Nvidia, a leader in artificial intelligence (AI) technology, releases its earnings today. Here are the key points to understand what to expect:

1. Revenue and Earnings

- Expected Revenue: $33.29 billion (+84% vs. last year).

- Earnings per Share (EPS): $0.70 (vs. $0.37 last year).

- Nvidia has exceeded its projections in the last five quarters.

2. Data Center Growth

- Segment Sales: $29.28 billion (new record).

- This represents the majority of revenue, driven by demand for AI and machine learning infrastructure.

3. Blackwell Chips: The Next Big Step

- Expected to generate billions in sales starting in Q1 2025.

- Risk: Supply chain constraints could limit immediate results.

4. Stock Performance

- Shares have tripled in value in 2024, closing at $145.88.

- Projection: Morgan Stanley raised the price target to $160.

5. Shareholder Returns

- Nvidia returned $15.4 billion through share buybacks and dividends this year.

- New Buyback Authorization: $50 billion.

Conclusion

Nvidia continues to lead in AI and advanced technology, with strong financial results and promising future prospects. This quarter's results will be crucial to confirm its position and impact on the tech market.

Analysts' Projections for Nvidia

1. 12-Month Price Targets:

- Average: $165.18.

- High: $200.

- Low: $90.

2. Recommendations by Investor Type:

- Buy: If you believe in Nvidia’s long-term potential and expect AI demand and new technologies (like Blackwell chips) to drive growth, the positive outlook supports buying decisions.

- Hold: Holding may be the prudent strategy if you already own shares and want to secure gains as revenue from new products materializes.

- Sell: Selling could be appropriate if you prefer to capitalize on current performance (+180% this year) and reduce risk due to potential supply constraints or market saturation.

Key Considerations:

- Nvidia remains a leader in the AI sector but faces short-term risks like supply chain issues.

- Morgan Stanley's $160 price target and "overweight" rating indicate confidence in growth, but the wide range of price estimates suggests high volatility.

Technical Analysis

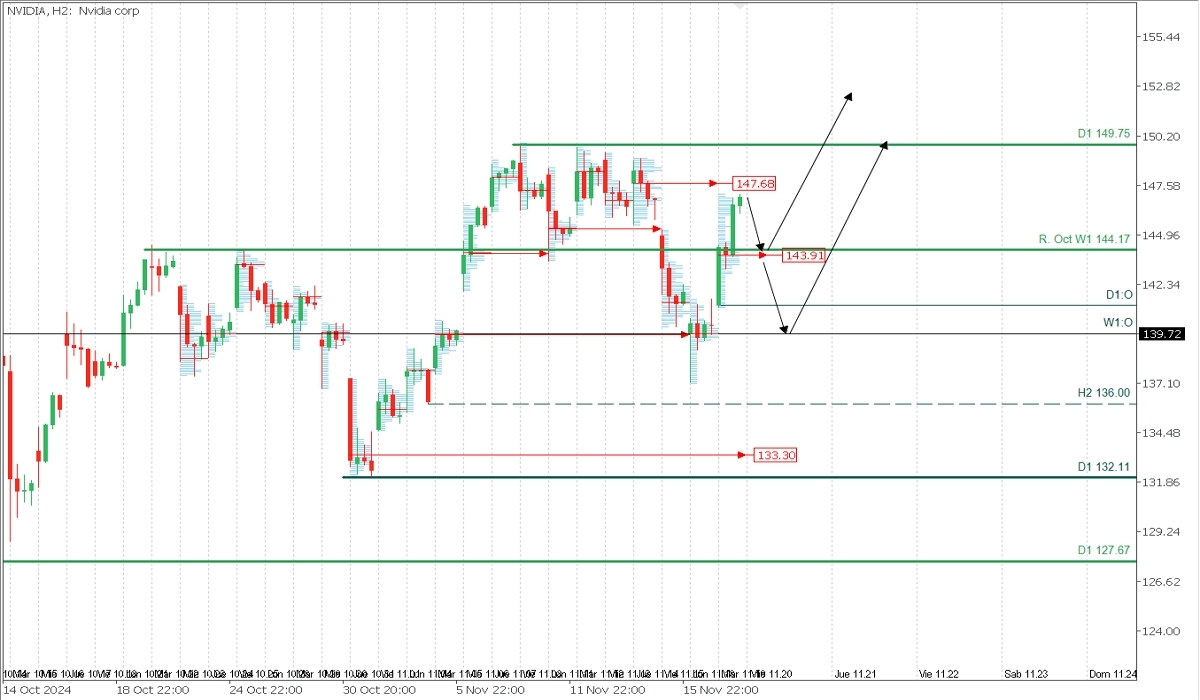

- Supply Zone (Sell): $147.68.

- Demand Zones (Buy): $143.91 and $139.72.

The price recovered yesterday and faces a supply zone around $147.68, which may encourage selling for a potential drop toward yesterday's Point of Control (POC) at $143.91. If this level breaks downward, selling could extend toward the weekly open at $139.72.

It’s important to consider that analysts have very high expectations for Nvidia. While strong results are expected, these expectations might trigger selling pressure toward key demand levels. From these levels, buying could resume, targeting $149.75 and projected price objectives for the coming months.