The US Dollar is struggling to maintain its earlier gains following weaker-than-expected Housing data and Jobless Claims, causing the US Dollar Index to fall back below 105.50. The disappointing Housing data signals a softening market, while the unexpected rise in Continuing Claims further undermines the USD's performance. Despite recent hawkish commentary from Federal Reserve officials, market expectations seem capped as the persistent hawkish tone has already been factored in. Upcoming Fed speakers are unlikely to add new insights, given the repetitive nature of their recent messages. Consequently, the financial markets are showing reduced enthusiasm for the US Dollar amidst underwhelming economic indicators.

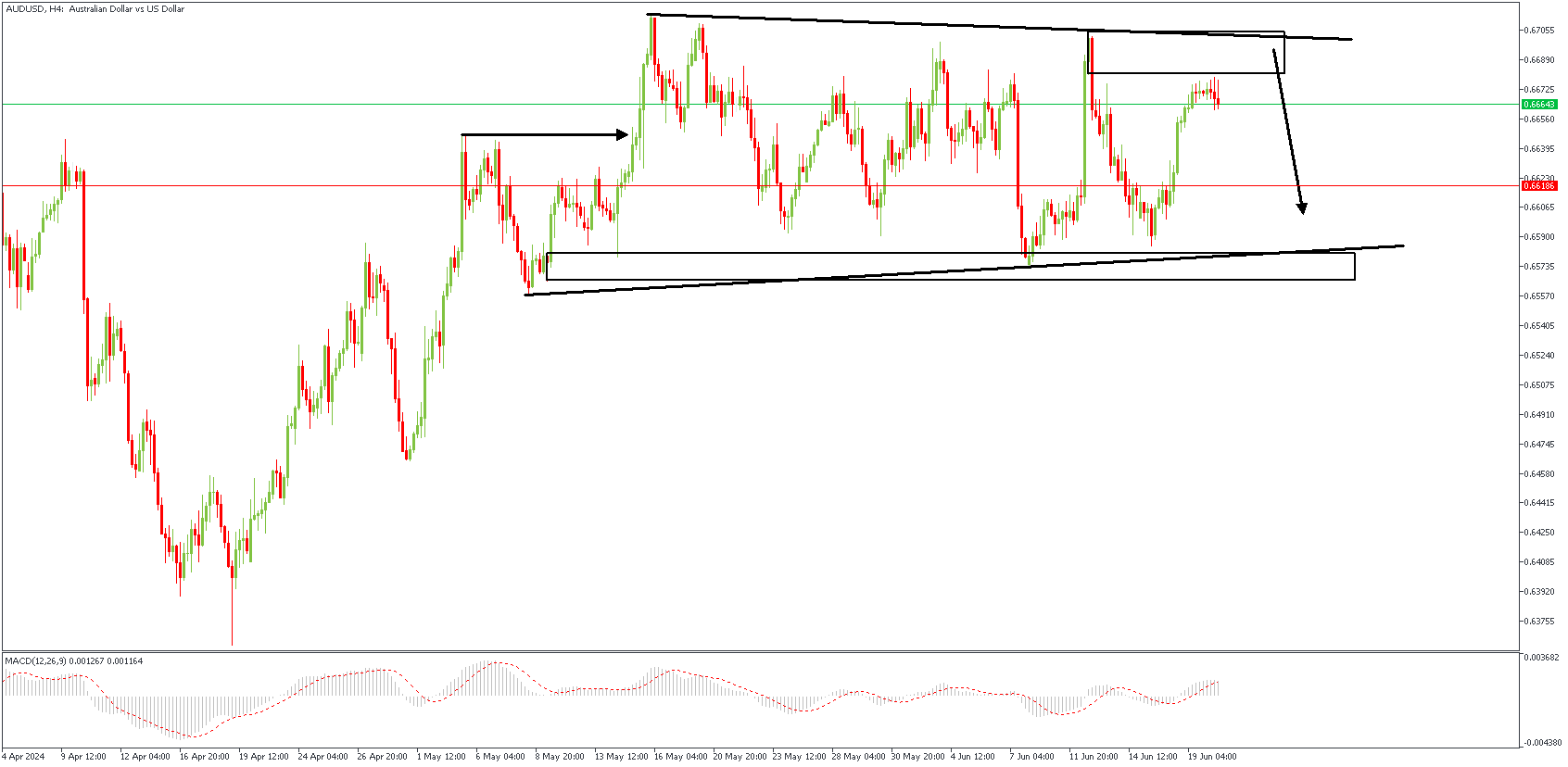

AUDUSD – H4 Timeframe

AUDUSD on the 4-hour timeframe can be seen to have bounced off the support trendline initially, following which price now seems to be fast-approaching the trendline resistance. Personally, I expect price to retest the trendline support region once more as price seeks to gather momentum for a bullish push.

