Following a week-long, 300-pip drop on AUDNZD last week, this week has opened up with some renewed bullish vigor with a 150-pip correction. While this looks incredible in favor of the Australian Dollar, there yet remains some mystery as to the exact direction the momentum will follow. Here’s my outlook as touching the price action on AUDNZD, GBPAUD and EURAUD pairs.

AUDNZD – H2 Timeframe

On the 2-hour timeframe chart of AUDNZD, we can see that price faced some initial rejection from the demand zone highlighted by the rectangle, after which price broke above the previous high. The SBR price action pattern that formed after the rejection is my basis for entry; a retest of the demand zone below the 76% Fibonacci retracement level.

Analyst’s Expectations:

Direction: Bullish

Target: 1.10114

Invalidation: 1.08372

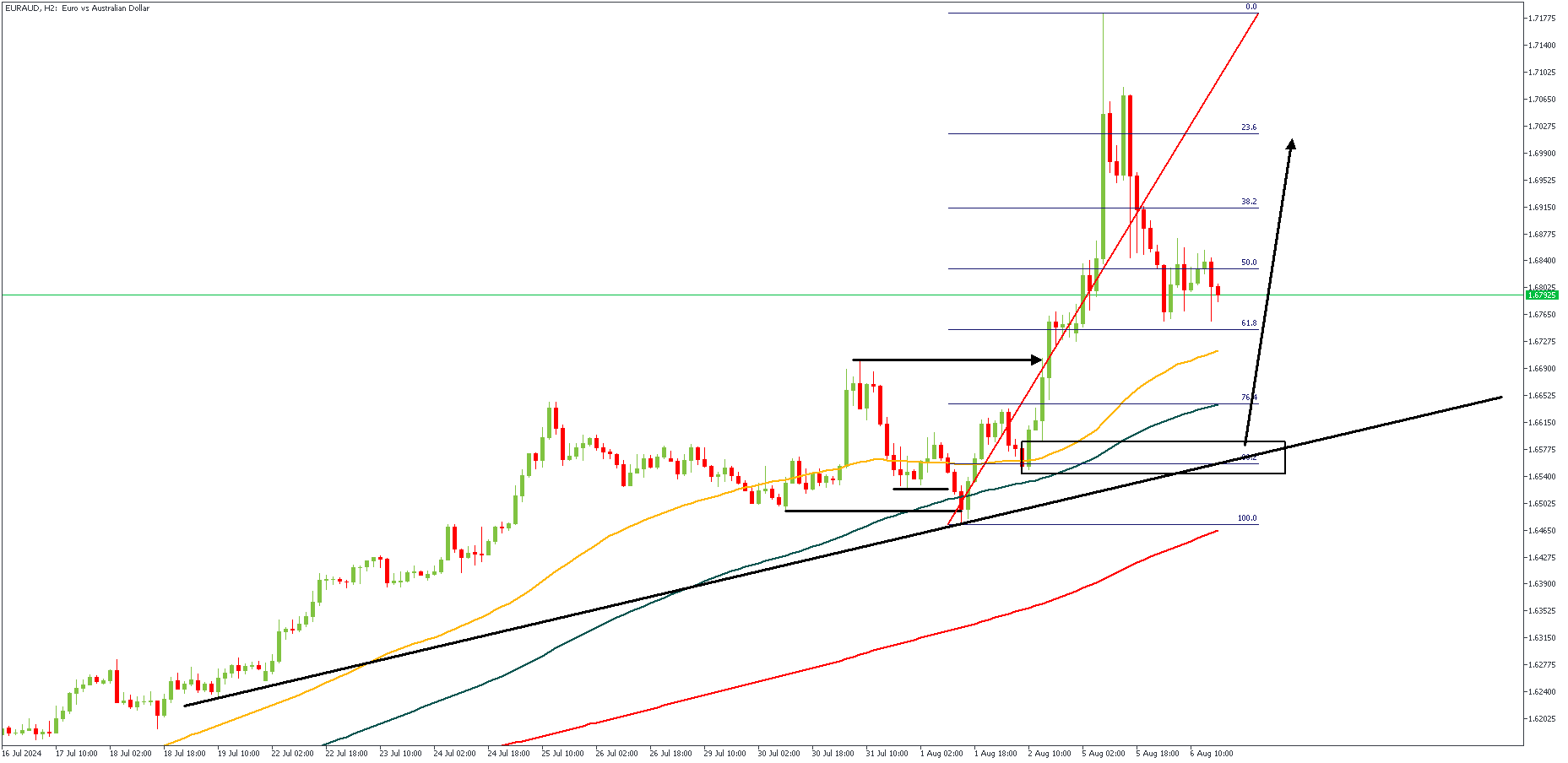

EURAUD – H2 Timeframe

