Fundamental Analysis

The Dollar Index (DXY) regained ground this week, rising to 101.60, driven by a rebound in Treasury yields and anticipation ahead of Jerome Powell's speech at Jackson Hole. The drop in the manufacturing PMI to 48.0 in August, the lowest of the year, adds pressure on the dollar, but expectations of rate cuts have sustained demand for the greenback.

Additionally, statements from Fed members like Susan Collins and Jeff Schmid, suggesting rate cuts if inflation continues cooling, create uncertainty about the dollar's future direction. This keeps the DXY in a key consolidation zone as investors await clearer monetary policy signals.

Technical Analysis

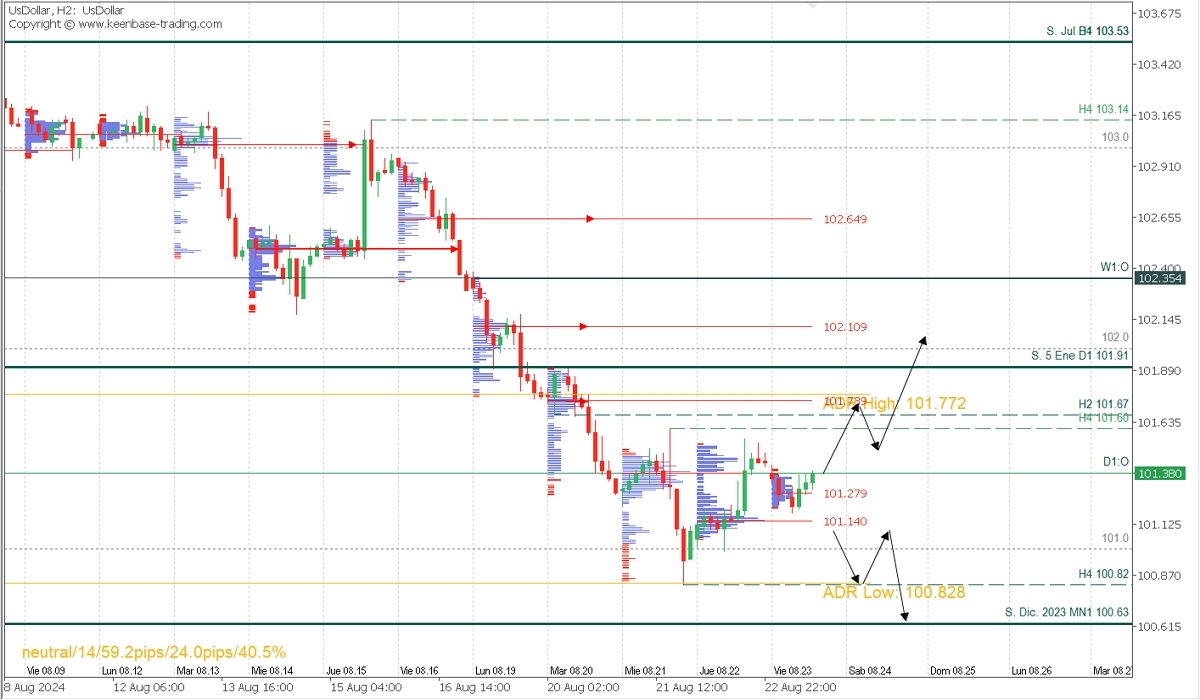

Dollar Index (DXY)

- Supply Zones (Sells): 101.77

- Demand Zones (Buys): 101.27 - 101.14

The recent price correction was triggered by yesterday's production and labour data. The mixed results from the S&P U.S. PMIs—better-than-expected composite and services data but weaker manufacturing numbers, coupled with lower-than-expected jobless claims—affected the index.

The overall trend is bearish, approaching the December support at 100.63, with weekly support at 100.82, where it corrected and is now testing the last intraday resistance at 101.60.

Although the price failed to break the key resistance at 101.60, a weaker decline toward yesterday's demand zone around 101.14 was observed, halting the drop during early sessions and forming a new volume cluster at 101.279. As long as the price stays above these demand zones, a renewed rally is expected to challenge the last significant intraday resistance of the bearish trend and aim for the next key supply zone around 101.77.

