The AUDUSD pair fell to 0.6650 as the US Dollar strengthened due to expectations that the Federal Reserve will keep interest rates high for longer. Market sentiment remains cautious with underperforming PMI figures from major economies, including the Eurozone, UK, Japan, and Australia. The US Dollar Index (DXY) is approaching resistance at 106.00 as investors turn to safe-haven assets amid global market sell-offs. The CME FedWatch tool suggests US interest rates may start declining from September, unlike other G-7 central banks that have already begun easing policies. The Reserve Bank of Australia is expected to maintain its rate at 4.35% due to high inflation, pressuring the Australian Dollar in the forex market.

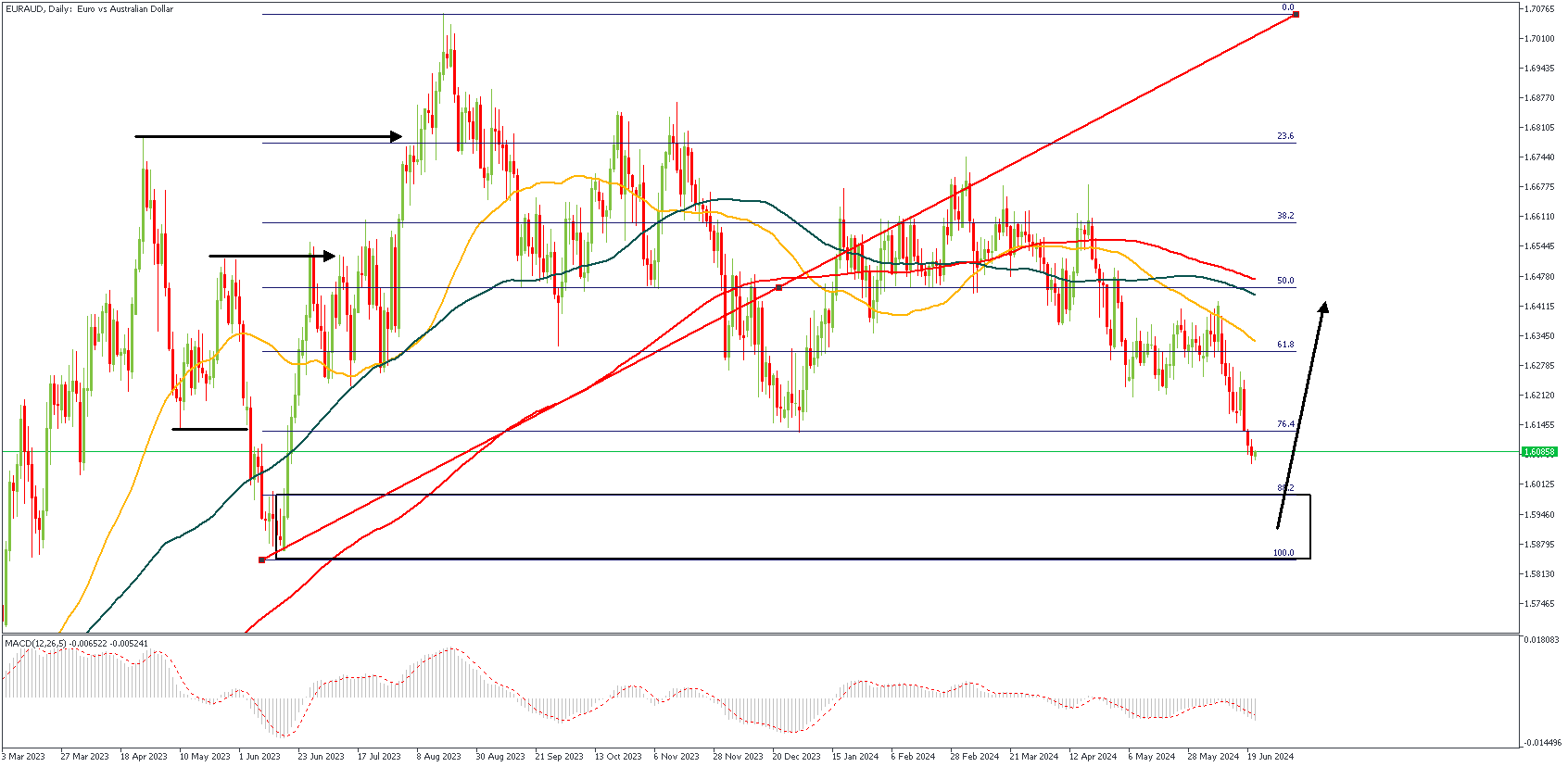

EURAUD – D1 Timeframe

EURAUD on the daily timeframe seems to be heading for the drop-base-rally demand zone after having broke above the previous high at the highlighted area. Hence, we see a sweep of the liquidity from the lows, followed by the break of structure which suggests the likelihood of a bullish reaction from the demand zone. Finally, considering that the demand zone fits within the 88% of the Fibonacci retracement tool, it seems safe to anticipate a bullish impulse from the marked demand zone.

