The Japanese yen strengthened on Tuesday following reports that the Bank of Japan might raise interest rates to 0.25% at its upcoming meeting, exceeding market expectations. This potential rate hike and plans to taper bond buying have caused significant movement in the yen, which is currently at 153.29 per dollar, down from its 38-year high earlier this month. Analysts like Shaun Osborne of Scotiabank suggest the yen's fair value is around 145 per dollar, indicating further room for appreciation. Despite recent gains, some experts believe the yen will weaken over time due to the interest rate differential between the U.S. and Japan. The dollar has lost approximately 4.7% against the yen in July.

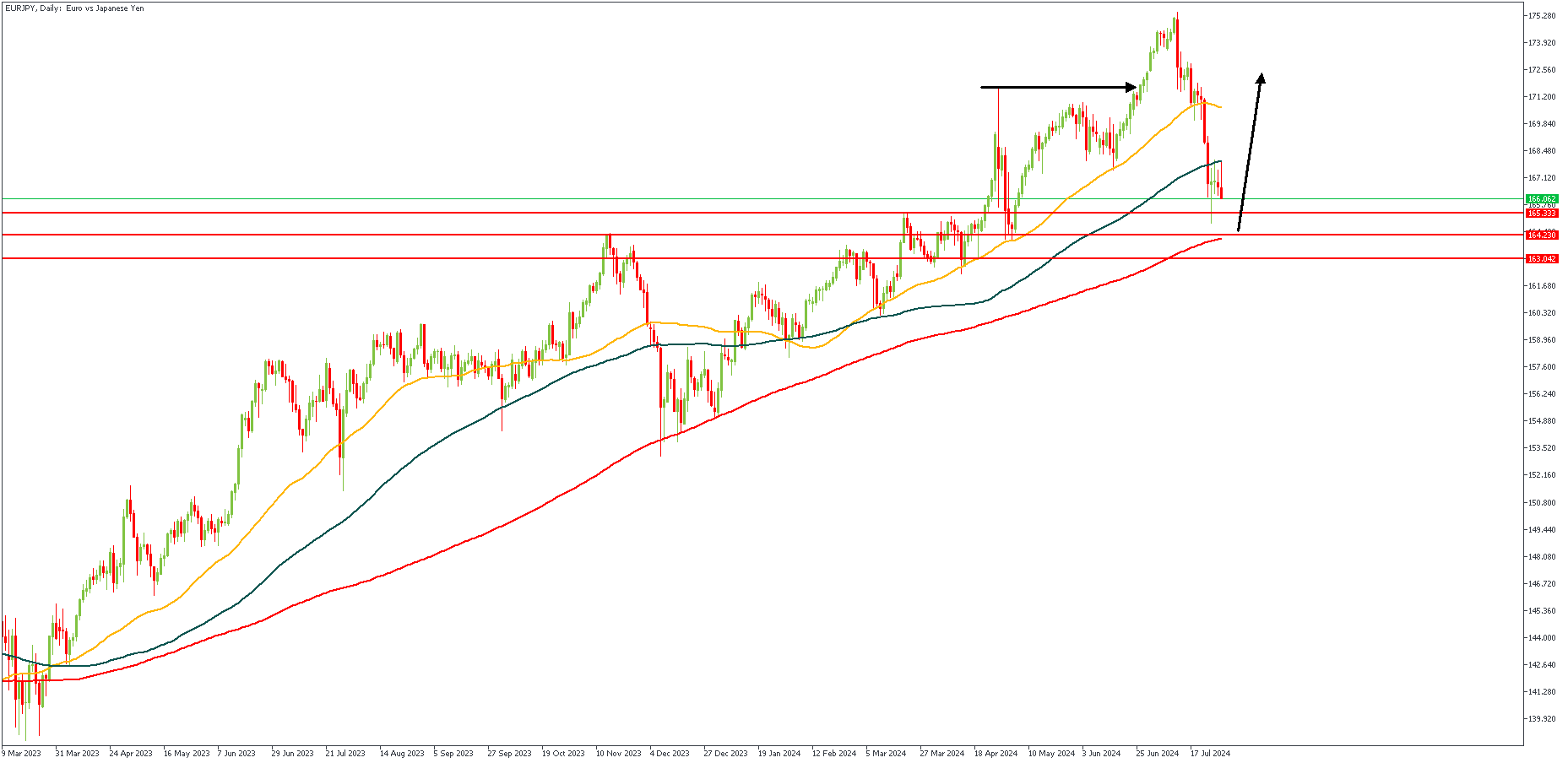

EURJPY – D1 Timeframe

EURJPY on the daily timeframe has seen a steep decline following the bullish momentum from JPY index, but the current position is anxiously close to the pivot region, with the likelihood of the 200-day moving average joining forces with the 88% of the Fibonacci retracement to bring about a reversal in the direction of price movement. Considering the bullish array of the moving averages, I think my sentiment is pretty solid in favor of a bullish outcome from the test of this confluence region.