However, if the price decisively breaks below the indicated demand zone, the bearish trend will likely resume, targeting the current weekly support at 100.82, in line with the average bearish range.

The renewed USDX rebound will drive:

- Sells in EURUSD, GBPUSD, AUDUSD, NZDUSD, XAUUSD, and

- Buys in USDJPY, USDCHF.

EURUSD

- Supply Zones (Sells): 1.1121 and 1.1143

- Demand Zones (Buys): 1.1087 and 1.1075

As long as the price remains below the early session volume cluster at 1.1121, consider sells targeting 1.11, 1.1139, and the demand zone at 1.1076. This scenario becomes invalid if the price decisively breaks above 1.1130, aiming for yesterday’s uncovered POC at 1.1143, with a possible bearish reaction toward 1.11 or 1.1087 on an extended move.

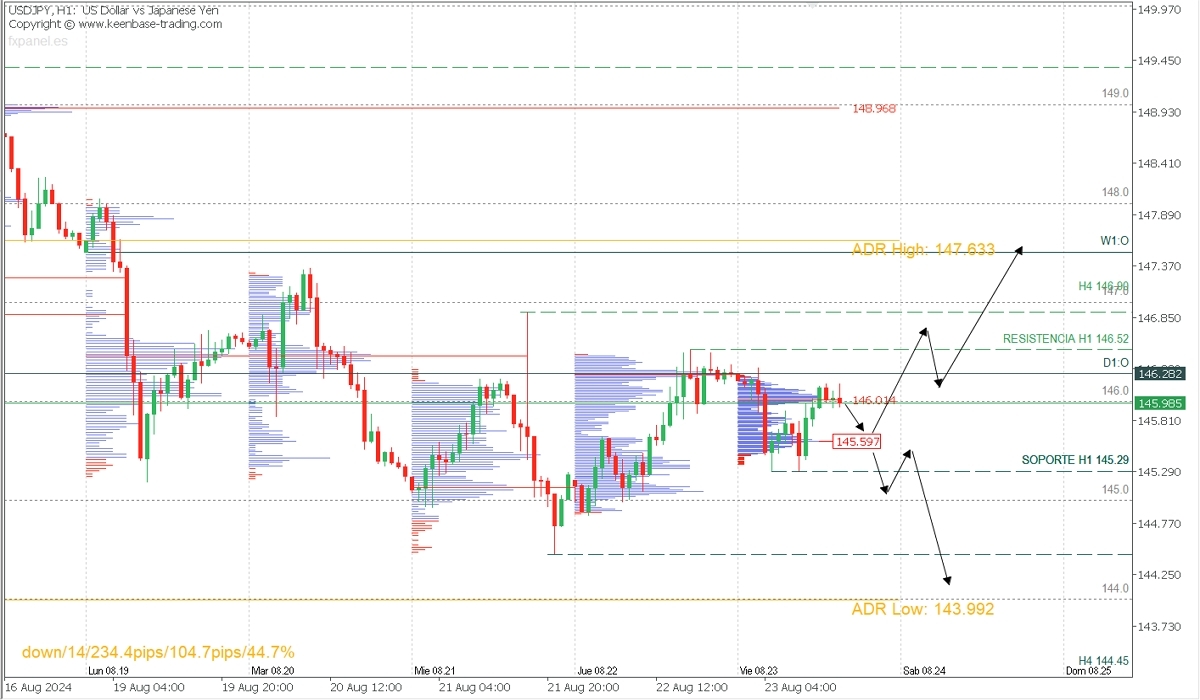

USDJPY

- Supply Zones (Sells): 146.28 and 146.01

- Demand Zones (Buys): 145.59, 145.00

The price is consolidating between yesterday's supply and demand zones, so a breakout above the closest supply at 146.01 and 146.28 confirms more buying pressure, aiming to challenge the last significant intraday resistance at 146.90. A decisive break, confirmed with two higher highs, will trigger a bullish reversal. On the other hand, if the price drops sharply below 145.59, targets will include breaking below 145.00 toward 144.45 and 144.00, continuing the bearish trend.

*Uncovered POC: The Point of Control (POC) is the level or zone where the highest volume concentration occurred. If a bearish move originated from it, it is considered a sell zone and forms resistance. Conversely, if an upward move originated from it, it is considered a buy zone, often forming support levels.