The British pound declined to $1.23, its lowest point since mid-November, following cautious remarks from Bank of England Deputy Governor Dave Ramsden, sparking speculation about the timing of the central bank's first rate cut. Ramsden indicated that the risk of UK inflation remaining high has lessened, potentially falling below the BoE's projections. GBPUSD is currently trading around 1.2345. This follows Megan Greene, another BoE official, cautioning against a rate cut, pointing to recent economic data showing increased wage growth and services price inflation in the UK. Market expectations now lean towards a rate cut at the August meeting, earlier than previously anticipated in September, with the possibility of an adjustment as soon as June.

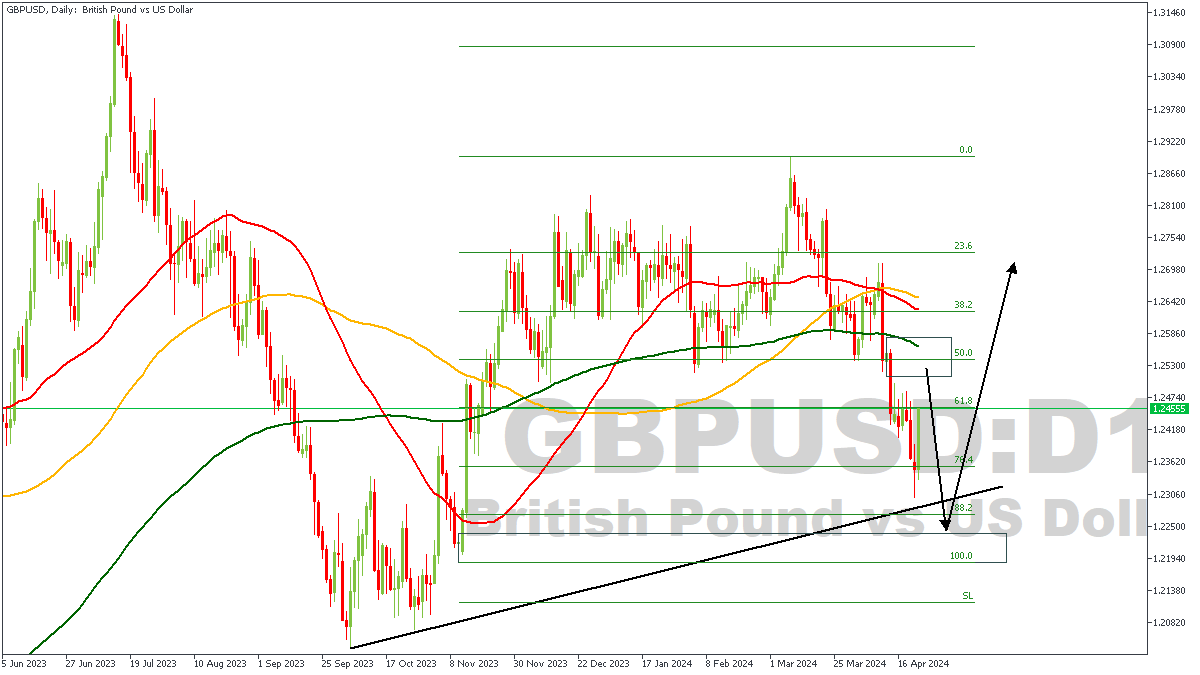

GBPUSD – D1 Timeframe

GBPUSD as seen from the daily timeframe chart is in a bullish trend, albeit currently undergoing a bearish retracement. It is my belief that we would get a price rejection from the supply zone around the 50% Fibonacci level, which would bring prices all the way down to retest the trendline support, and the demand zone, before flying all the way back up. In simple words, my overall sentiment in this regard is bullish.

Analyst’s Expectations:

Direction: Bullish

Target: 1.26463

Invalidation: 1.21800

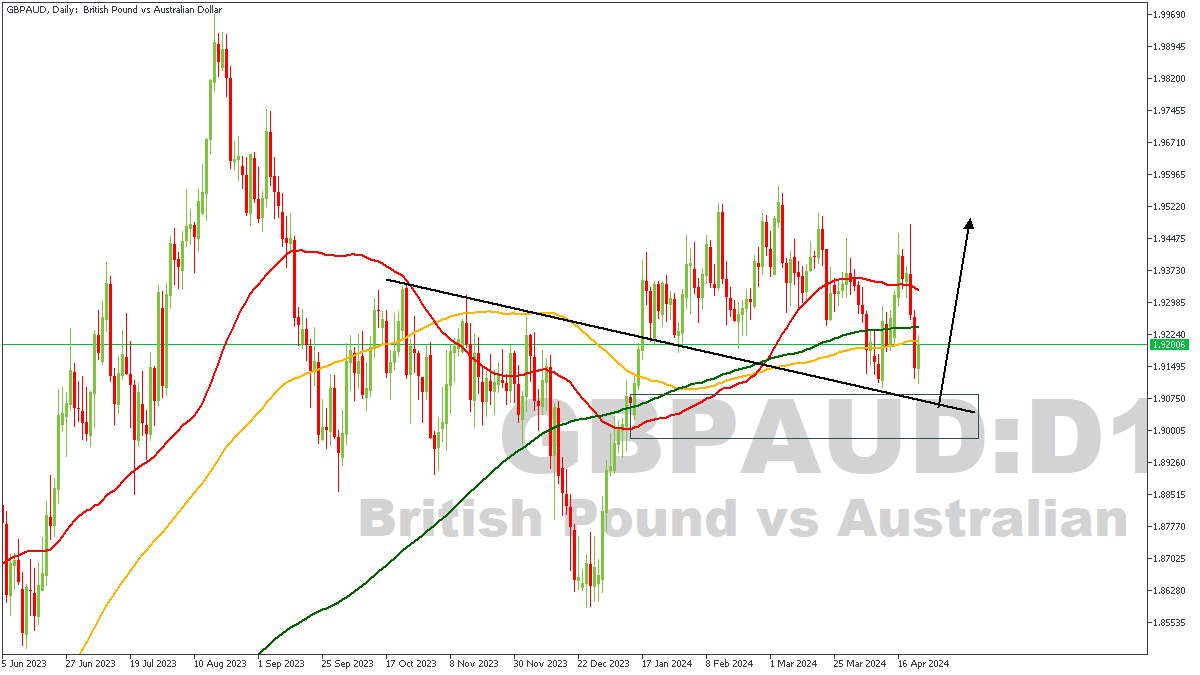

GBPAUD – D1 Timeframe

Here on the Daily timeframe chart of GBPAUD, we see price behaviour which hints at the fact that price is currently in search of a reliable demand zone/confluence capable of providing sufficient momentum for the bulls to invade the markets. To this end, I expect to see a retest of the trendline support, as it aligns with a premium demand zone, and then a resumption of the bullish pressure on the GBPAUD price.

Analyst’s Expectations:

Direction: Bullish

Target: 1.93405

Invalidation: 1.89499

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.