Stocks closed lower yesterday, with the S&P 500 dropping 19 points, reducing its October gains to under 1%. This decline was primarily due to continued drops in major tech stocks and rising Treasury bond yields, pushed up by stronger-than-expected jobs data and a solid third-quarter GDP report. Earnings from Meta (META) and Microsoft (MSFT) highlighted the high costs of expanding AI technology, weighing on big tech companies' profit margins. Apple (AAPL) and Amazon (AMZN) are set to release their September-quarter updates after the market closes. Apple will likely provide insights into the demand for the iPhone 16, and Amazon is expected to discuss future spending plans. In the bond market, the 10-year Treasury yield remains around its highest level since early July, currently at 4.288%. Fueled by a strong economy and expected government borrowing after next week's election, inflation concerns have also pushed 2-year Treasury yields to a multi-month high of 4.174%.

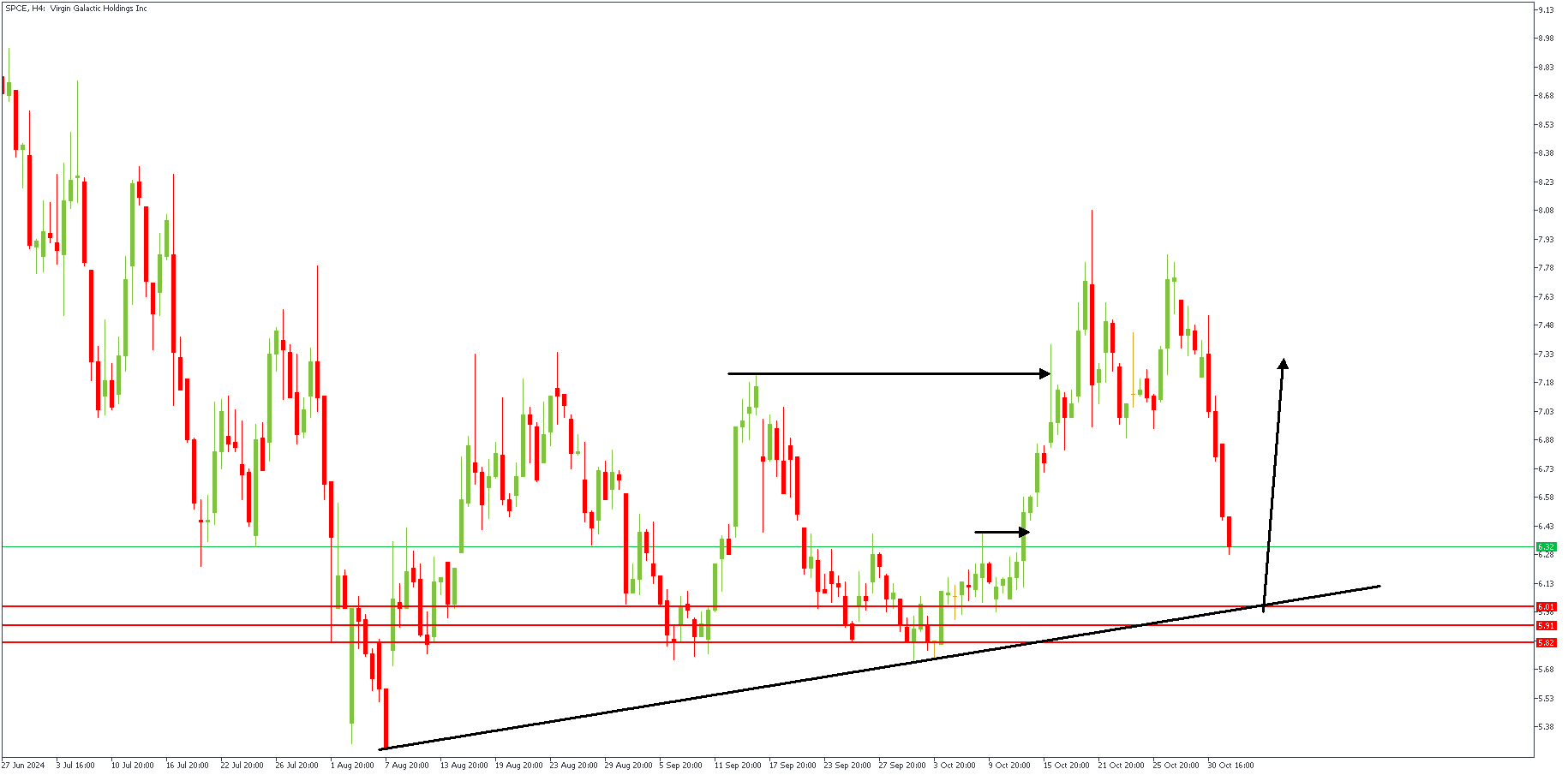

SPCE – H4 Timeframe

Following the recent bullish break of structure, we have seen the price create a retracement that is currently approaching the drop-base-rally demand zone at the bottom of the previous impulse. Considering the confluence from the Daily timeframe pivot zone and the trendline support, I would say the bullish continuation might just be a few pips away.

