NZDUSD trades near the monthly high of 0.5985, recovering from earlier declines, but faces pressure from an expected drop in New Zealand's job growth. The pair failed to defend its April low and hit a new yearly low, potentially extending losses despite the RBNZ's restrictive monetary stance. A forecasted 0.2% contraction in Q2 employment and a rise in the jobless rate to 4.7% could push the RBNZ to reconsider its policies. Conversely, a stronger-than-expected job report might support NZDUSD by reducing rate-cut speculation. Overall, NZDUSD may struggle to surpass the monthly high if economic data disappoints.

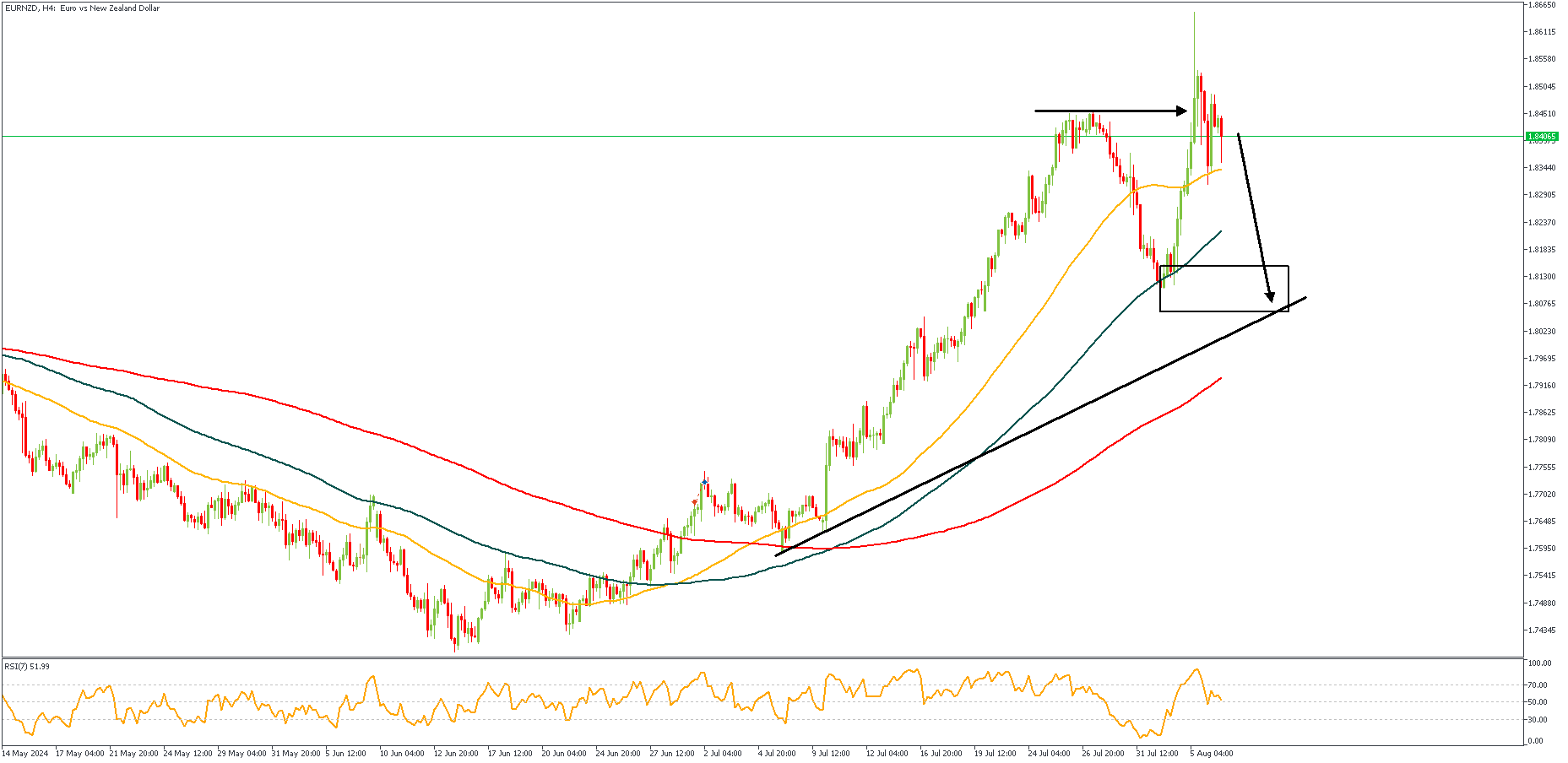

EURNZD– H4 Timeframe

The RSI (Relative Strength Indicator) on the 4-hour timeframe of EURNZD is currently returning from the overbought region, indicating the likelihood of a bearish momentum. Considering the recent break above the previous high, it is possible price seeks out the demand zone below the 100-period moving average in order to use it as an area of support for price. Although the overall direction is bullish, as a result of the fundamental release from the RBNZ, we may see a temporary decline in the price to accommodate new buyers.

