Barclays PLC reduced its stake in Public Service Enterprise Group (PEG) by 11.1% in the third quarter, now owning 975,784 shares valued at $87.05 million. Other institutional investors also adjusted their positions in PEG, with some increasing holdings and others acquiring new stakes. Hedge funds and institutional investors collectively own 73.34% of the company’s stock.

PEG shares opened at $85.56 on Thursday, maintaining a trading range between its 52-week low of $56.85 and high of $95.22. The stock has a market capitalization of $42.63 billion and a dividend yield of 2.81%. The company declared a quarterly dividend of $0.60 per share, payable on December 31, 2024.

In its recent earnings report, PEG posted $0.90 earnings per share, beating estimates of $0.87. Revenue was up 7.6% year over year to $2.64 billion. Analysts predict the company will achieve $3.67 per share for the current fiscal year.

Equity analysts have a generally favorable outlook for PEG, with multiple firms giving “Buy” ratings and an average price target of $88.08. While Barclays lowered its target to $88, others like UBS and Morgan Stanley have set higher targets between $94 and $95.

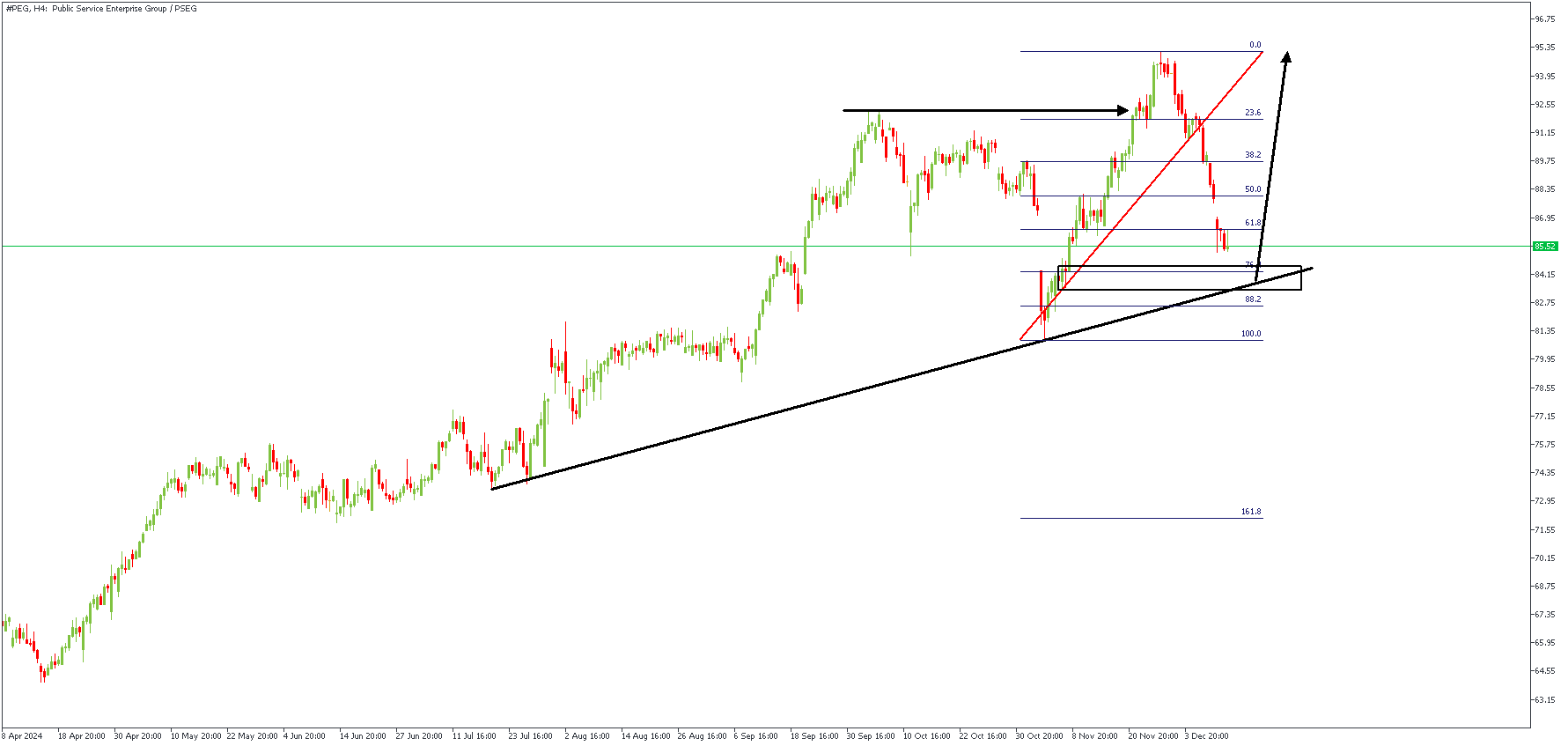

PEG – H4 Timeframe

The 4-hour timeframe chart of PEG stock shows an uptrend, meaning the price has steadily increased. Recently, the price pulled back after hitting a new high, retracing down to key Fibonacci levels (76% and 88%), zones where the price often reverses back up. Analysts expect the price to find support near these Fibonacci levels. The sentiment is bullish, considering the confluence of the Fibonacci level, the rally-base-rally demand zone, and the trendline support. The key takeaway, however, is to watch for confirmation of a bounce from the highlighted trendline or Fibonacci support zones before entering a buy position.

Analyst’s Expectations:

Direction: Bullish

Target: 95.24

Invalidation: 79.01

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.