The USDCHF pair trades around 0.9170, marking its fifth day of gains during Monday's early European session. A stronger US Dollar is supported by better-than-expected US job data for December, which has eased worries about further interest rate cuts from the Federal Reserve. Markets are now waiting for the US Producer Price Index (PPI) report, due Tuesday, for more economic clues.

Meanwhile, geopolitical tensions, including ongoing conflicts in the Middle East, are driving demand for the safe-haven Swiss Franc. Concerns about President-elect Donald Trump's policies are also adding uncertainty, but for now, the stronger US Dollar is supporting the USDCHF pair. Based on this, let's see how the price lines up on the EURCHF charts.

EURCHF – D1 Timeframe

.png)

There has been a recent bullish break of structure on the daily timeframe chart of EURCHF as the price broke above the previous high, leaving behind a supply zone and a Fair Value Gap region. From the daily timeframe chart perspective, the price is expected to attempt a retest of the FVG region before continuing bullish. Now, let's see how this looks on the entry timeframe.

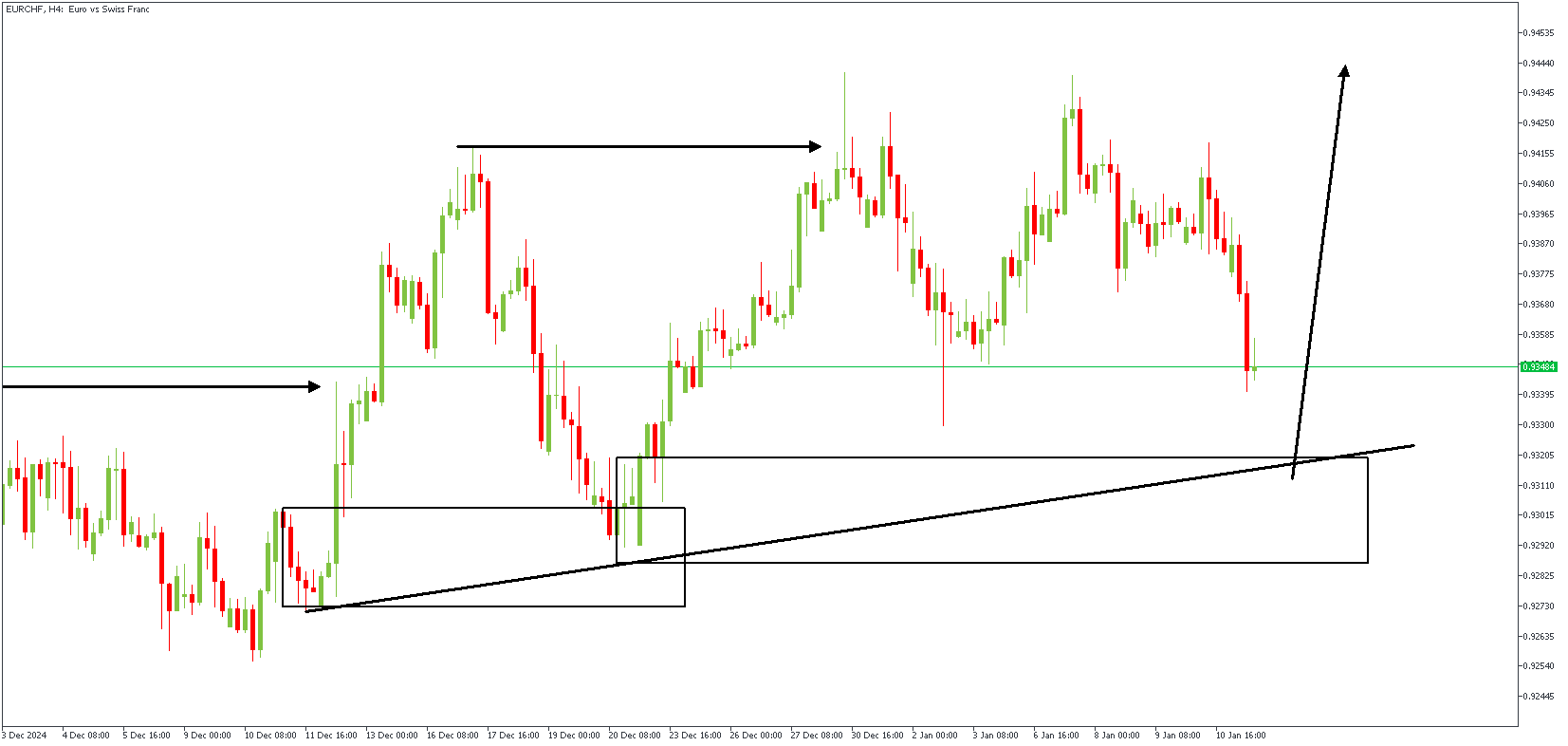

EURCHF – H4 Timeframe

As seen on the daily timeframe, my sentiment as touching EURCHF is bullish. The confluence of the trendline support and the drop-base-rally demand zone is my expected area of entry, with targets highlighted below.

Analyst's Expectations:

Direction: Bullish

Target: 0.94397

Invalidation: 0.92589

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.