Summit Global Investments recently reduced its shares in Qualcomm, selling 8,158 shares in the third quarter, leaving them with 48,279 shares valued at about $8.2 million. Other large investors also adjusted their positions. For example, Wedge Capital Management increased its Qualcomm holdings by 17.1%, while Sumitomo Mitsui DS Asset Management raised theirs by nearly 40%. On Friday, Qualcomm’s stock opened at $172.91, with the company having a market value of $192.62 billion. Qualcomm recently reported earnings of $2.26 per share, beating analysts' expectations, and revenue of $10.24 billion. The company also announced a quarterly dividend of $0.85 per share, which will be paid on December 19. This annual dividend provides a 1.97% yield.

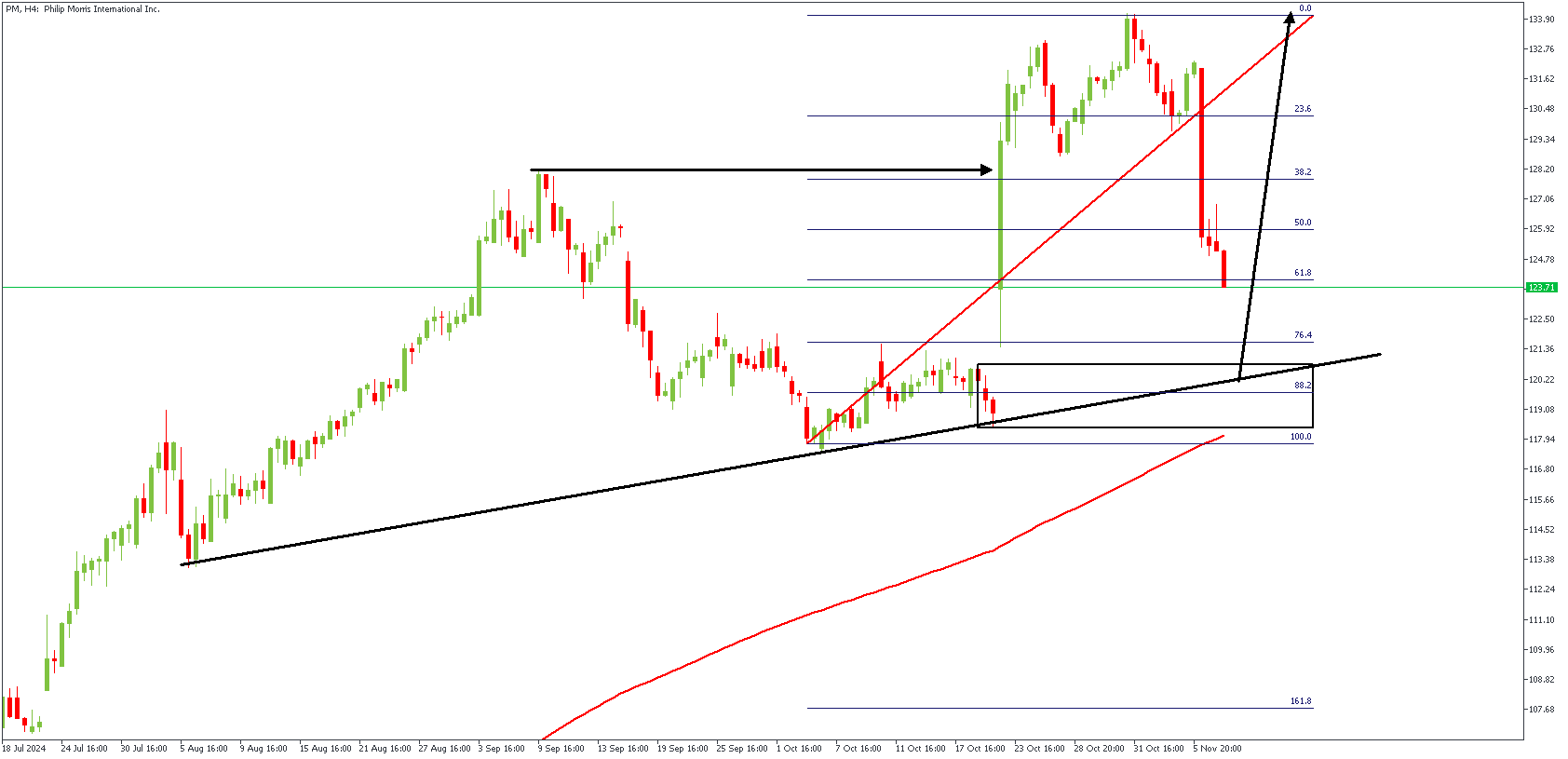

PM – H4 Timeframe

The price on the 4-hour chart of Philip Morris appears to be pretty open-and-shut. Price recently broke above the previous high (highlighted by the horizontal arrow), followed by a retracement which is now heading into the 76% Fibonacci retracement area. In addition, the drop-base-rally demand zone at the 88% Fibonacci level, the trendline, and the moving average support.

