Exciting Update: FBS Reduces Trading Spreads on AUDJPY

AUDJPY, the instrument of the week, reflects the economic interaction between Australia and Japan. The Australian Dollar (AUD) reacts to domestic economic reports and the policy of the Reserve Bank of Australia. Meanwhile, the Japanese Yen (JPY) is influenced by Japan’s economic conditions and the decisions of the Bank of Japan. This currency pair reflects economic trends in both countries of the Asia-Pacific region.

Japan Interest Rate Decision, April 26

Suppose the Bank of Japan raises the interest rate from -0.10% to 0.10%. This decision would reflect a shift towards a tighter monetary policy, which typically strengthens the national currency by attracting yield-seeking capital. Consequently, the Japanese Yen could rise against the Australian Dollar, potentially driving the AUDJPY pair down. Conversely, suppose the Bank of Japan maintains the rate at -0.10%, contrary to expectations. This decision may show they still have concerns about economic stability, which could weaken the Yen and support a higher AUDJPY exchange rate.

Australia Consumer Price Index (CPI) YoY, April 24

If Australia’s CPI comes in at 4.1%, below the forecast of 4.3% and significantly lower than the previous 5.4%, it would indicate a decrease in inflationary pressures. This scenario might prompt the Reserve Bank of Australia to maintain a more accommodative monetary stance, potentially weakening the AUD against the Yen and driving the AUDJPY pair downwards. However, if the CPI unexpectedly exceeds the forecasts, it will indicate persistent inflation, and the Reserve Bank of Australia could consider tightening monetary policy sooner, strengthening the AUD and potentially pushing AUDJPY higher.

Australia Producer Price Index (PPI) QoQ, April 26

If the Australian PPI shows an increase of only 0.9% against the forecasted 1.9%, it would suggest a slowdown in production cost inflation, potentially leading to lower future consumer prices. This could make the Reserve Bank of Australia delay or minimize rate increases, weakening the AUD relative to the JPY and possibly resulting in a lower AUDJPY rate. Contrary, if the PPI exceeds expectations, demonstrating higher production costs that might propagate to consumers, the RBA could prompt quicker monetary tightening, strengthening the AUD and elevating the AUDJPY exchange rate.

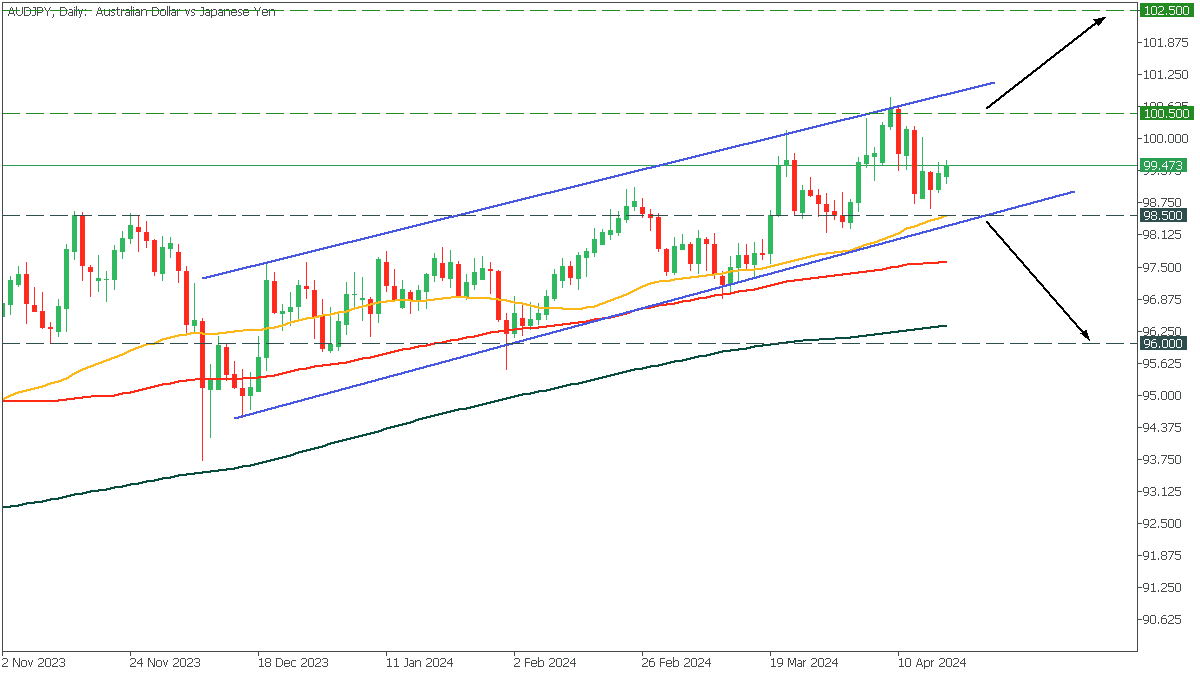

In the Daily timeframe, AUDJPY formed an ascending channel pattern, and the price bounced off the lower trendline. Despite the long-term growth, the price may correct after the news release.

If AUDJPY breaks the resistance of 100.500, it will rise to 102.500, which is the high of 2014;

Otherwise, a break of the trend line and a fall below 98.500 will lead to a decline to 96.000.