Fundamental Analysis

Today, September 12, 2024, the European Central Bank (ECB) is expected to cut interest rates by 60 basis points, marking a significant adjustment in its monetary policy. The main refinancing rate could drop to 3.65% in response to slowing inflation, which reached 2.2% in August. This move reflects growing concerns about the eurozone's weakening economic growth. Christine Lagarde's speech and updated economic forecasts will be crucial to understanding the future direction of monetary policy and its impact on the EURUSD pair, which may experience volatility.

Despite easing inflation and slower wage growth, strength in some service sectors raises uncertainty about the extent of future rate cuts. While the 60 basis point reduction is almost certain, the long-term outlook will depend on the evolution of key economic indicators and how the ECB manages the balance between growth and price stability.

Technical Analysis

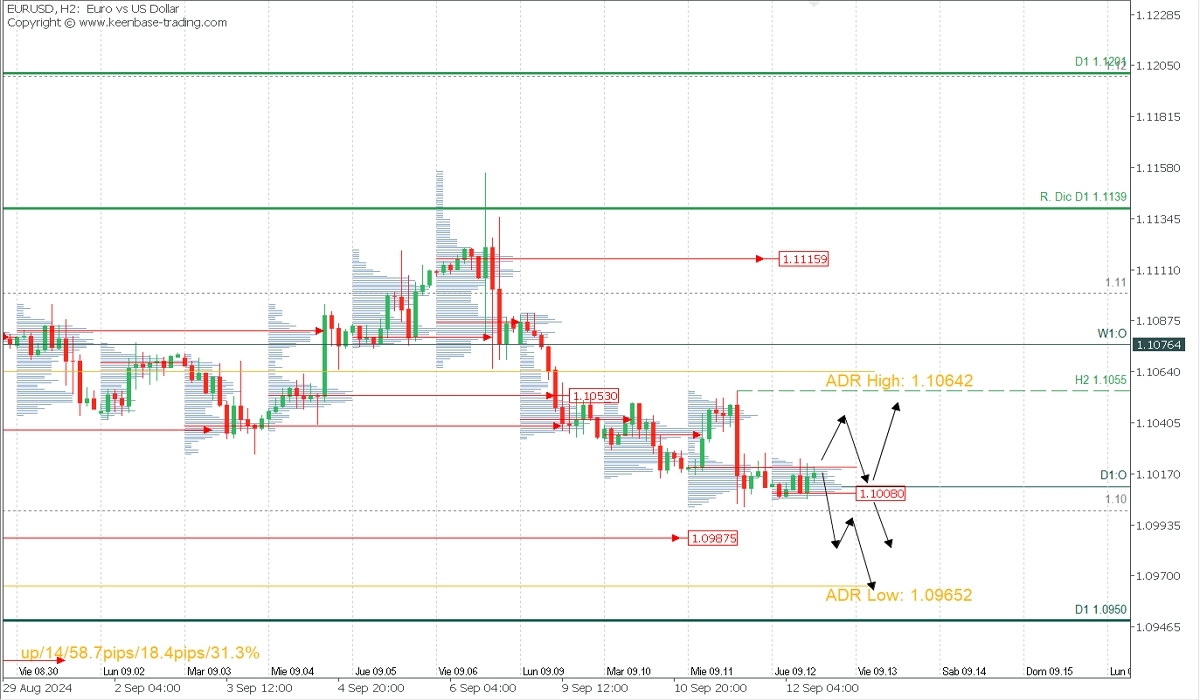

EURUSD

- Supply Zones (Sellers): 1.1020 and 1.1044

- Demand Zones (Buyers): 1.1008 and 1.0987

Consolidation below yesterday’s supply zone around 1.1020 suggests weak buying interest. As long as the pullback stays below this area, renewed selling is expected towards the uncovered POC* at 1.0987, with a potential extension to the bearish range at 1.0965. A rebound above 1.1020 may seek liquidity at the high-volume node around 1.1044 before resuming the decline toward 1.0987. The bearish scenario holds as long as the pullback does not decisively break above the last intraday resistance at 1.1055.

If the ECB cuts rates less than expected, there will be an upward reaction in the euro, potentially breaking key intraday resistance. Consider entering sell positions only after a confirmed exhaustion/reversal pattern (ERP) below 1.1020. If no pattern forms, wait for a rebound toward the next selling zone at 1.1044 and confirm the sell entry with an M5 technical setup. Avoid early, unconfirmed entries.

