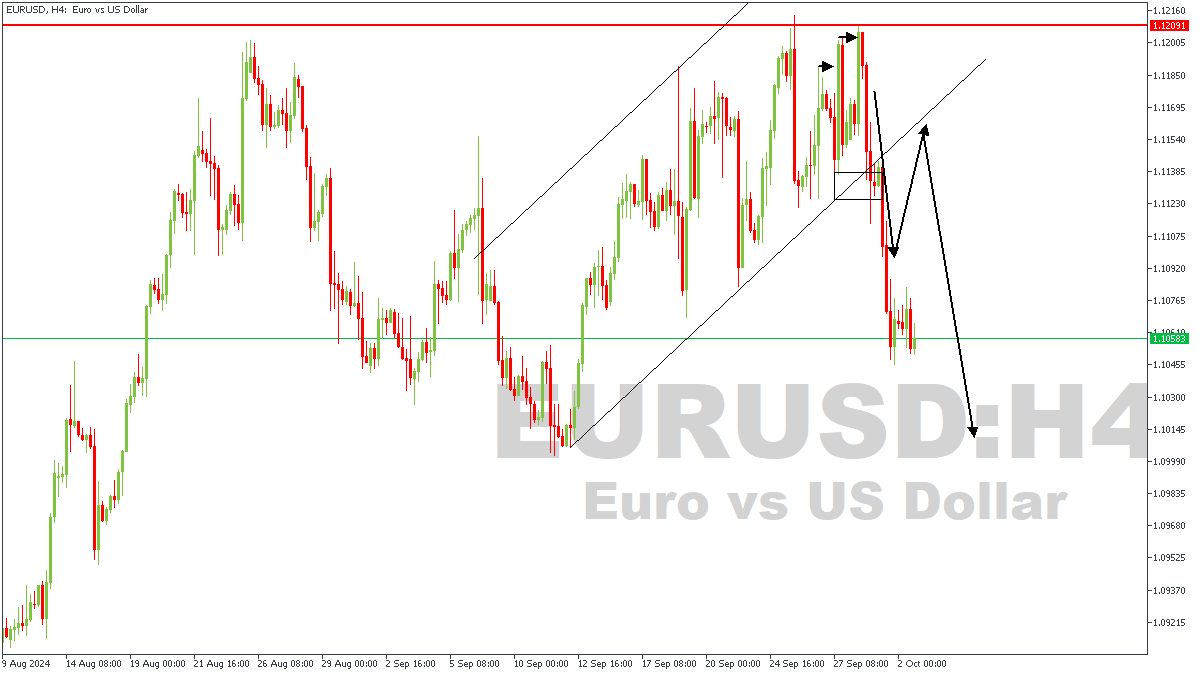

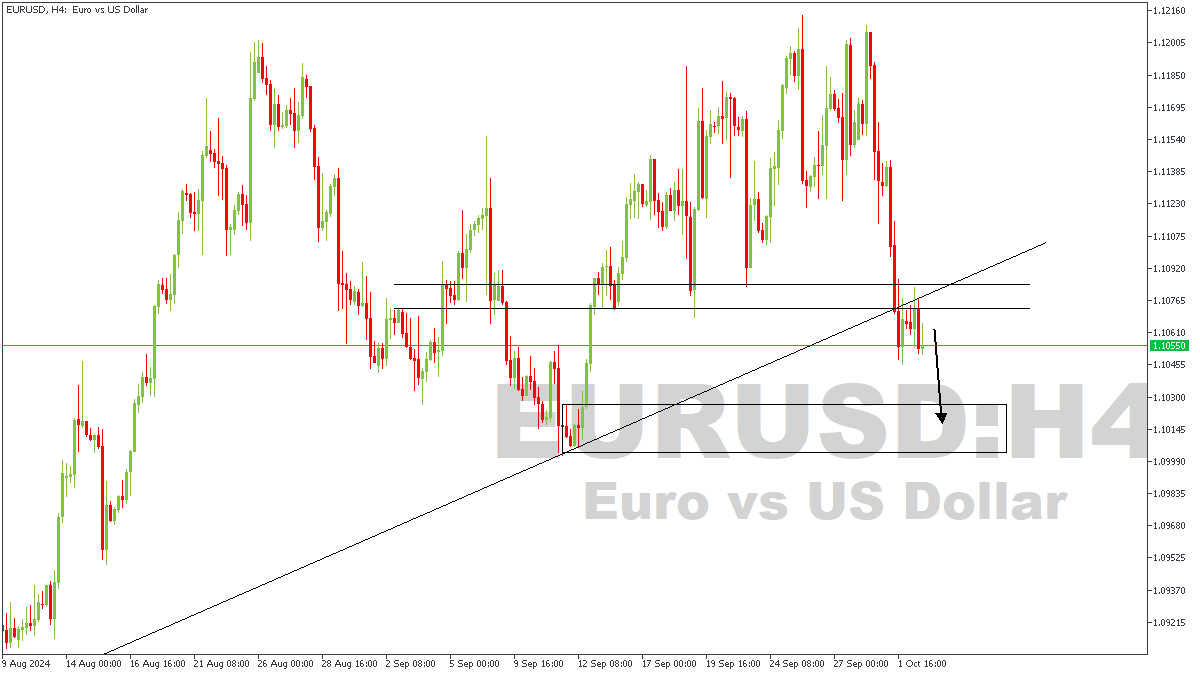

EURUSD – RECAP

On Monday, 30th of September, during the livestream with the VIP community, we took a look at the price action on EURUSD and predicted a drop from the daily timeframe pivot. At this moment, price has completed a 155-pip drop and seems to still have some more to go.

EURUSD – H4 Timeframe

The 4-hour timeframe of EURUSD at the moment indicates price has recently broken below, and retested a pivot region on the 4-hour timeframe. A trendline support was also broken with a retest; the conclusion here, therefore is that price intends to remain bearish.

Analyst’s Expectations:

