European Central Bank (ECB) President Christine Lagarde has signaled that more interest rate cuts may be coming if upcoming inflation data matches expectations. Speaking at the Bank of Lithuania, Lagarde mentioned that the eurozone is nearing its 2% inflation target and hinted at further easing if the current trends continue. The ECB recently reduced interest rates for the third time in a row, bringing the deposit rate down to 3% from its peak of 4% as inflation cools and economic growth slows.

Inflation in the eurozone dropped to 2.3% in November, down from over 10% last year, and is projected to fall further in the coming years. However, Lagarde cautioned that geopolitical events and potential U.S. trade policies, such as tariffs promised by Donald Trump, could impact eurozone growth and energy costs. The ECB’s next interest rate decision is scheduled for January 30, shortly after Trump’s inauguration.

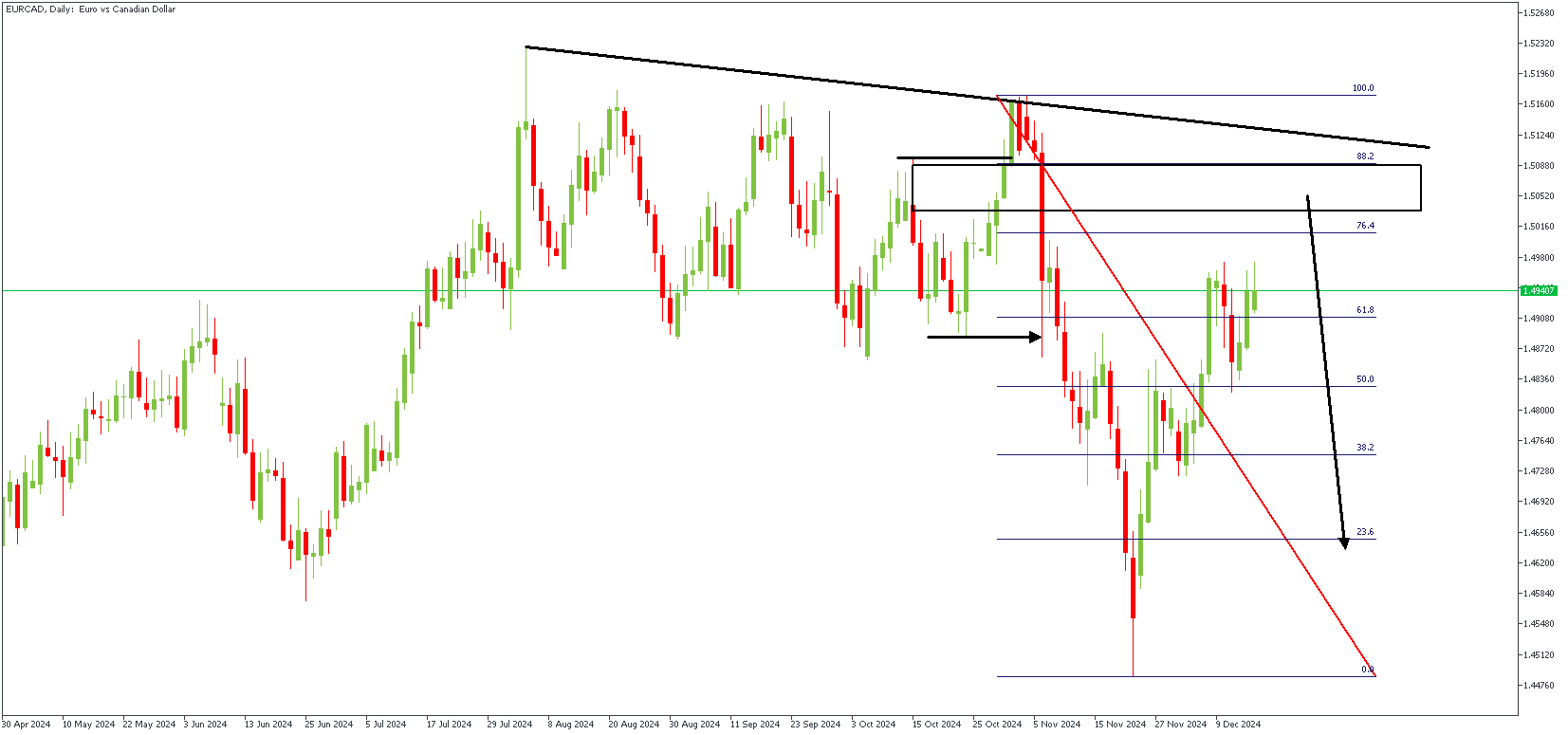

EURCAD – D1 Timeframe

On the daily timeframe chart of EURCAD, a few striking technical factors intertwine: the SBR (Sweep-Break-Retest) pattern, resistance trendline, and Fibonacci retracement levels. Since the most recent impulse created a new low, it sets the tone for a bearish sentiment afterward.