Analyst’s Expectations:

Direction: Bullish

Target: 1.64544

Invalidation: 1.58084

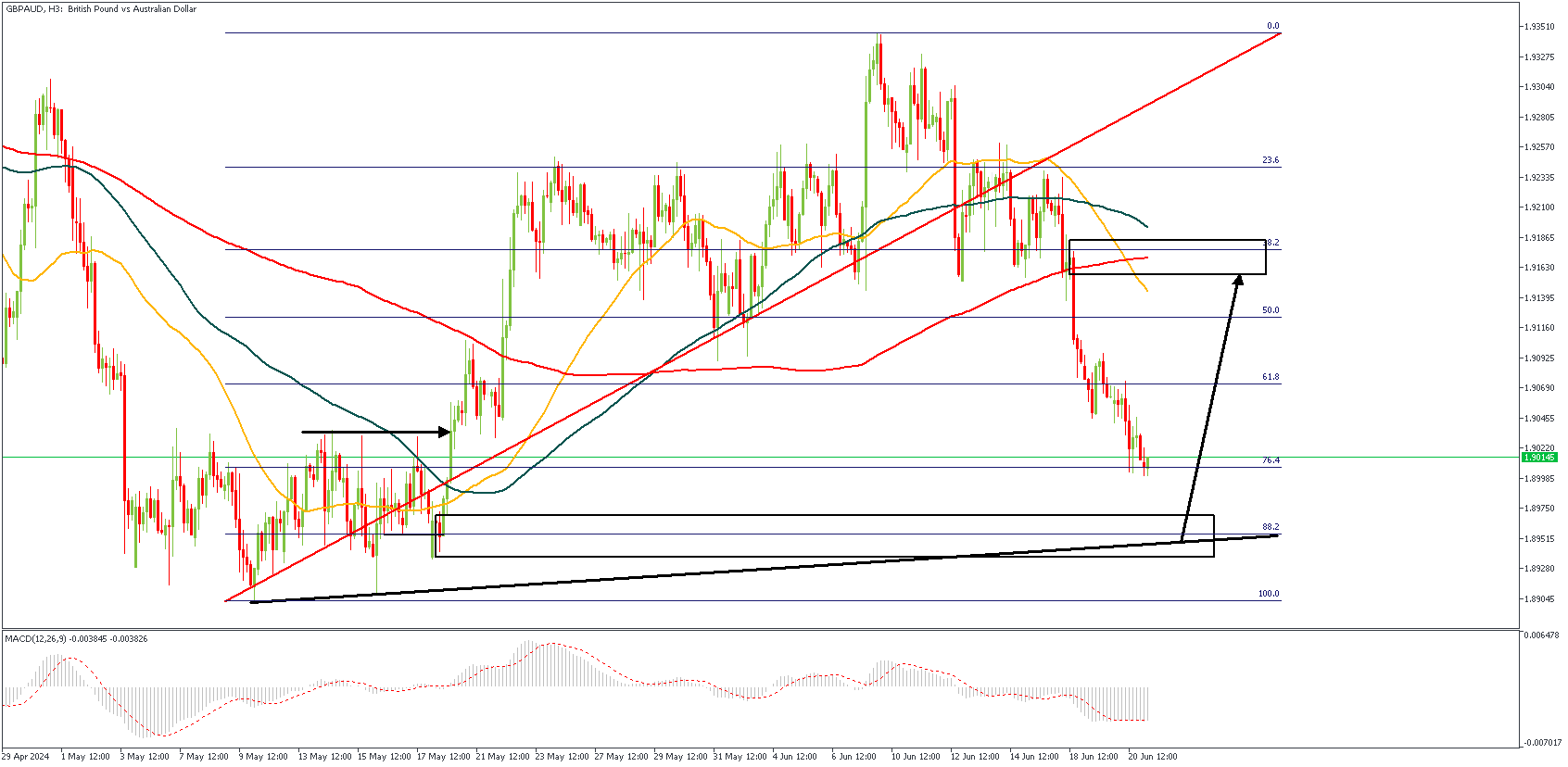

GBPAUD – H3 Timeframe

The 3-hour timeframe of GBPAUD is currently diving towards the demand zone as shown on the attached chart. The alignment of the demand zone with the trendline support increases my confidence in expecting a bullish move from the area of demand. The break above the previous high is also a clue, alongside the 88% Fibonacci retracement level.

Analyst’s Expectations:

Direction: Bullish

Target: 1.91559

Invalidation: 1.88962

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.