EURAUD on the 2-hour timeframe presents a SBR (Sweep-Break-Retest) pattern which aligns perfectly with the bullish array of the moving averages, and the 88% of the Fibonacci retracement tool. The trendline support, and the 100-period moving average support serve as additional confluences in favor of the bullish sentiment on EURAUD.

Analyst’s Expectations:

Direction: Bullish

Target: 1.70275

Invalidation: 1.64423

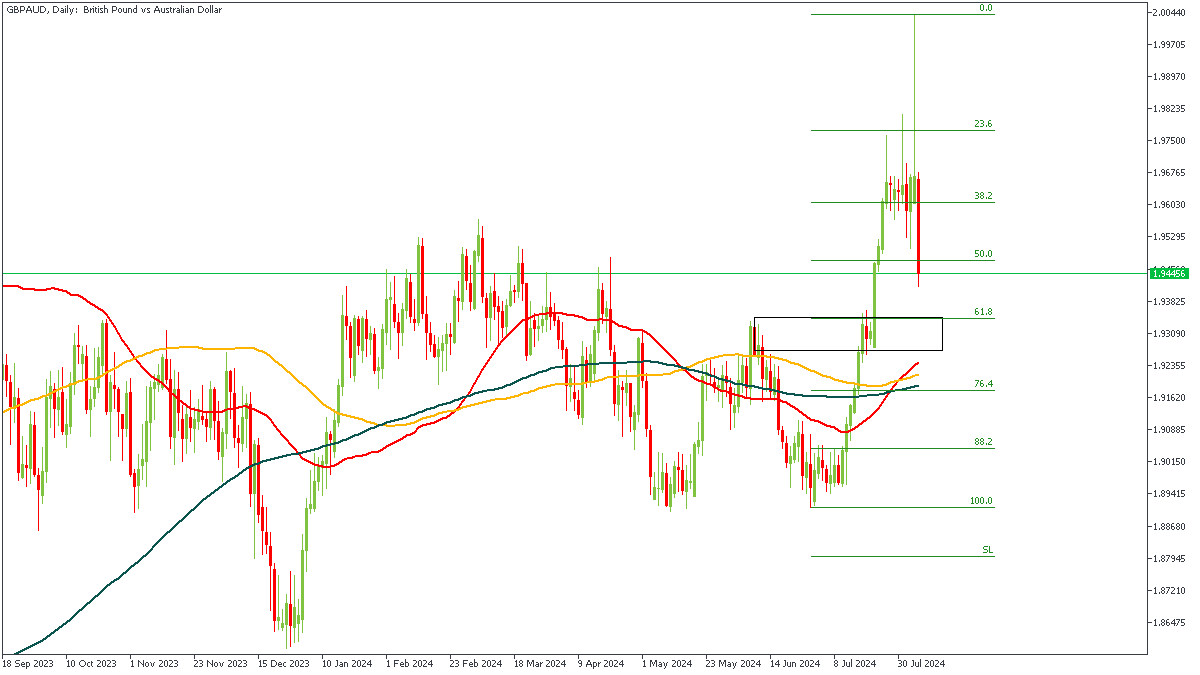

GBPAUD – D1 Timeframe

As for GBPAUD, the Daily timeframe provides the clearest price action movement. On the Daily timeframe of GBPAUD, we see price approaching the 61% of the Fibonacci retracement zone, with a rally-base-rally demand zone overlapping the golden ratio level of the retracement tool. Considering the presence of the 50-day moving average nearby, it seems safe to expect a bullish outcome from the demand zone.

Analyst’s Expectations:

Direction: Bullish

Target: 1.97589

Invalidation: 1.91051

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.