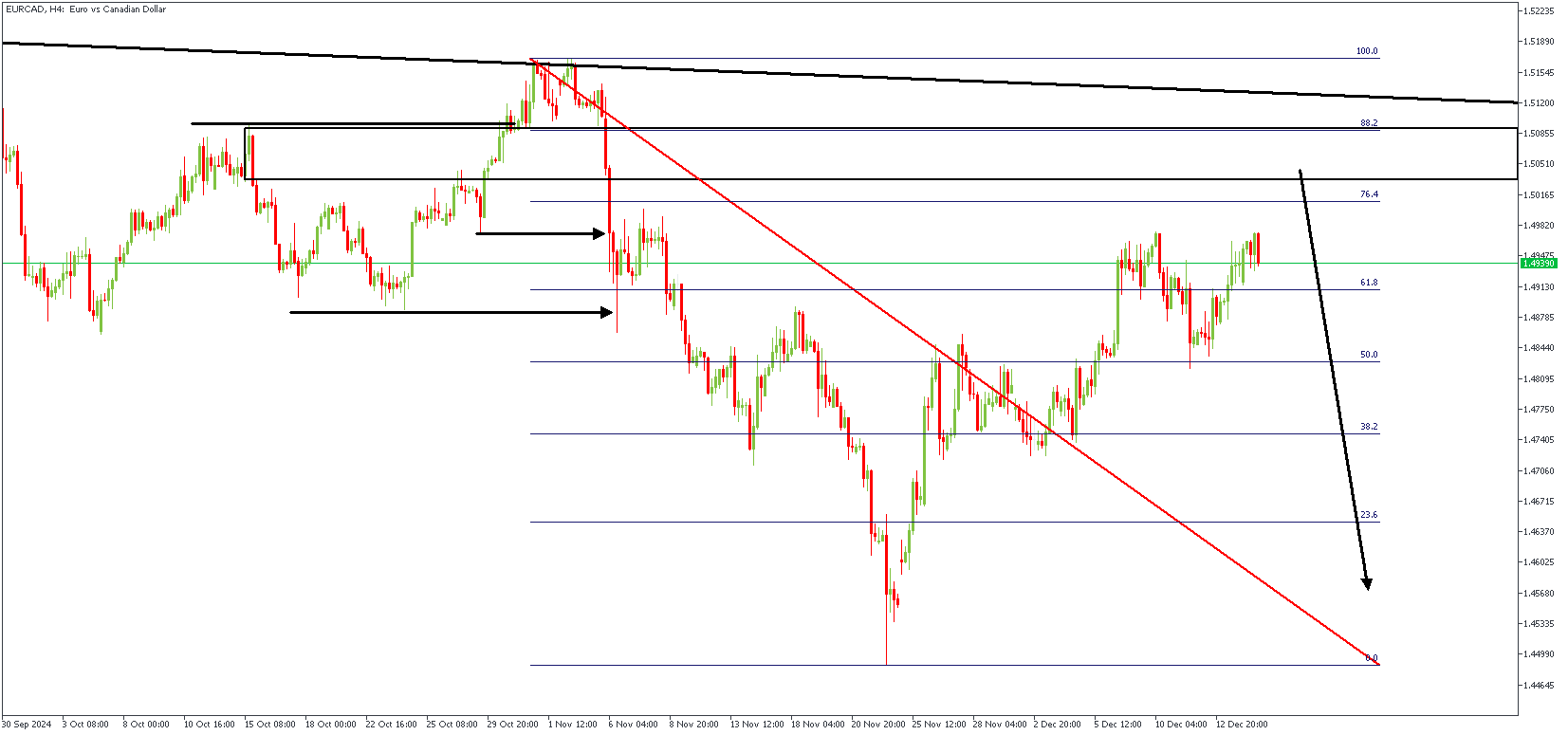

EURCAD – H4 Timeframe

In the 4-hour timeframe, the SBR pattern takes on the form of a head-and-shoulders pattern, with the right shoulder expected to be around the 88% Fibonacci retracement level. The resistance trendline will also be pivotal to the final outcome of this projection.

Analyst’s Expectations:

Direction: Bearish

Target: 1.46569

Invalidation: 1.51743

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.