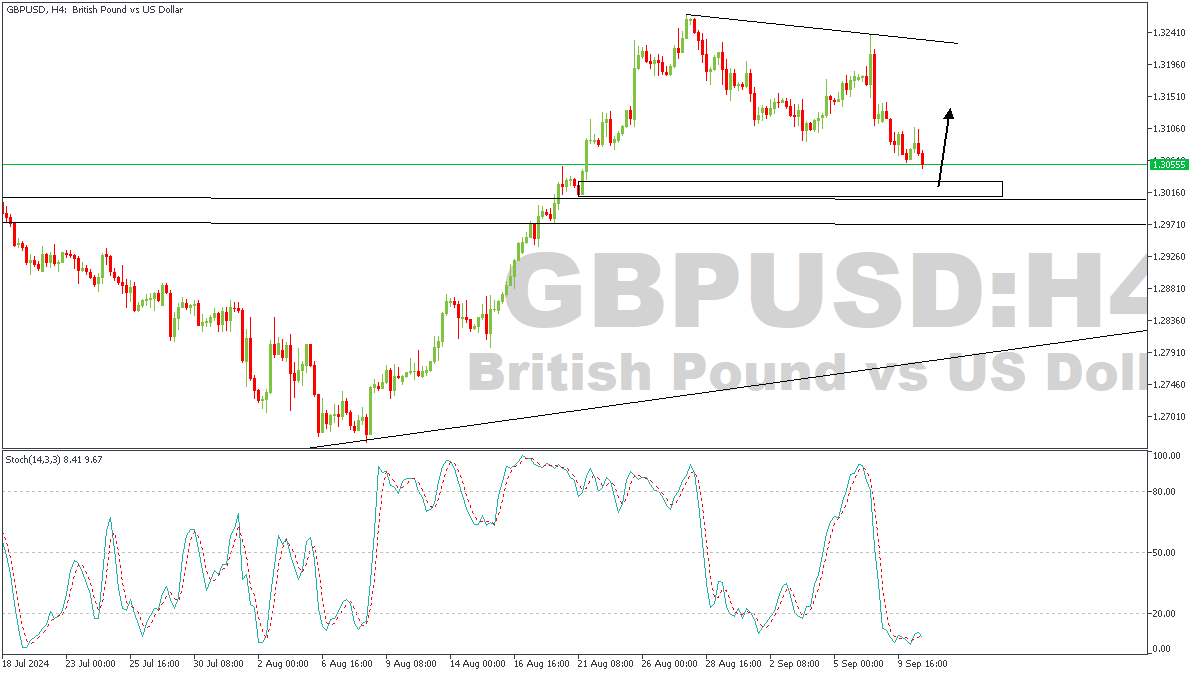

The British pound has slightly dropped, with GBPUSD trading at 1.3055, down 0.14%. UK wage growth slowed to its lowest point in two years, easing to 5.1% from 5.4%, a sign that could help the Bank of England's efforts to lower inflation. Despite slower wage growth, the UK job market remains strong, with unemployment falling slightly to 4.1%. This solid data suggests the Bank of England won’t rush to cut interest rates next week, but a rate cut is still expected in November. Investors are also watching for upcoming GDP data and U.S. inflation figures, which could influence future rate decisions.

