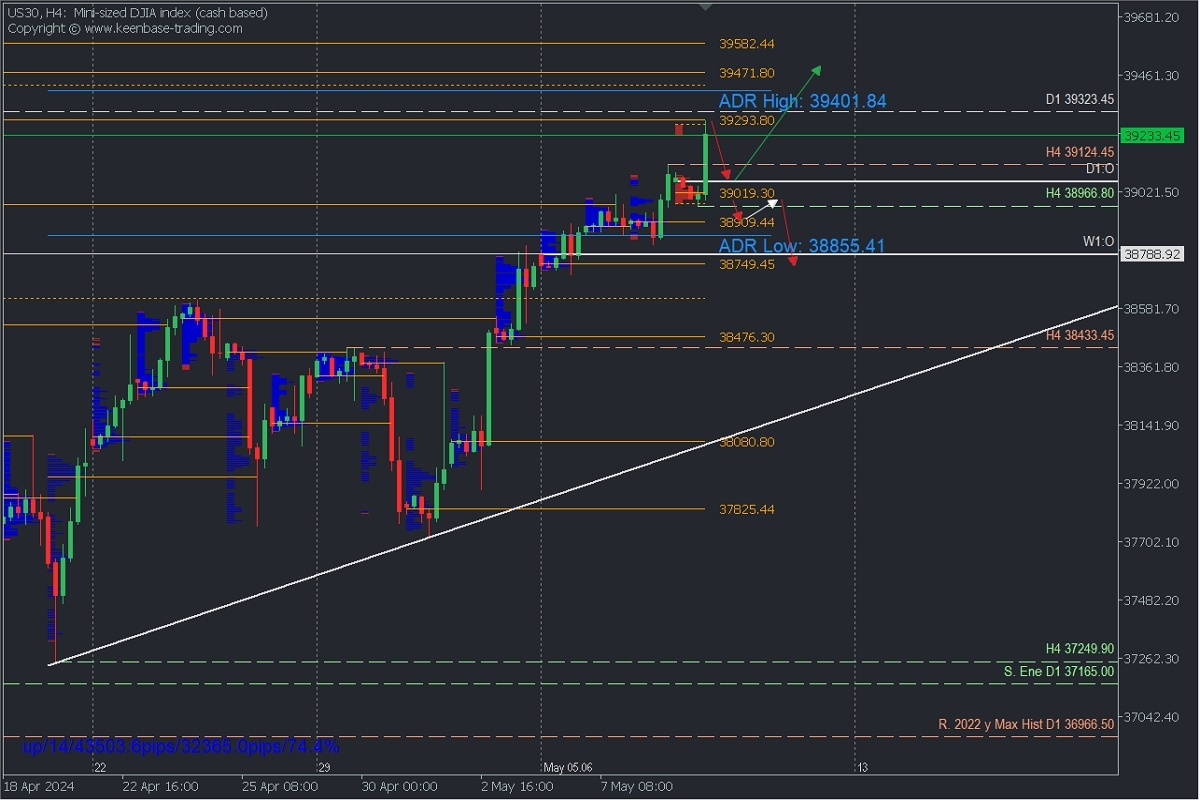

- Bearish Scenario: Sell below 39354 with TP1: 39124.45, TP2: 39062, and TP3: 39020 with S.L. above 39323 or at least 1% of account capital.

Bullish scenario after retracement: Buy above 39019 (awaiting the formation of the bullish reversal pattern) with TP: 39324, TP2: 39471.80, and TP3: 39582.44 with S.L. below 38966 or at least 1% of account capital. Apply trailing stop.

Technical Analysis H4:

On the daily and H4 chart of the US30 index, we observe the breakout of all April's high-volume seller nodes, reaching a key level at 39323.45 and a POC at 39293.80, a selling zone that will trigger a retracement towards the broken local resistance at 39124.45 and more extensively towards the uncovered POC of the day at 39019.30, demand zones that the bulls will defend for a new rally towards 39471.80 and 39582.44 as the next supply zones to reach.

However, observing the price compression, we can expect more extended sales after breaking below the daily POC at 39019.30 and the last relevant support of the bullish move of the previous 3 weeks at 38966.80 with targets at the uncovered POCs and demand zones at 38909.44 and after its breakout on a second touch, the POC at 38749.45, the first demand zone of the week.

Always await the formation and confirmation of an Exhaustion/Reversal Pattern (ERP) on M5 before entering any trade in the key areas we indicate. We explain the patterns in this telegram post: https://t.me/spanishfbs/2258

"Uncovered POC" refers to the Point of Control, which is the level or zone with the highest volume concentration. If there was a bearish movement after the Point of Control, it is considered a selling zone and forms a resistance area. Conversely, if there was a bullish impulse from the Point of Control, it is considered a buying zone, usually situated at lows and forming support zones.

Disclosure:

This analysis does not constitute investment advice or an offer to engage in financial transactions. Although all investment involves risks, trading forex and other leveraged assets can involve significant losses. A full understanding of the risks before investing is recommended.