Barclays is predicting that Tesla will beat expectations for Q3, forecasting earnings per share of 68 cents compared to the consensus estimate of 60 cents. This optimism comes from potential improvements in Tesla's profit margins, cost savings, and possibly solid revenue from regulatory credits. However, Barclays is still cautious about Tesla’s future, noting uncertainties around the company’s production outlook and how it will recover its margins. Although Tesla recently revealed its robotaxi, the focus now shifts back to the company’s core performance. Barclays believes the Q3 results could be a positive short-term boost for Tesla’s stock. The firm maintains a neutral rating on Tesla with a price target of $220.

Last Thursday, Tesla revealed its new robotaxi, the Cybercab, which looks like a combination of the Model 3 and Cybertruck. Despite the excitement leading up to the event, the lack of detail left some investors disappointed, causing Tesla's stock to drop 8.8% the next day. Meanwhile, shares of ride-hailing companies like Uber and Lyft surged, as investors saw them as better positioned in the self-driving car space, especially with limited information from Tesla's event.

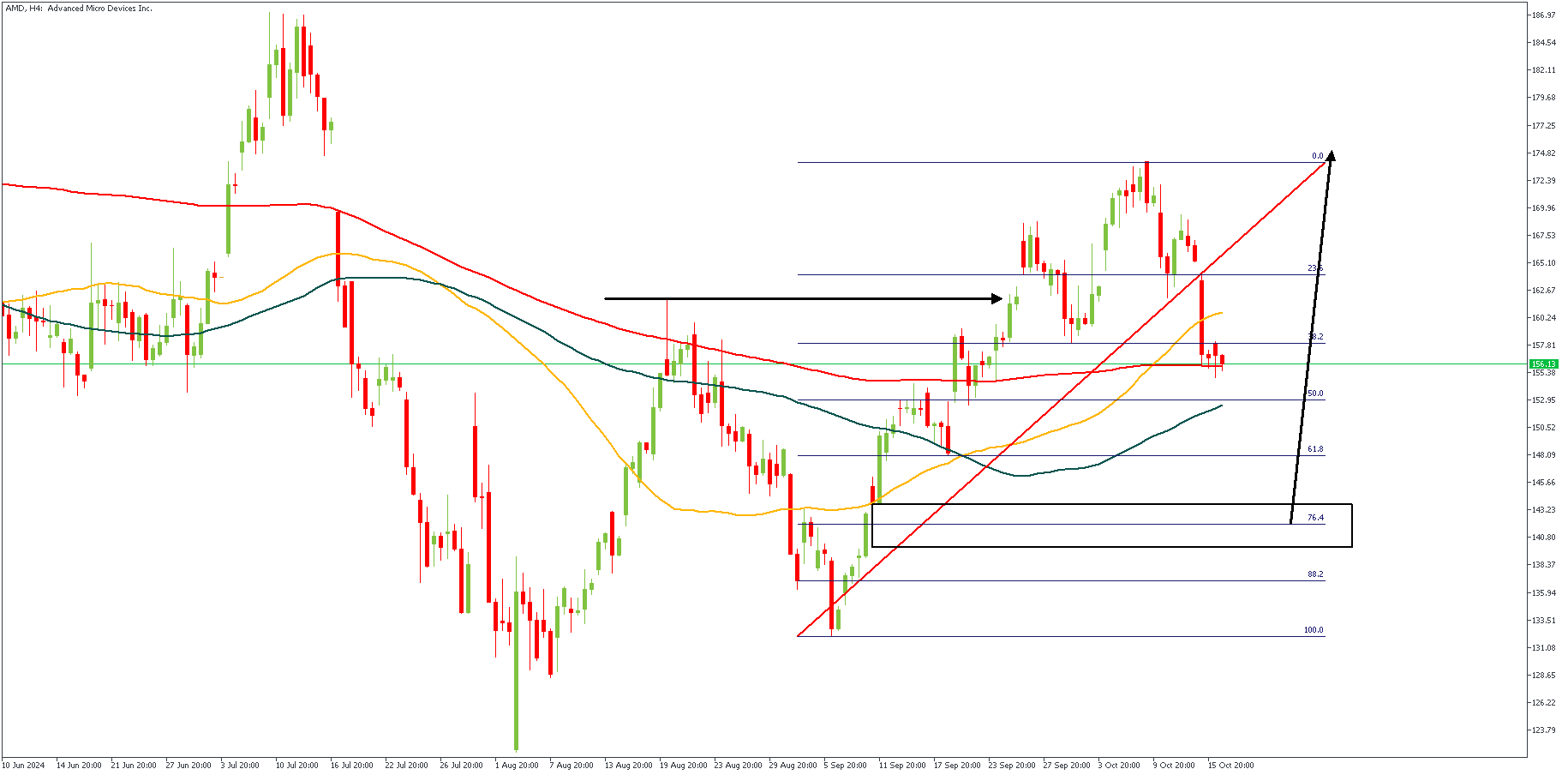

AMD – H4 Timeframe

The 4-hour timeframe chart of AMD share prices shows a recent break above the previous high, with the 50-period moving average crossing above the 100 and 200 period moving averages – often considered an indication of a change in trend. I have marked out a rally-base-rally around the 76% of the Fibonacci retracement tool. A trendline support could also be traced from the two major lows to serve as a confluence for the bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: 174.56

