The USDCHF pair continues to drop, trading near 0.9030 on Wednesday as the US Dollar weakens for the third day. The US Dollar Index (DXY) remains under pressure while traders look ahead to Friday’s US job report, which could impact the Federal Reserve’s decisions. Meanwhile, tensions between the US and China have increased, with both countries imposing new tariffs on each other’s goods, boosting demand for the safe-haven Swiss Franc. In other news, Switzerland’s manufacturing sector slightly improved in January but fell short of expectations. Investors are now waiting for Switzerland’s unemployment data on Thursday for more insight into the country’s labor market.

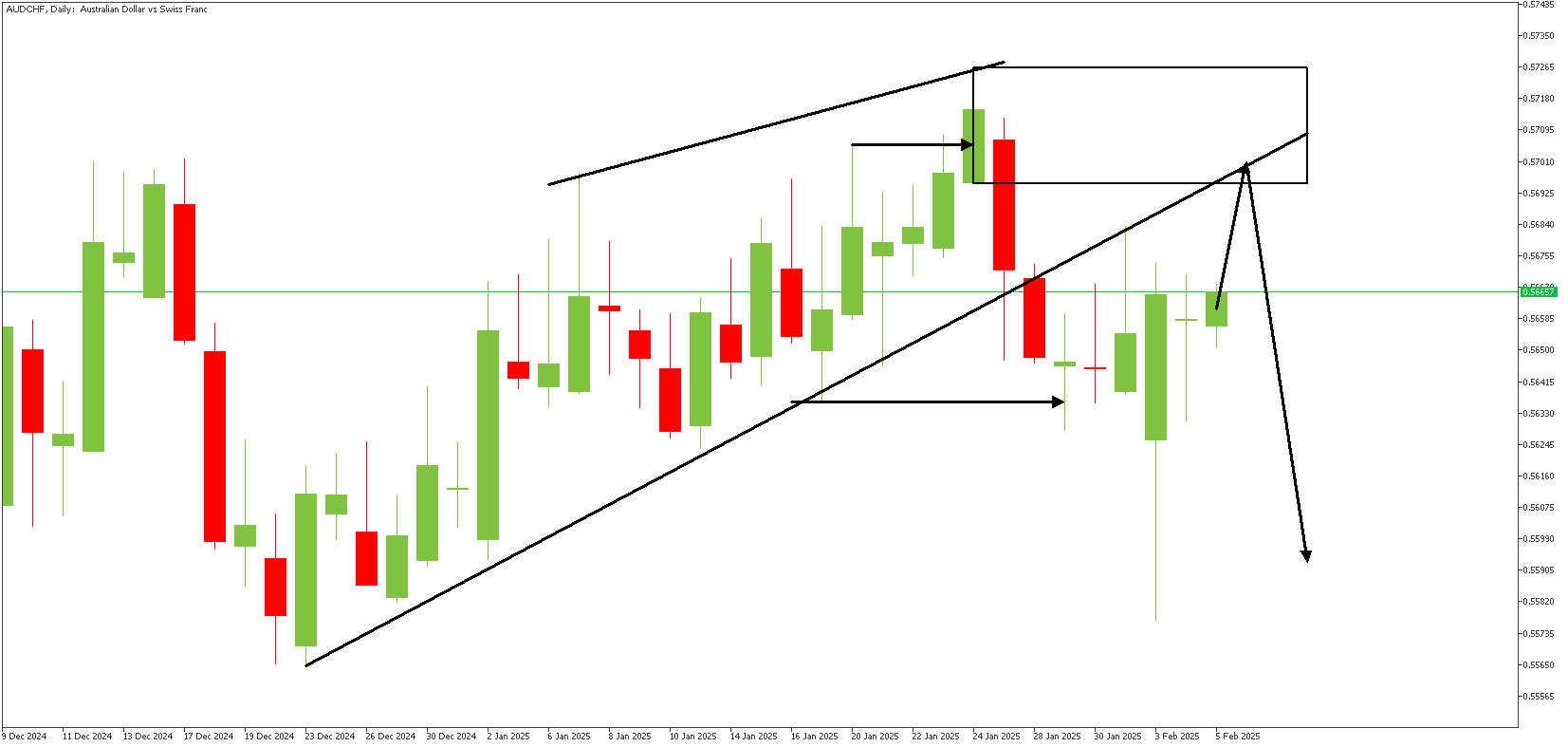

AUDCHF – D1 Timeframe

Technically speaking, when the price breaks out of a consolidation pattern, it often returns to the last broken trendline for a retest. In the case of AUDCHF, on the daily timeframe chart, we see the price currently reaching the trendline resistance. At the moment, the trendline itself overlaps the rally-base-drop of an SBR pattern. This gives the initial basis for bearish intervention.

