Google's parent company, Alphabet Inc. (NASDAQ: GOOGL), is one of the most popular stocks among hedge funds, with 202 of them holding shares. On 13th Feb., Mizuho Securities gave Alphabet a favorable rating of "Outperform," though they slightly lowered their price target from $235 to $230. They still believe the stock is a good buy for several reasons.

Alphabet's advertising revenues have been more substantial than expected, especially in insurance, retail, and political ads. This has helped boost earnings from both Google Search and YouTube. Although the company faced challenges with its Cloud division due to capacity limitations, demand for its Core GCP products and AI infrastructure remains high. Cloud revenue could grow even more once these capacity issues are addressed.

Alphabet is also investing heavily in AI and custom hardware, which shows that management is confident about the company's long-term growth potential.

Overall, Alphabet ranks 4th on our list of trending AI stocks on Wall Street. While we see a lot of growth potential in Alphabet, other AI stocks might offer even higher returns in a shorter period.

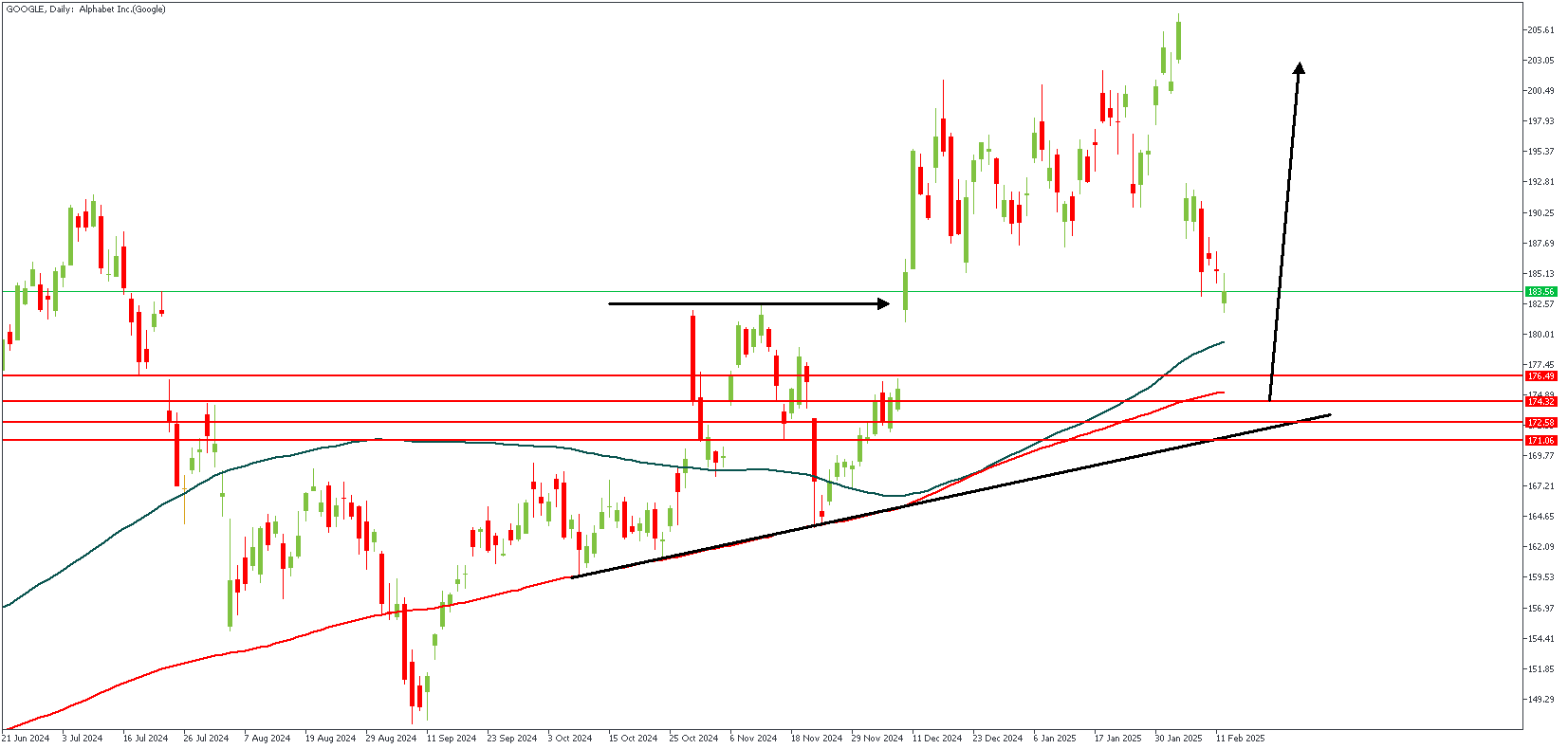

Google – D1 Timeframe

Following the bullish break of structure on Google's Daily timeframe chart, the price is currently retracing towards the moving average support. The bullish array of the moving averages and the trendline support provide additional confluence for the bullish argument.

