AUDUSD remains near its lowest levels since August touched on Wednesday and looks vulnerable to further declines. However, traders are holding back from making big moves and are waiting for the US Nonfarm Payrolls (NFP) report, which will provide clues on the Federal Reserve's (Fed) next steps regarding interest rate cuts. This key jobs data will likely impact the US Dollar (USD) and influence the AUDUSD pair's movement.

Expectations that the Fed might not ease its policies as much as previously thought, along with growing caution in global markets, are keeping the USD supported. Meanwhile, the Australian Dollar (AUD) faces pressure due to increasing bets that the Reserve Bank of Australia (RBA) could cut interest rates soon, following weaker-than-expected GDP data earlier this week.

Adding to the challenges for the Aussie Dollar are ongoing geopolitical tensions, economic concerns in China, and uncertainty about US President-elect Donald Trump's trade tariffs. These factors suggest that the Australian Dollar could face further downside risks. Even if AUDUSD manages a slight recovery, it may not last long and could be seen as an opportunity for sellers. As a result, the pair is on track to close the week lower, potentially marking its weakest weekly close of 2024.

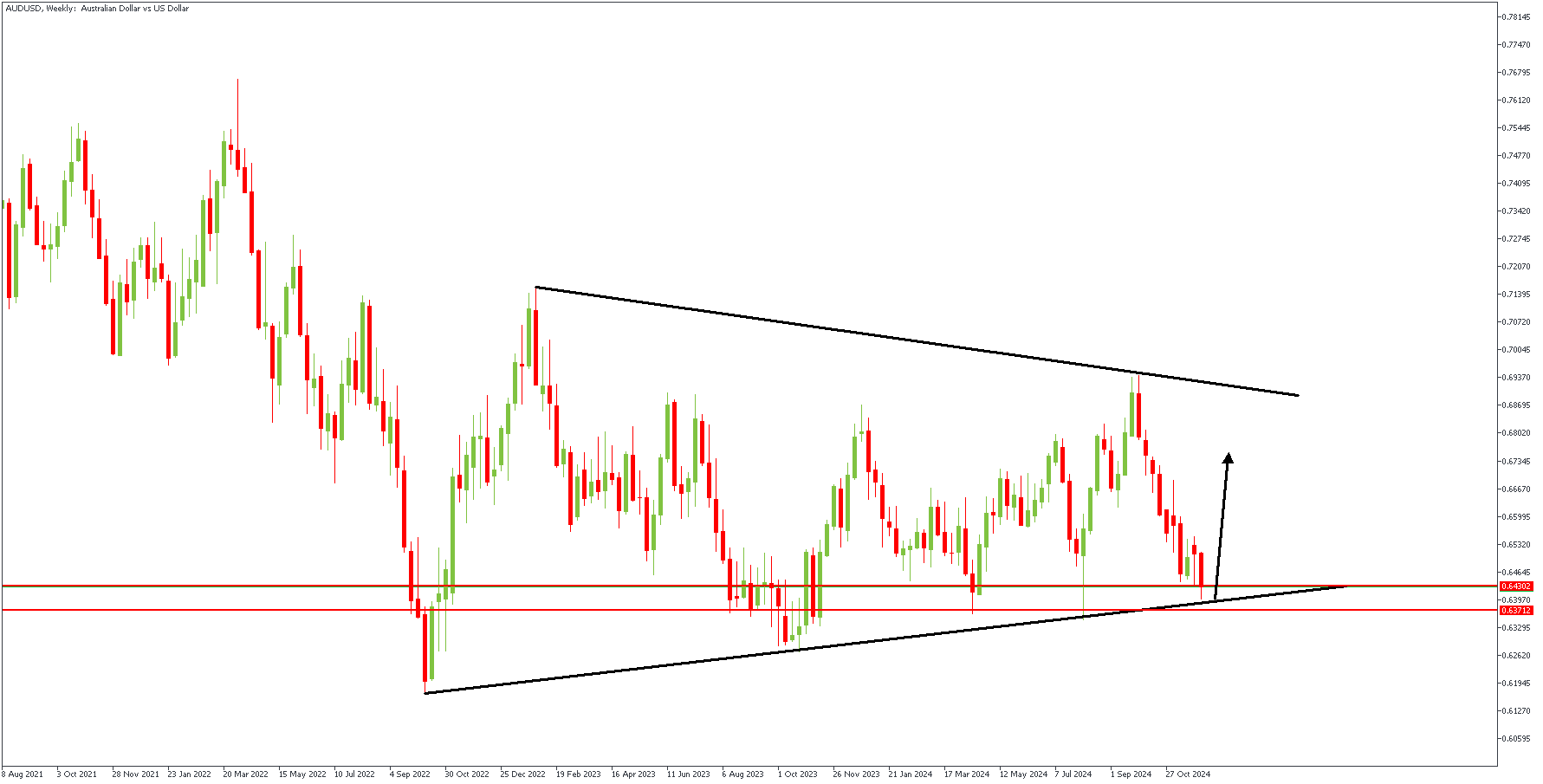

AUDUSD – W1 Timeframe

The AUDUSD price chart on the weekly timeframe shows prices ranging within a wedge pattern, with the current price resting on the trendline support of the wedge pattern. There is also a critical pivot zone right around the current price, as highlighted by the two horizontal red lines. Although the demand zone could be more precise in the weekly timeframe, we will look to the daily timeframe for clarity.

D1 Timeframe

.png)

We see that the wick hides the demand zone on the daily timeframe. In such a situation, the Fibonacci retracement tool can be trusted to clarify the matter. Hence, the price is around the 88% Fibonacci retracement level, and a reversal may soon be underway.

Analyst's Expectations:

Direction: Bullish

Target: 0.67650

Invalidation: 0.62608

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.