Analyst's Expectations:

Direction: Bullish

Target:7.33

Invalidation:5.72

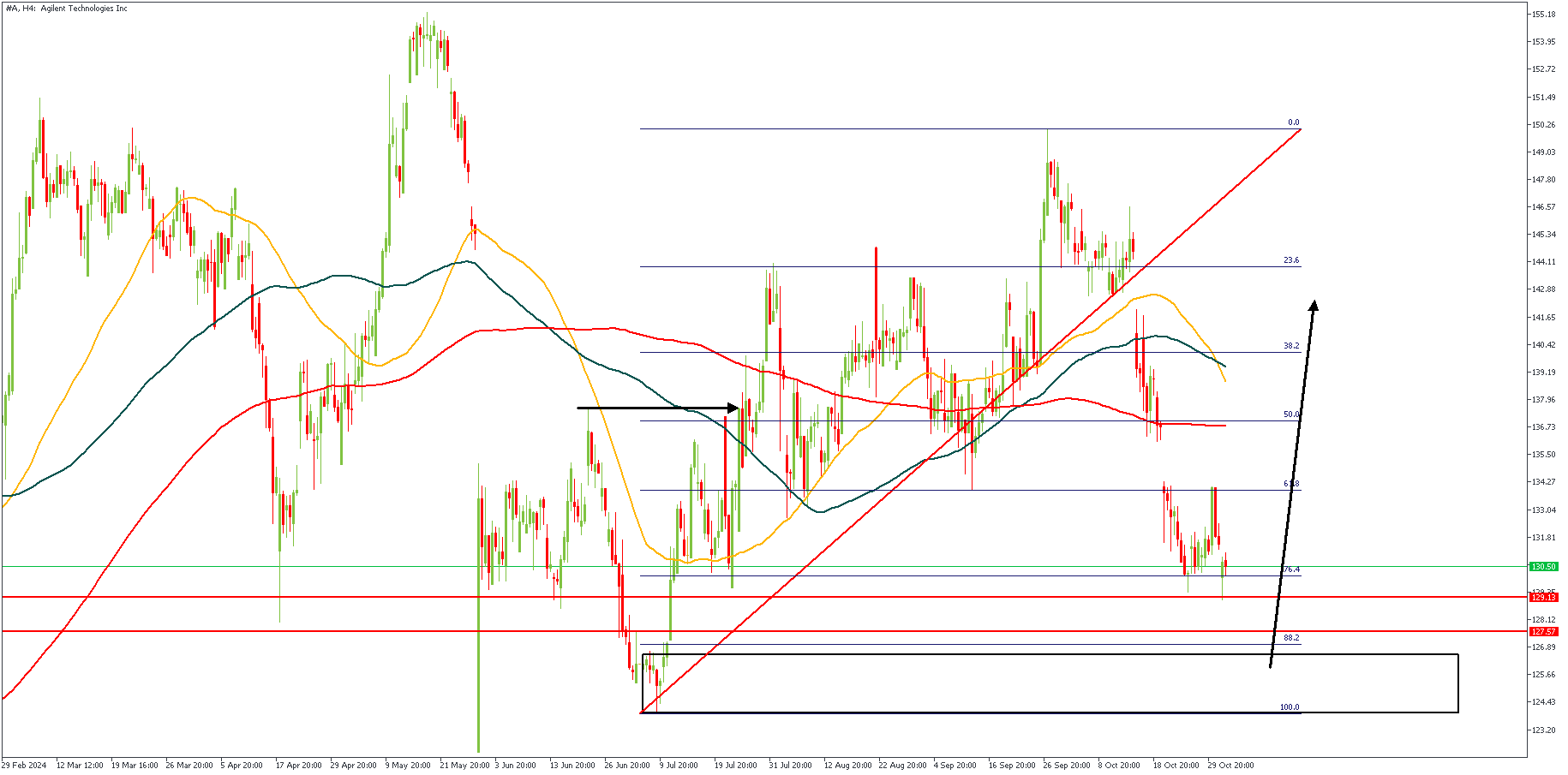

AH – H4 Timeframe

On the 4-hour timeframe chart of Agilent Ent. stocks' price action, we see price currently resting around 76% of the Fibonacci retracement, with further bullish confluence from the drop-base-rally demand zone. In this case, however, I would advise some caution, so aim for the 200-period moving average as the initial profit target.

Analyst's Expectations:

Direction: Bullish

Target:142.28

Invalidation:123.18

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.