Technical Summary

Bearish continuation scenario: Sell below 1.1020 with TP at 1.0987, 1.0965, and 1.0950. This scenario is invalidated if the price breaks above 1.1055.

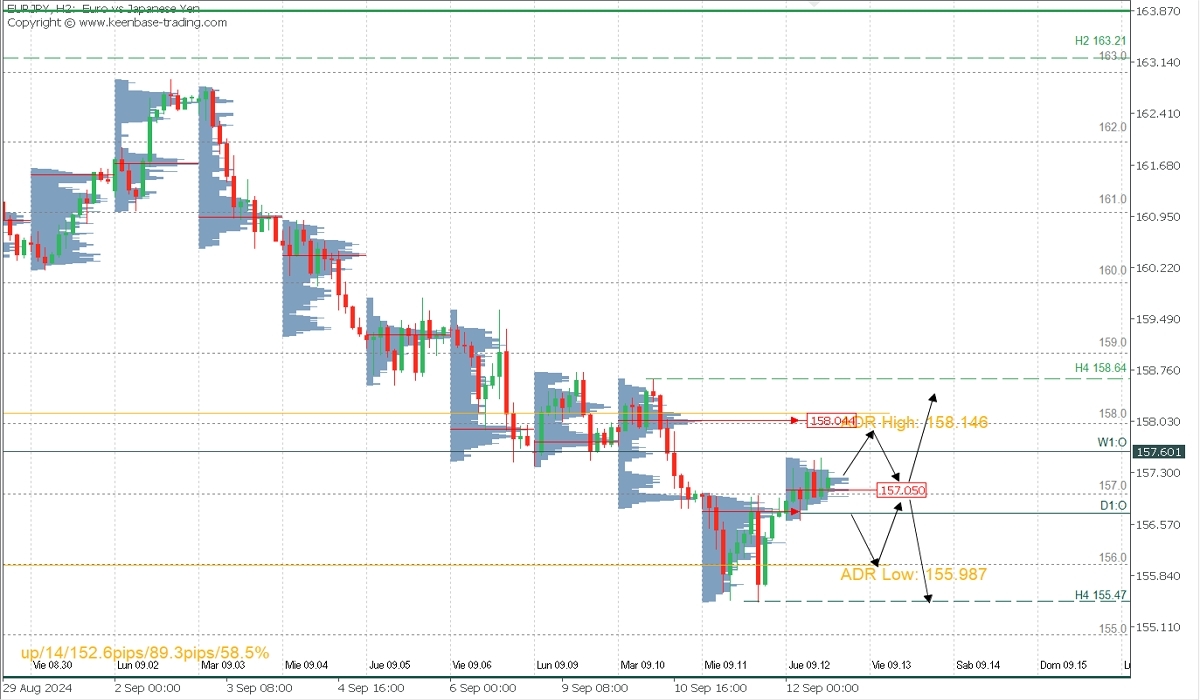

EURJPY

- Supply Zones (Sellers): 158.00

- Demand Zones (Buyers): 156.73 and 157.05

The yen’s broad correction against its counterparts has also supported the euro in recent hours. As long as prices remain above the demand zone between 156.73 and 157.00, a rebound toward the closest supply zone at 158.00 is expected. A break of 158.00 threatens the last validated intraday bearish resistance at 158.64. A decisive break or confirmation with two upward moves will reverse the current bearish trend. However, a strong reaction at the supply zone and a drop below 156.70 suggest weakness in bulls, potentially extending the decline to the daily range at 156.00.

If the ECB cuts rates less than expected, buying will be triggered toward 158.00 or higher. However, if expectations are met or exceeded, the fall could target the bearish range and potentially break the current support at 155.47.

Technical Summary

- Corrective bullish scenario (with a smaller-than-expected cut): Buy above 157.00 with TP at 158.00, and only consider 158.64 if a decisive break occurs.

- Bearish scenario: Sell below 157.00 with TP at 156.00 or 155.47 on extension.

POC Explained

POC (Point of Control): The level or zone where the highest concentration of volume occurred. If a bearish move followed, it is considered a selling zone and forms resistance. Conversely, if a bullish move followed, it is a buying zone, typically located at lows and forms support.