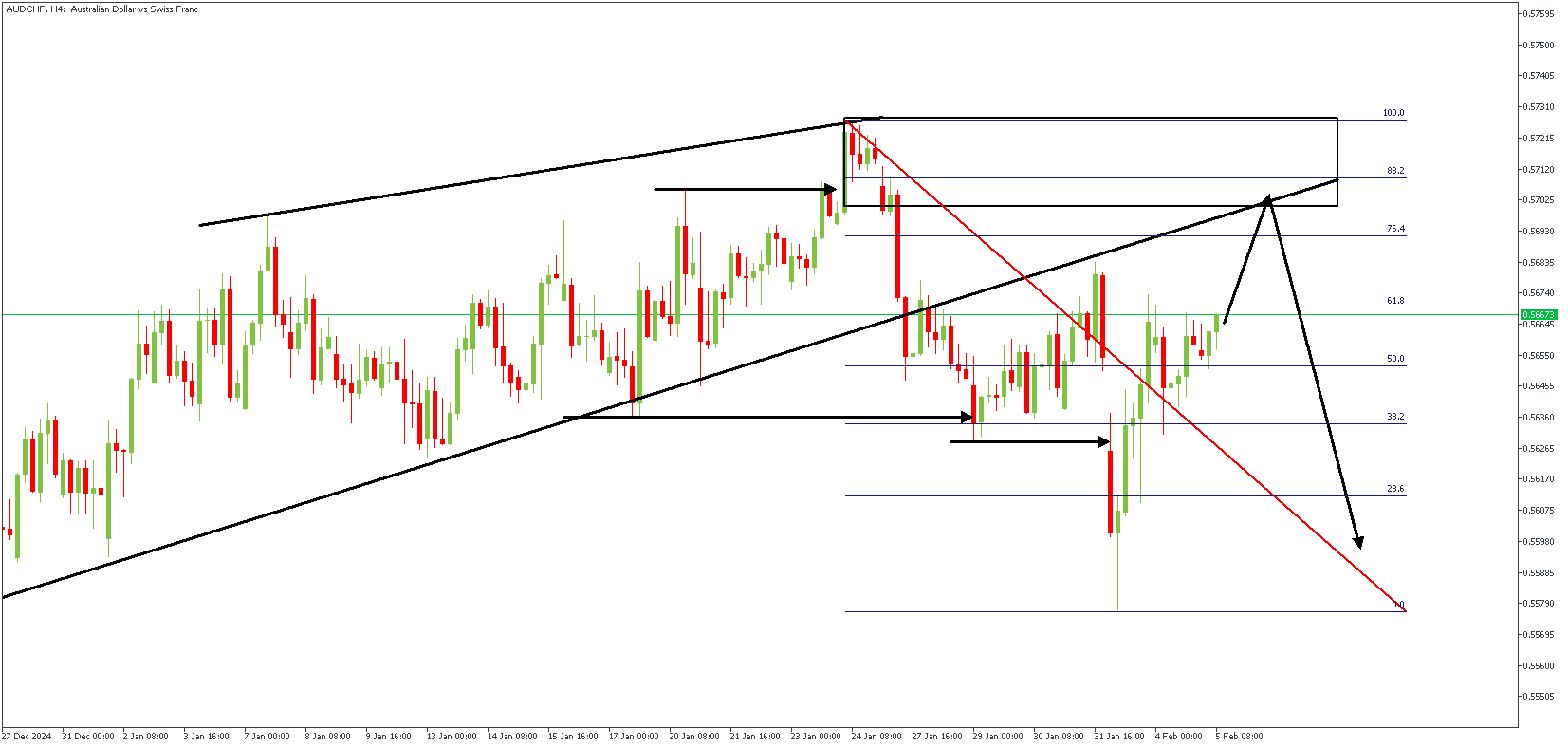

AUDCHF – H4 Timeframe

The lower timeframe reveals more details regarding the highlighted supply zone on the 4-hour timeframe chart of AUDCHF, with the 76% region of the Fibonacci retracement tool further confirming the likelihood of a bearish outcome. When you compare the lower timeframe condition to the higher price action, the sentiment settles in favor of the bears.

Analyst’s Expectations:

Direction: Bearish

Target: 0.56075

Invalidation: 0.57313

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.