Invalidation: 131.13

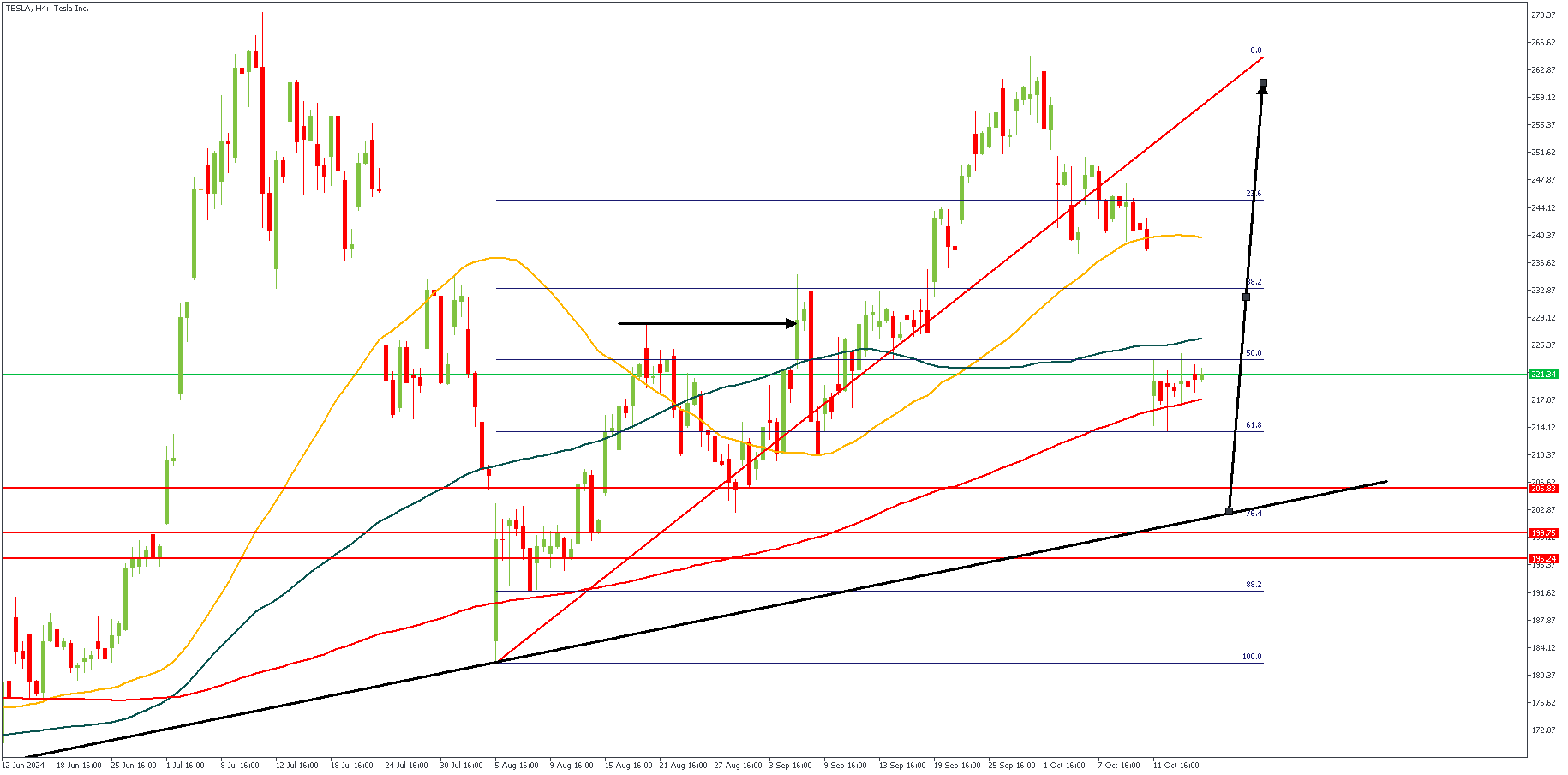

TESLA – H4 Timeframe

Tesla stock broke above the highlighted high not too far from the daily timeframe pivot zone; there’s also a trendline support at the base of the price action, leading to a suspicion of a bullish continuation. The bullish array of the moving averages is the final piece that nails the bullish sentiment in place.

Analyst’s Expectations:

Direction: Bullish

Target: 264.06

Invalidation: 181.38

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.