Fundamental Analysis

Yesterday, the Nasdaq 100 index fell by approximately 1.5%, dragged down by a broad sell-off in technology stocks, particularly those linked to the artificial intelligence (AI) sector. Companies such as Nvidia, Palantir, and Arm dropped around –3.5%, –9.4%, and –5%, respectively. The decline was triggered by an MIT report stating that 95% of companies investing in generative AI are not seeing tangible returns, fueling concerns about the sustainability of the AI boom. Even the CEO of OpenAI pointed to signs of a potential bubble in this sector, further heightening investor anxiety. Meanwhile, defensive sectors like consumer staples, utilities, and real estate held up better, with some even posting gains.

Technical Analysis

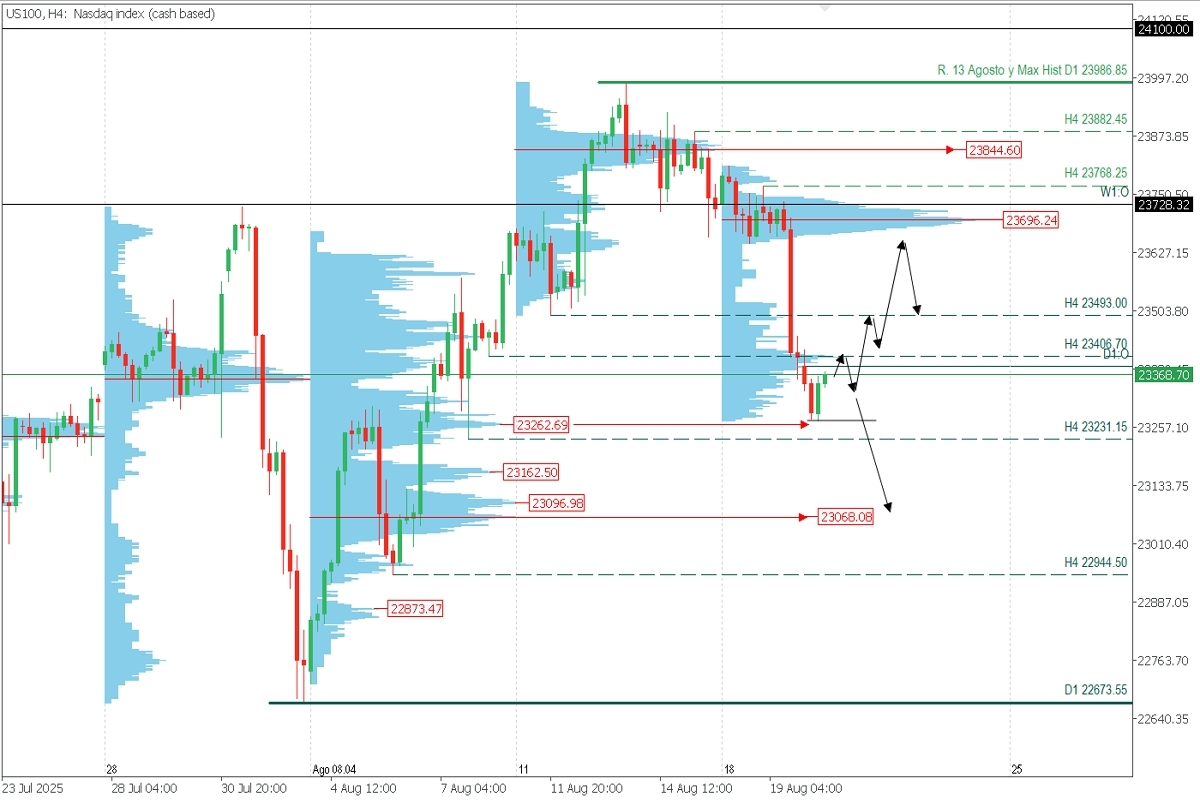

US100 | H4

Supply (Sell) Zones: 23407 | 23696 | 23845

Demand (Buy) Zones: 23263 | 23163 | 23100 | 23068

The sharp drop on August 19 decisively broke below the 23493 support and left a Fair Value Gap (FVG) that the price may attempt to correct in the short term, targeting buyer volume nodes around 23263. However, a seller volume block is observed near the broken support at 23406.70, which could now act as resistance.

If the price breaks decisively above 23407, the rebound is expected to extend toward 23493 and potentially to 23640, filling the volume gap.

However, if the price remains below 23400, further downside toward buyer volume zones between 23231 and 23000 is likely.