Summary of the Current Situation

Coinbase (COIN) stock has shown significant variations in recent days. This analysis is based on current data and analyst projections, clearly showing the stock's status and potential.

Key Financial Data

- Current Stock Price (June 27, 2024): $214.58

- Price Range (June 24-27, 2024): $72.00 - $78.00

- Market Cap: $53,369,497,948

- Average Daily Volume: 8,770,400 shares

- Today's Volume: 90,857 shares

- 52-Week High: $283.48

- 52-Week Low: $62.84

- Price-Earnings Ratio (P/E): 0

- Forward P/E (1 year): 42.83

- Earnings Per Share (EPS): $-3.23

Analyst Projections

- 1-Year Price Target: $250.00

- 12-Month Average Price Target: $248.89

- High Estimate: $325.00

- Low Estimate: $145.00

Financial Data Analysis

1. Revenue and Profitability: Coinbase has faced profitability challenges, with a negative EPS of $-3.23. However, the forward P/E ratio of 42.83 indicates analysts expect significant growth in the coming years.

2. Trading Volume: The average daily volume of 8,770,400 shares suggests high market interest and activity. The relatively low current volume (90,857 shares) could indicate a temporary pause in trading.

3. Price Evaluation: With a current price of $214.58, the stock is significantly below its 52-week high of $283.48, which could represent a buying opportunity given the growth projections.

Additional Factors

1. Sector and Industry: Coinbase operates in the financial sector, specifically in consumer financial services, positioning it strategically in a rapidly growing market.

2. Analyst Projections: Most analysts have a positive outlook, with an average price target of $248.89, implying significant growth potential from the current level.

Price Scenarios

1. Optimistic Scenario ($280 - $325): If Coinbase successfully capitalizes on its international expansion and regulatory conditions are favourable, the stock price could approach the high estimate of $325.

2. Neutral Scenario ($210 - $250): With no significant changes in the operating environment and a stable cryptocurrency market, the stock could move towards the average price target of $248.89.

3. Pessimistic Scenario ($145 - $180): An increase in restrictive regulations or a downturn in the cryptocurrency market could lead to a decrease in the stock price, approaching the low estimate of $145.

Recommendation

For long-term investors, Coinbase presents an interesting opportunity due to its market position and growth potential. However, it is crucial to stay alert to regulatory news and the evolution of the cryptocurrency market, as these factors can significantly influence the stock price.

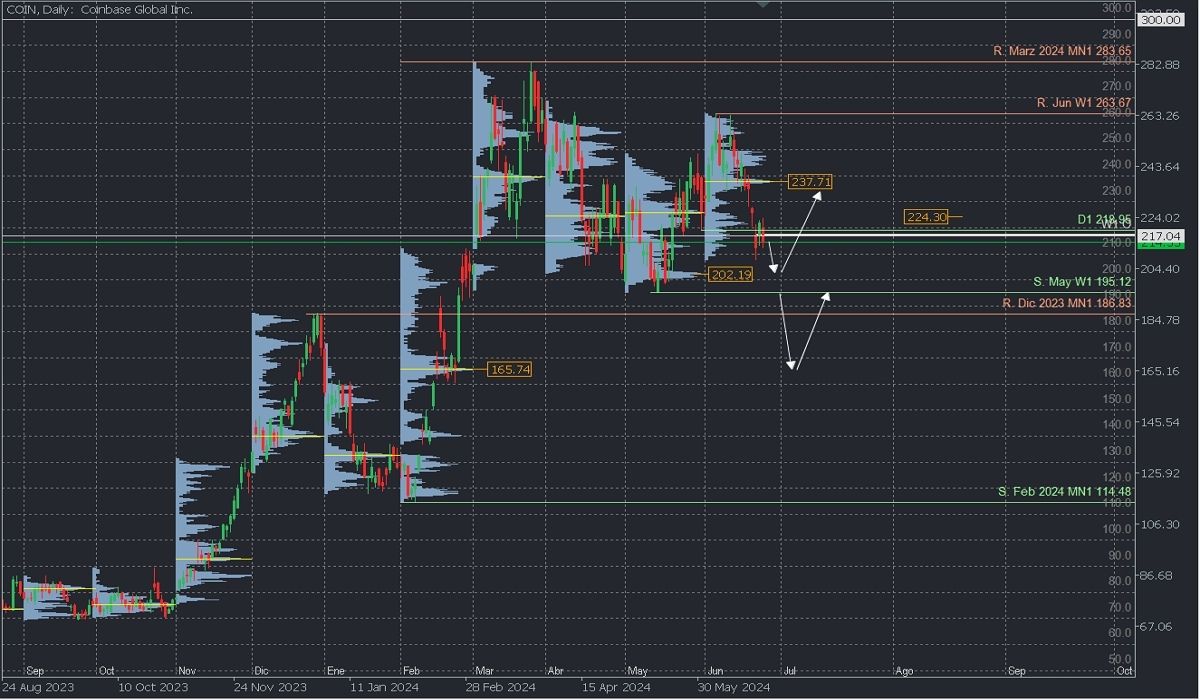

Technical Analysis, Daily

The consolidation of the past few months could extend the decline towards the next high-volume node from May around $202.19, from where a recovery towards the uncovered average POC of the last three months at $224.30 and June's POC at $237.71 is expected. Both are selling zones, but market optimism may encourage bulls to renew the rally towards $250 and June's resistance at $263.67.

On the other hand, if May's support at $195.12 is lost, the stock will extend its decline towards February's buying zone at the uncovered POC* at $165.74, with an expected active intervention by the bulls.