Analyst’s Expectations:

Direction: Bearish

Target: 0.66186

Invalidation: 0.67174

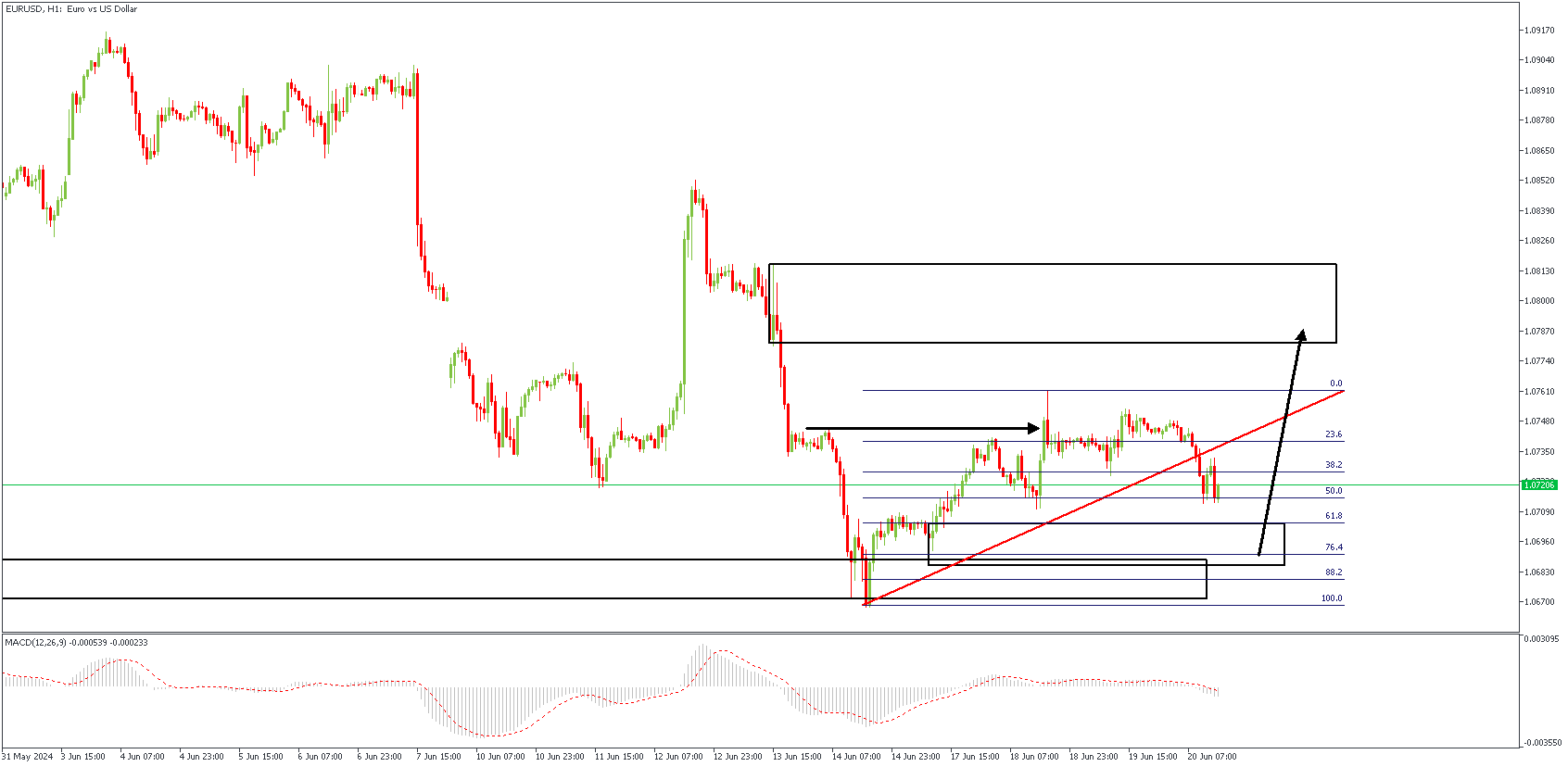

EURUSD – H1 Timeframe

After the break of structure on the 1-hour timeframe of EURUSD at the highlighted high, price has now begun a retracement move aimed at finding a reliable demand zone to trigger the buys from. The 76% of the Fibonacci retracement tool, and the demand zone provide ample support for price to resume its bullish movement.