Analyst’s Expectations:

Direction: Bearish

Target: 1.81501

Invalidation: 1.85421

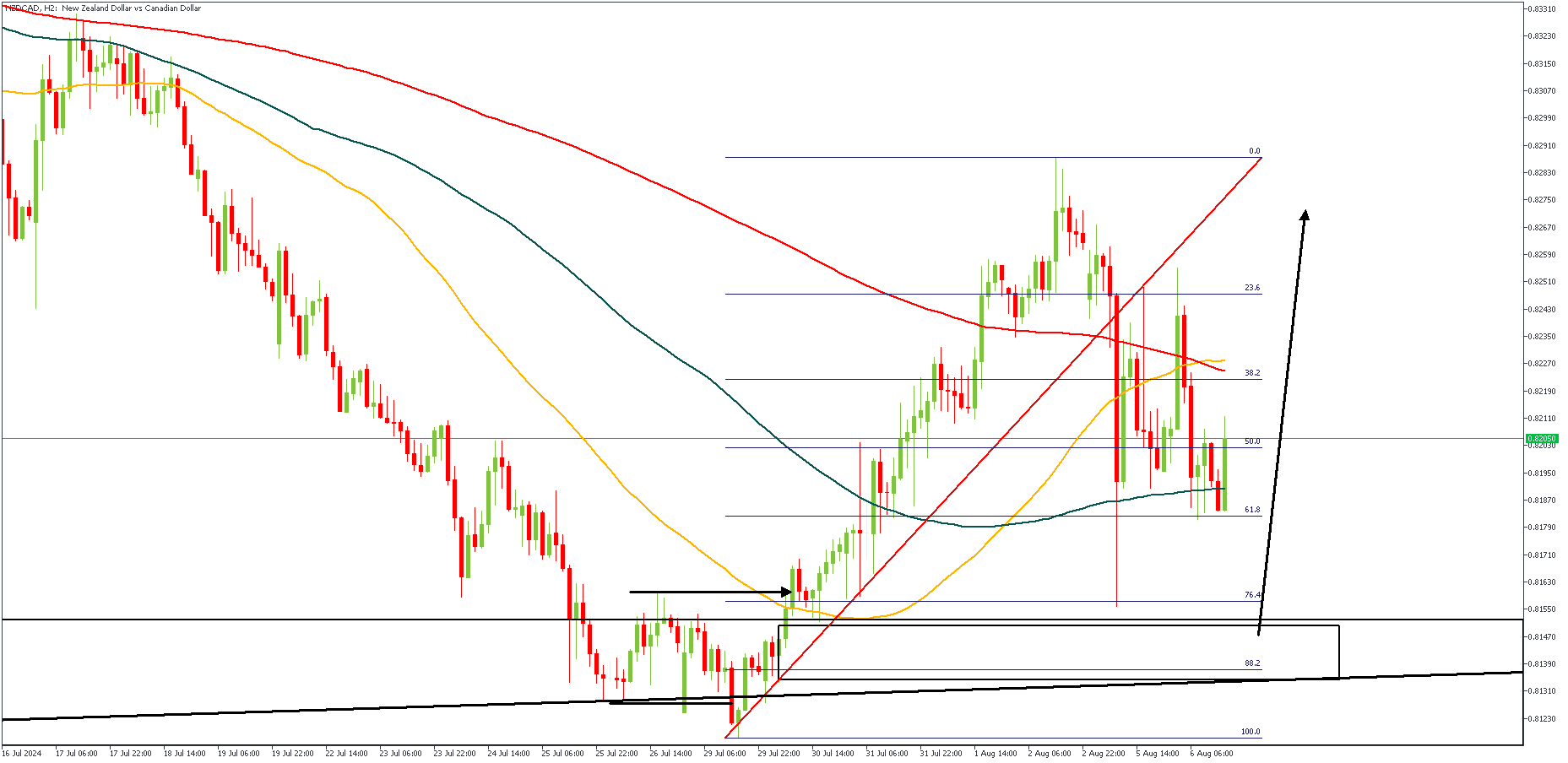

NZDCAD – H2 Timeframe

The 2-hour timeframe of NZDCAD shows a typical price action pattern I’ve always referred to as the SBR (Sweep-Break-Retest) pattern; we see the liquidity from the previous low getting swept, followed by a break of structure. In this case, the 76% of the Fibonacci retracement tool is my target for an entry since it overlaps a demand zone, as well as the daily timeframe pivot zone.

Analyst’s Expectations:

Direction: Bullish

Target: 082500

Invalidation: 0.81130

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.