Summary

- Dow Futures: +0.84%, last at 38,649

- S&P 500 Futures: +0.9%, last at 5,313.25

- Nasdaq Futures: +1.0%, last at 18,426.00

- Monday Close:

- Dow: 39,894

- High/Low: 39,906 / 39,827

Fundamental Factors Affecting U.S. Markets

- Trump-Powell Rift Resurfaces

- Trump called Fed Chair Powell "Mr. Too Late" and "a major loser," urging immediate rate cuts.

- Tensions spiked after Powell warned about Trump's tariffs and advocated for a measured policy path.

- Rising political interference adds volatility and uncertainty to rate expectations.

- Fed Policy Outlook in Focus

- The market expects gradual cuts, but Trump pressure and tariff threats complicate the Fed's trajectory.

- Powell's independence likely remains intact, but investor sentiment is fragile amid political noise.

- Tesla Earnings Awaited

- Trade Policy Still a Wild Card

- Trump's erratic tariff announcements fuel risk-off moves and complicate inflation and growth forecasts.

- FX and equity markets remain sensitive to trade rhetoric.

Key Takeaway for Traders

- Short-term: U.S. index futures rebound after Monday's selloff, but political risk remains elevated.

- Medium-term: A continued rift between Trump and Powell could undermine Fed credibility, boost volatility, and shake the USD.

- Long-term: Trade tensions + political influence may weigh on U.S. growth and earnings, especially if Powell resists pressure to cut.

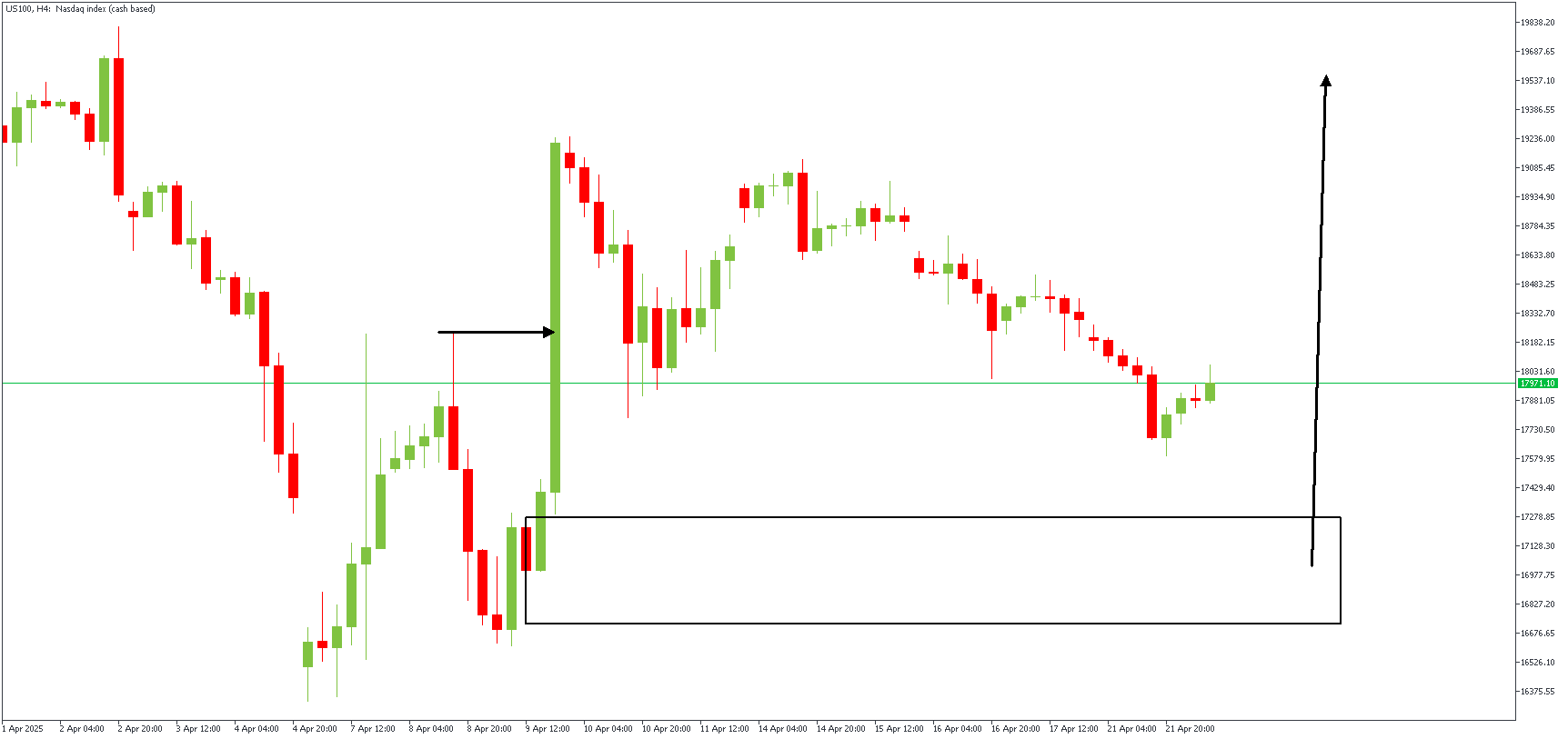

US100 – H4 Timeframe

Following the bullish break of structure on the 4-hour timeframe chart of US100 and the FVG created by the impulsive break, I expect a classic retest of the demand zone and a continuation of the bullish movement.

