Exciting Update: FBS Reduces GBPAUD Trading Spreads

The GBPAUD pair represents the exchange rate between the British Pound and the Australian Dollar, serving as a crucial metric of economic interaction between the United Kingdom and Australia. Monetary policy changes, economic reports, and political developments heavily influence the GBP. In particular, it’s sensitive to European changes, given the UK’s significant economic ties to the region. On the other hand, the AUD is impacted by Australia’s commodity-based economy, with prices of natural resources like iron ore and coal playing a critical role and shifts in economic stability within the Asia-Pacific region. This makes the GBPAUD pair extremely reactive to changes in economic indicators and policy adjustments from both countries.

Reserve Bank of Australia Assistant Governor Kent Speaks, June 26, 1:35 (GMT+2)

If Assistant Governor Kent delivers a more optimistic economic outlook than anticipated, suggesting robust growth and potential tightening monetary policy, the Australian Dollar will likely strengthen. This appreciation of the AUD would generally lead to a decrease in the GBPAUD exchange rate. Conversely, if Kent’s speech delivers a less favorable view of the economy, possibly hinting at prolonged monetary easing due to slower recovery or economic setbacks, it would likely weaken the AUD.

UK Gross Domestic Product (GDP) QoQ, June 28, 08:00 (GMT+2)

Should the upcoming UK GDP data reveal growth exceeding the forecast of 0.6%, it indicates a more robust economic recovery than analysts predicted. Such an outcome would bolster the GBP by demonstrating the resilience and strength of the UK economy, leading to a potential increase in the GBPAUD exchange rate as investor confidence in the GBP grows. Alternatively, if the GDP figures are disappointing and show weaker growth than forecasted, it would raise concerns about the pace of economic recovery in the UK.

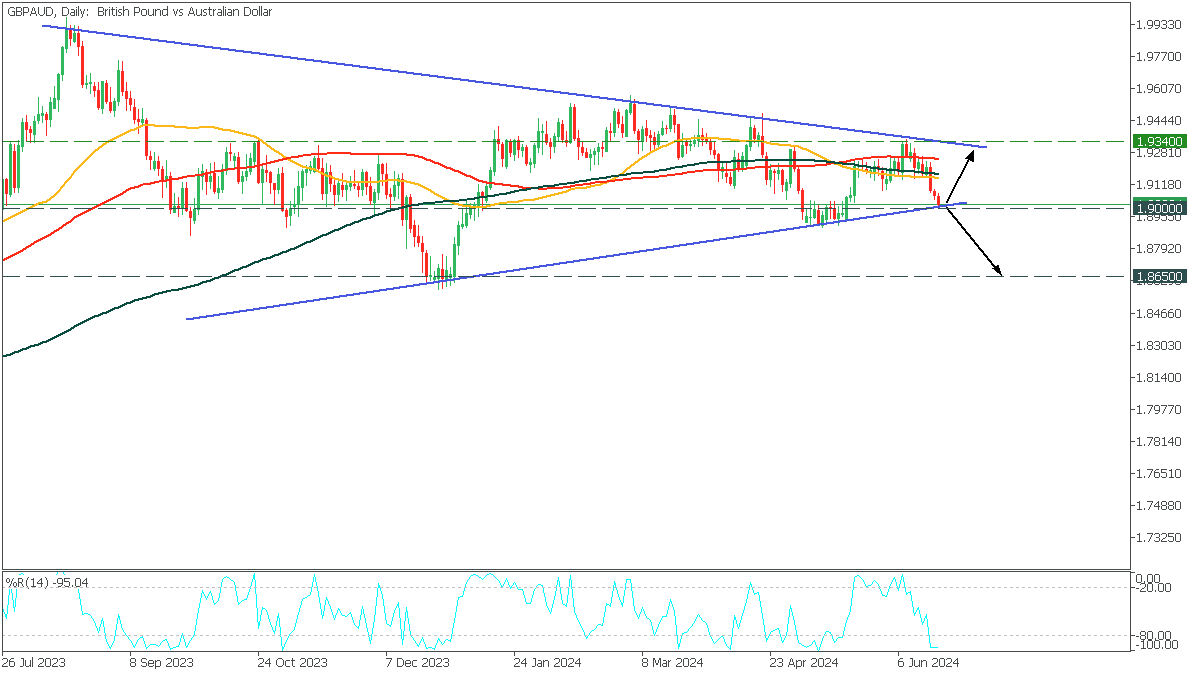

In the Daily timeframe, GBPAUD has formed a symmetrical triangle pattern, and the price has reached the lower trend line. The moving averages indicate bearish sentiment, but the %R shows extremely oversold, which creates two possible scenarios.

If the bears push the price below 1.9000, breaking the lower trend line, GBPAUD will fly down to 1.8650;

A rebound from the support will send the price to the upper trend resistance at 1.9340.