Analyst’s Expectations:

Direction: Bearish

Target: 1.07847

Invalidation: 1.06645

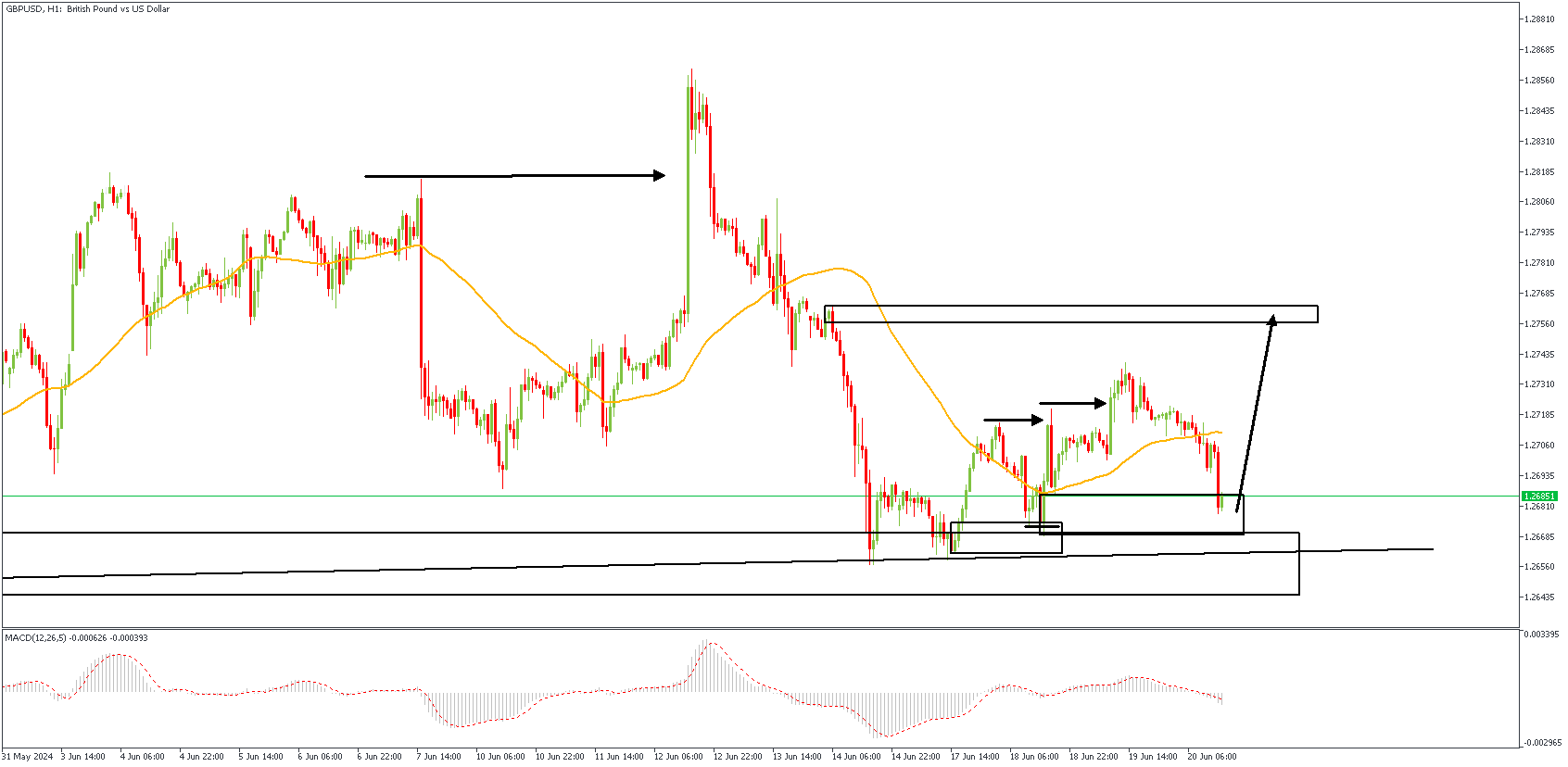

GBPUSD – H1 Timeframe

The market structure on the 1-hour timeframe of GBPUSD suggests the market is currently in a bullish phase. The two small arrows indicate a bullish break of structure with the current price sitting within the demand zone. On this basis, I believe the next price action would be a bullish impulse. A lower timeframe confirmation is crucial in this case though.

Analyst’s Expectations:

Direction: Bullish

Target: 1.27608

Invalidation: 1.26519

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.