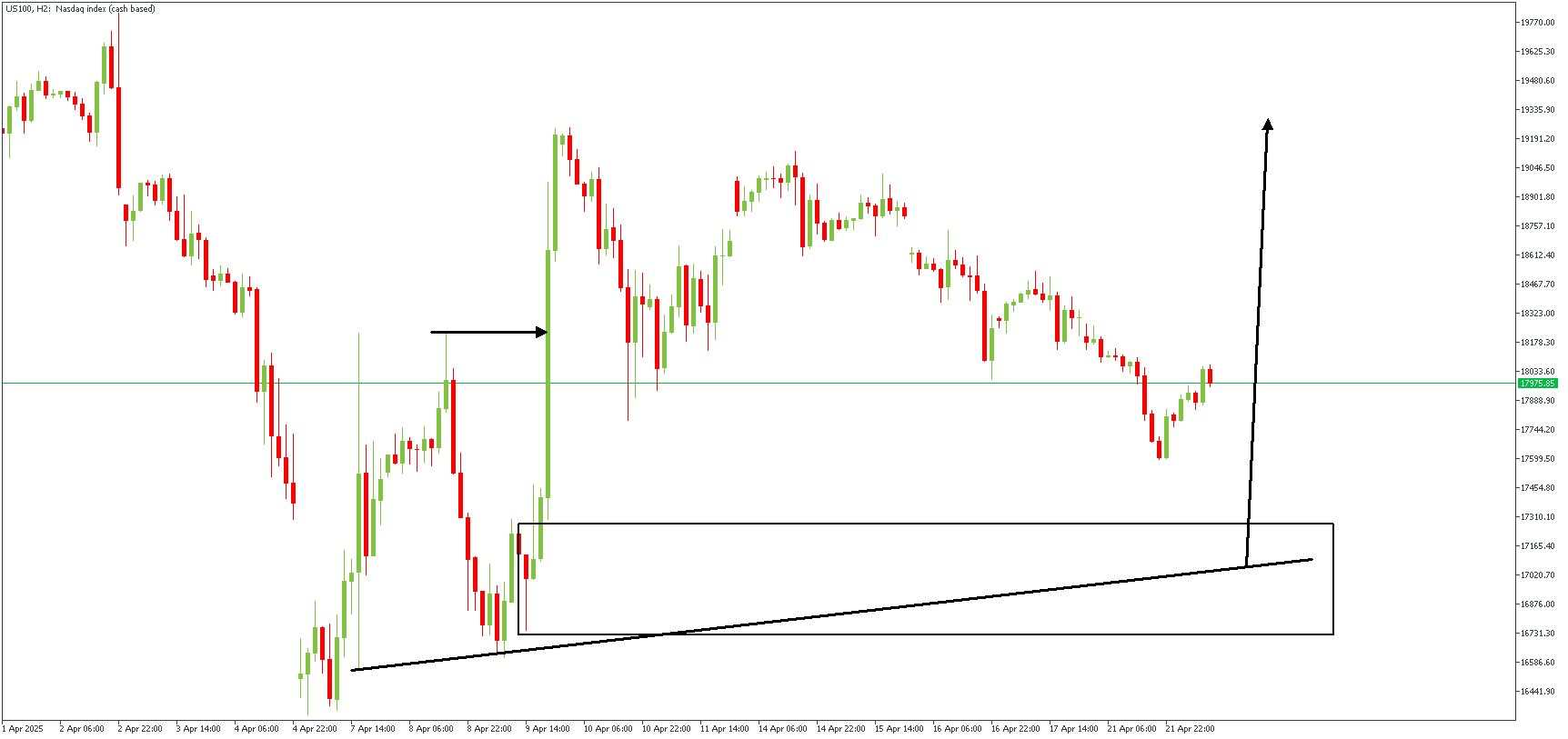

US100 – H2 Timeframe

The 2-hour timeframe chart of US100 adds a trendline support confluence to the demand zone highlighted. The expectation is for the price to rebound off the demand zone as it aims to create a higher high.

Analyst's Expectations:

Direction: Bullish

Target- 19245.64

Invalidation- 16401.21

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.