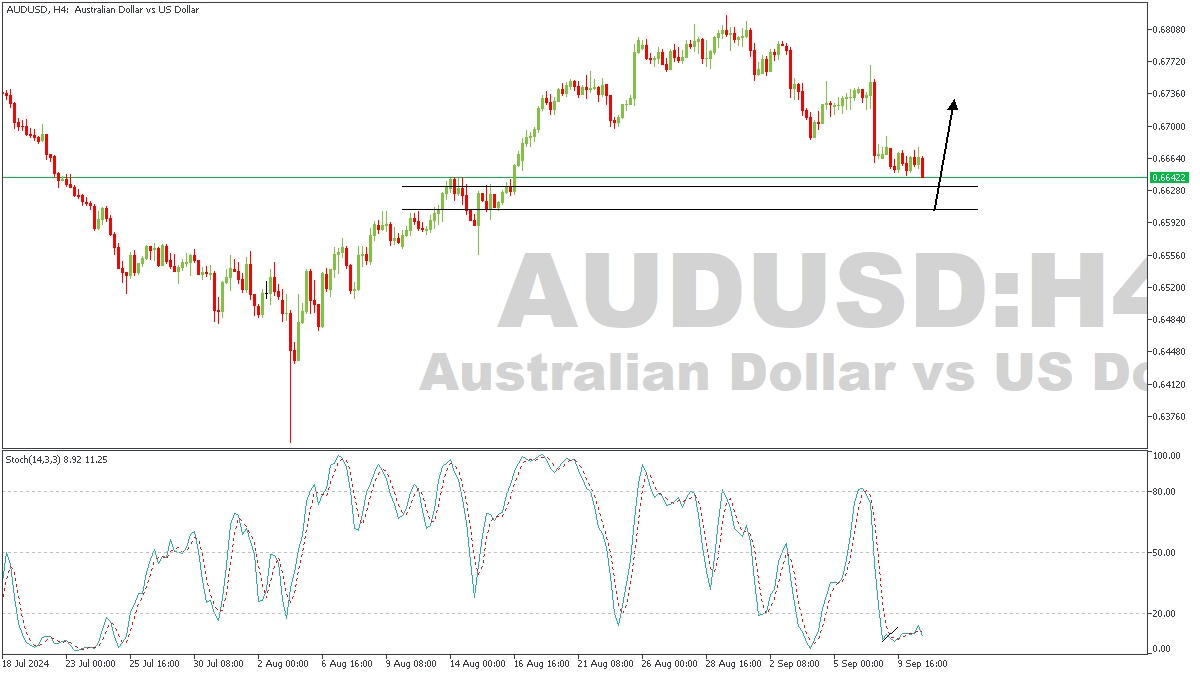

AUDUSD – H4 Timeframe

AUDUSD on the 4-hour timeframe as seen on the attached chart is currently heading into the daily timeframe pivot region, whilst the stochastic indicator remains largely oversold. In cases like this, a lower timeframe break of structure and break of trendline usually signals that price is ready to commence its reaction from the pivot zone.

Analyst’s Expectations:

Direction: Bullish

Target: 0.67155

Invalidation: 0.65570

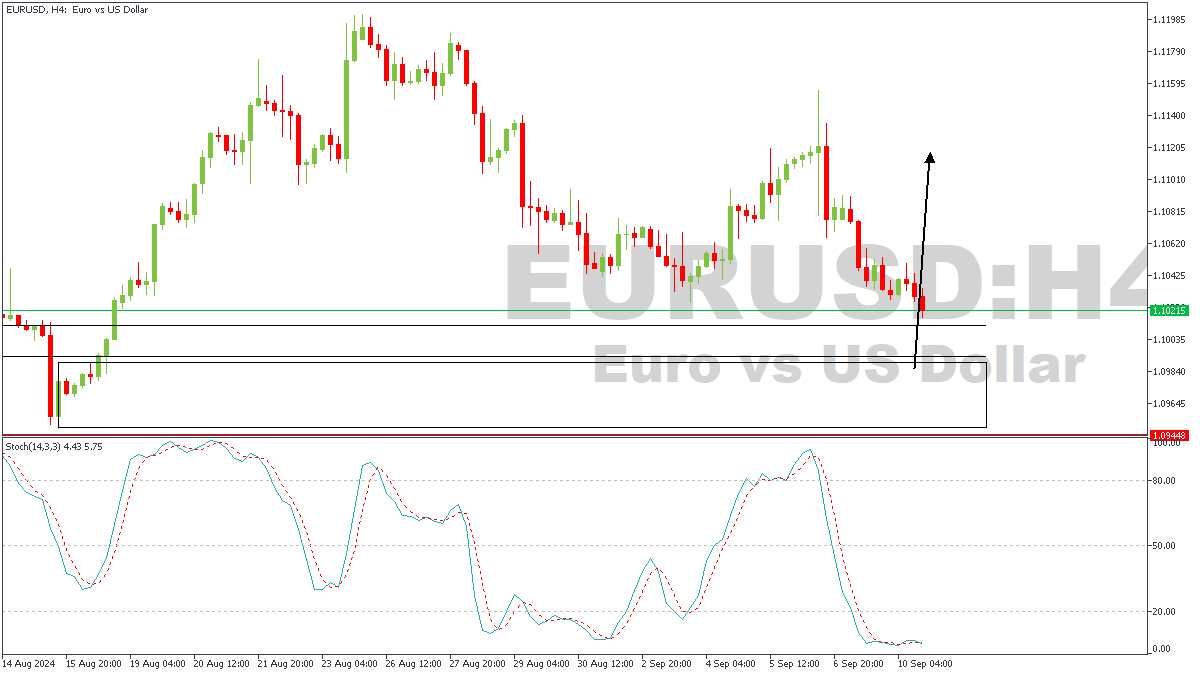

EURUSD – H4 Timeframe

Although the price action on the 4-hour chart of EURUSD is very similar to what we observed on the AUDUSD prior, EURUSD has a peculiar condition. I expect to see a possible sweep of the buy-side liquidity below the daily timeframe pivot zone before any likely commencement of the bullish pressure. The stochastic being oversold is another considerable confirmation in this regard.

Analyst’s Expectations:

Direction: Bullish

Target: 1.10677

Invalidation: 1.08895

GBPUSD – H4 Timeframe

GBPUSD is looking quite prim as it prepares to react from the daily timeframe pivot. The demand zone overlapping the pivot zone is a key confluence, that may contribute to price’s resumption of a bullish intent. Also, don’t forget the oversold stochastic indicator as well.

Analyst’s Expectations:

Direction: Bullish

Target: 1.31151

Invalidation: 1.29418

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.