Analyst’s Expectations:

Direction: Bullish

Target: 133.95

Invalidation: 116.64

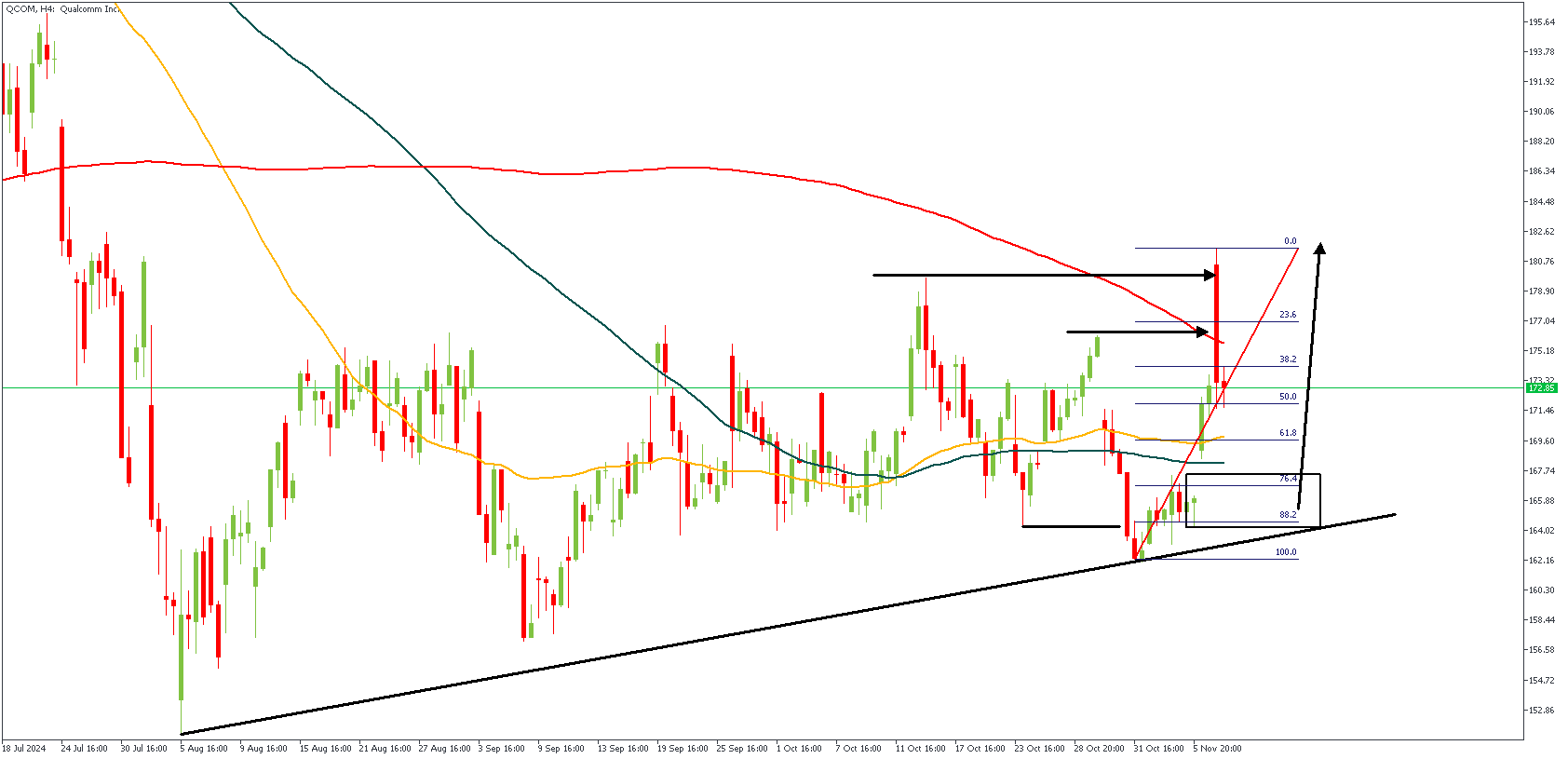

QCOM – H4 Timeframe

The spike above the previous high describes a break of structure, and a bullish change of character. The 76% Fibonacci retracement level serves as a critical area of support for price since it features other critical bullish confluences like; the rally-base-rally demand zone, trendline support, and the 100-period moving average support.

Analyst’s Expectations:

Direction: Bullish

Target: 182.62

Invalidation: 161.18

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.