Direction: Bearish

Target: 1.10257

Invalidation: 1.10828

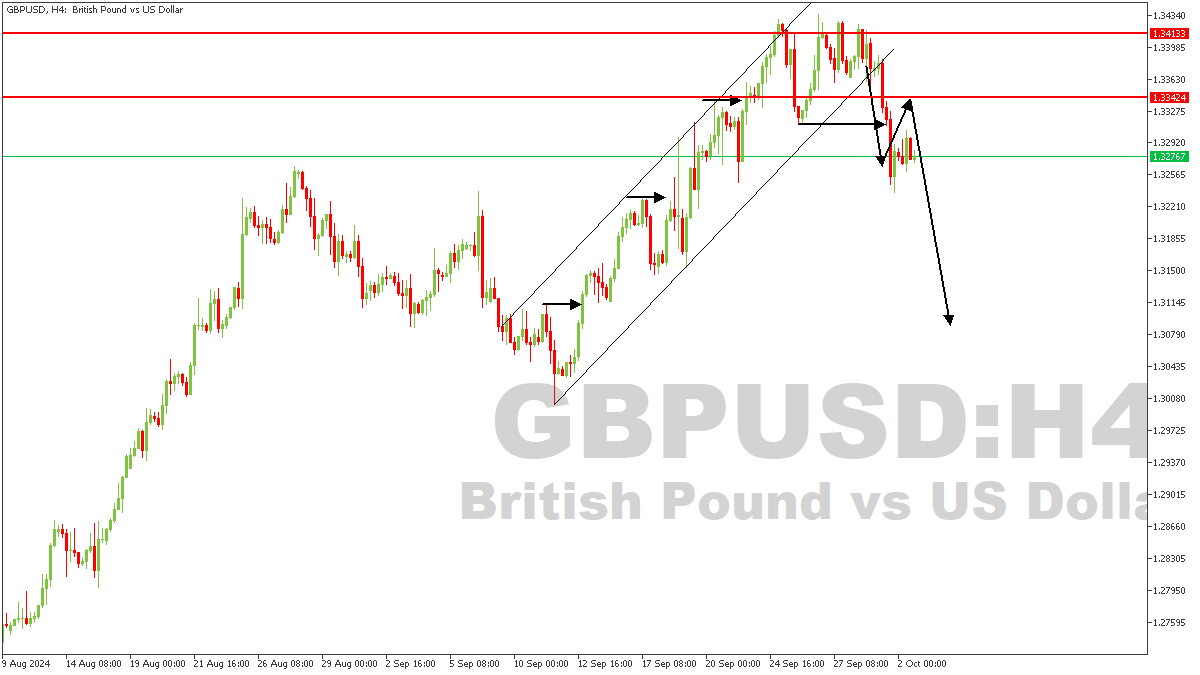

GBPUSD – RECAP

GBPUSD was not left out of the analysis during the Monday Market Review in the VIP community – with Gold going on to drop over 180pips afterwards.

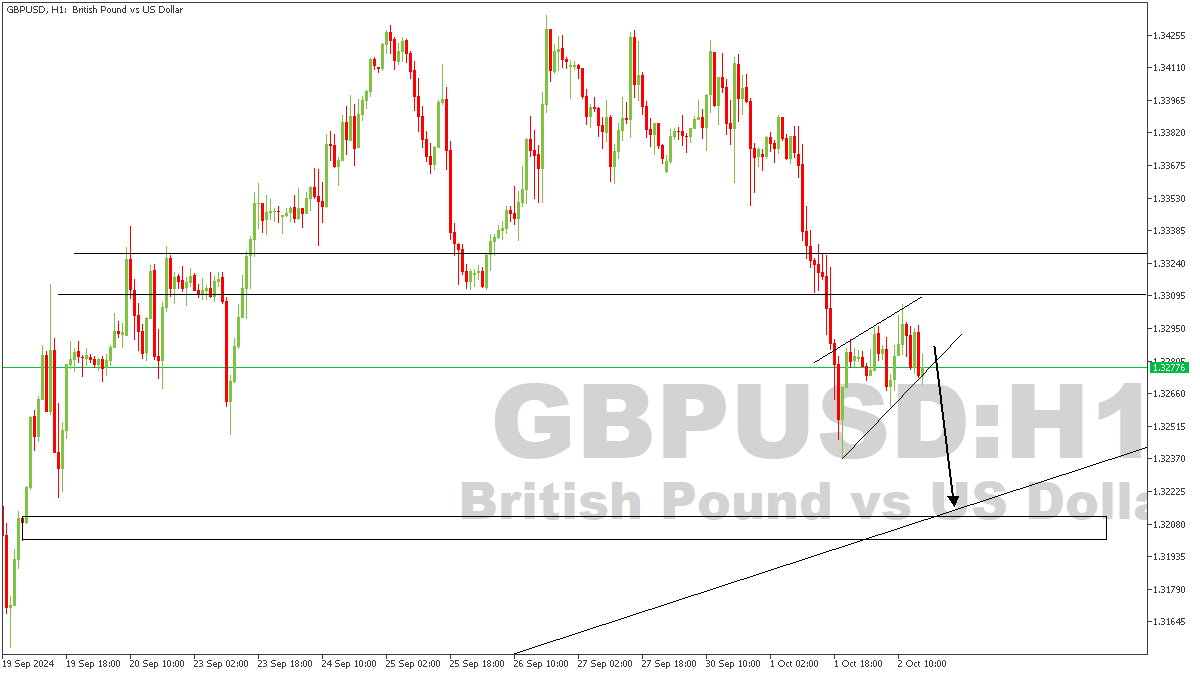

GBPUSD – H1 Timeframe

At the moment on the 1-hour timeframe chart of GBPUSD, price has formed a rising wedge as it approached the recently broken 4-hour timeframe pivot zone. In line with this, I expect to see the bearish momentum continue until it reaches the highlighted area of demand on the chart.

Analyst’s Expectations:

Direction: Bearish

Target: 1.32127

Invalidation: 1.32975

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.