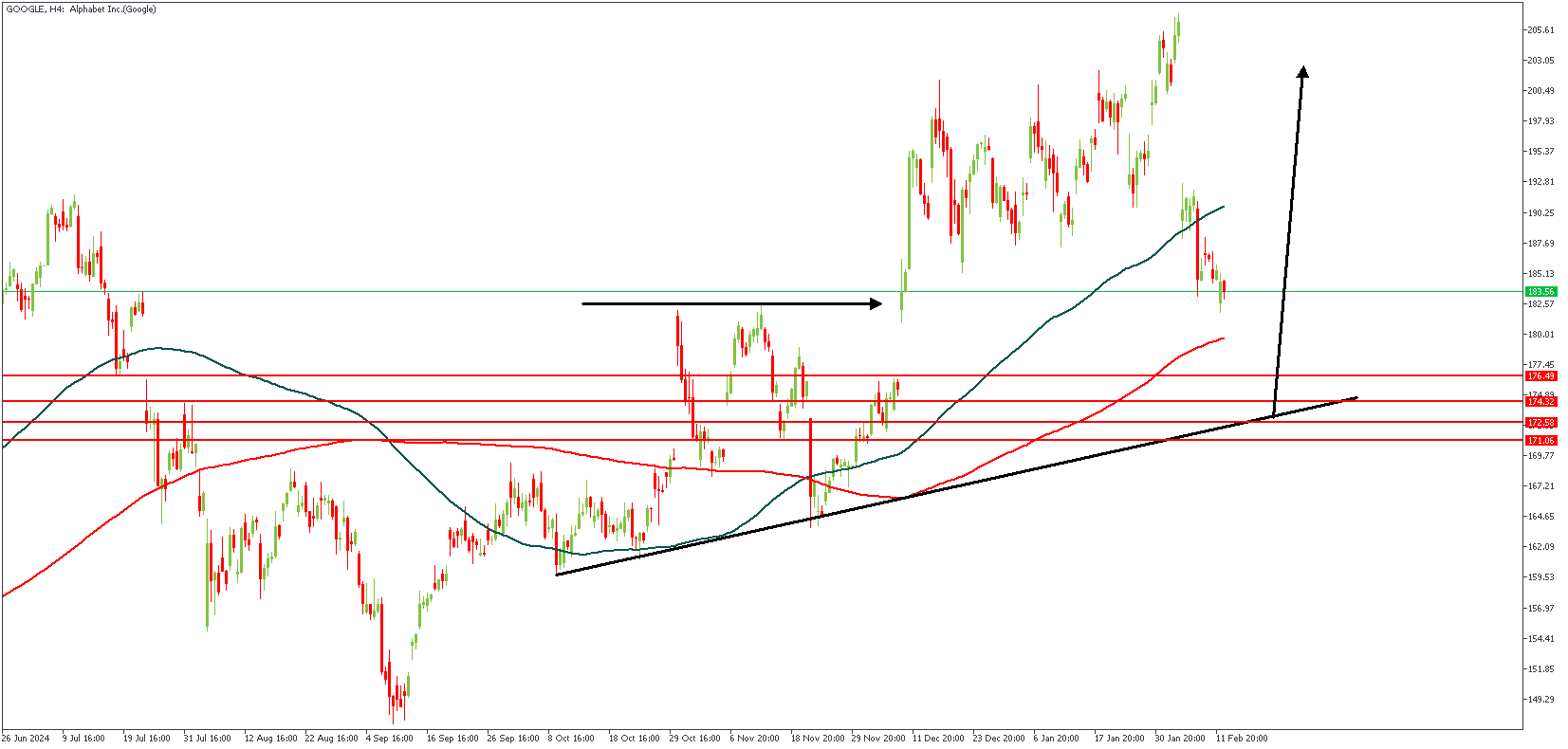

Google – H4 Timeframe

The 4-hour timeframe chart reveals the details of the Fair Value Gap, the daily timeframe pivot region, and the trendline support. The demand zone from the tip of the previous low falls within the 76% region of the Fibonacci retracement tool and also overlaps the daily timeframe pivot zone.

Analyst's Expectations:

Direction: Bullish

Target: 200.83

Invalidation: 167.63

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.