Analyst’s Expectations:

Direction: Bullish

Target: 172.560

Invalidation: 162.151

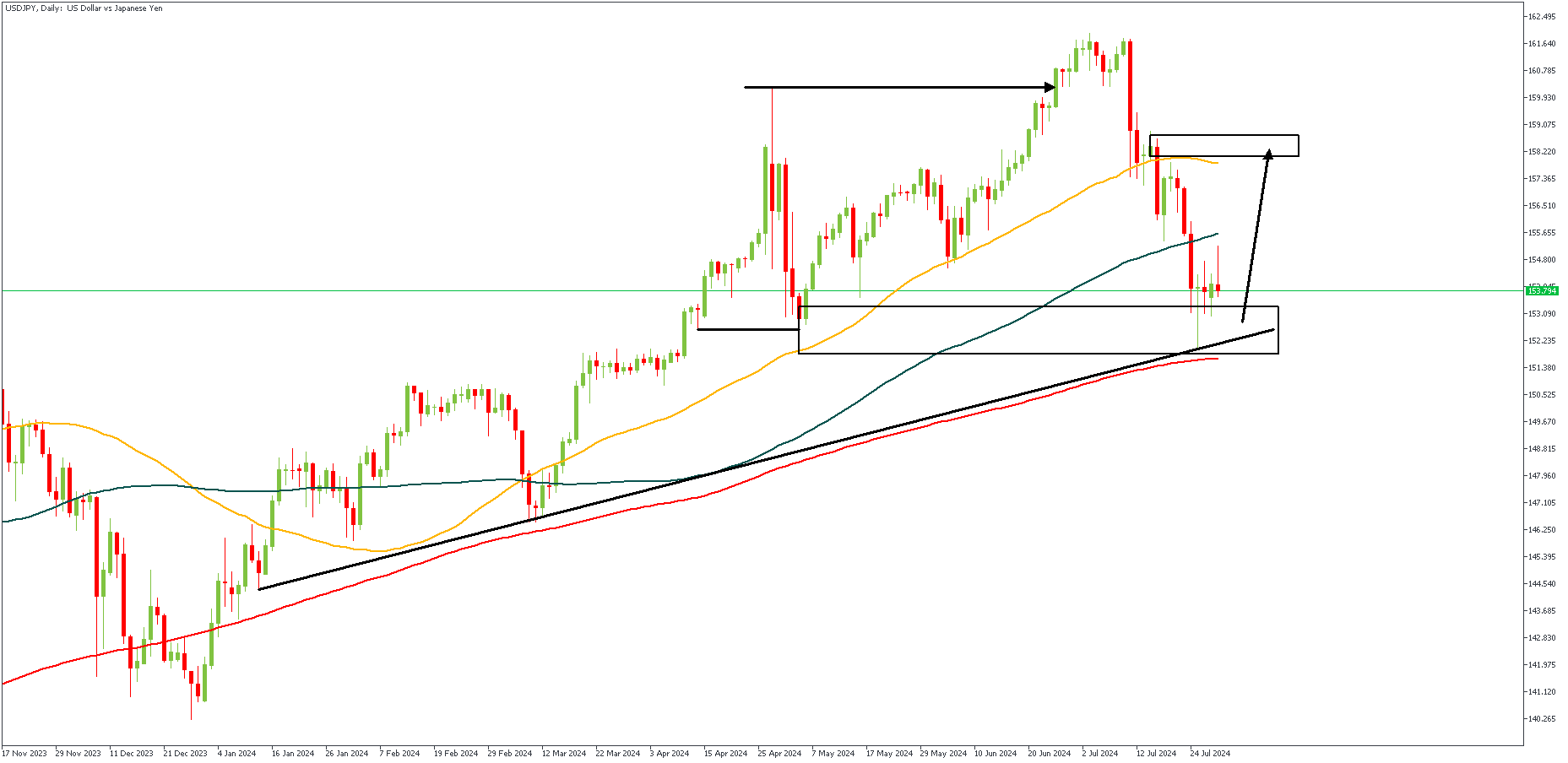

USDJPY – D1 Timeframe

The daily timeframe of USDJPY presents an even clearer scenario. Here, we see a SBR price action pattern been formed, with a retest around the trendline support, the 200-day moving average, and the drop-base-rally demand zone from the previous bullish swing. Considering the bullish array of the moving averages, it is my belief that a reversal is imminent.

Analyst’s Expectations:

Direction: Bullish

Target: 157.932

Invalidation: 151.500

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.