The US dollar remains strong against the Japanese Yen, driven by a significant interest rate differential favoring the US. The USDJPY pair tested the 50-day EMA and found support at the 155 Yen price level; a critical psychological barrier. Analysts expect the pair to target the 160 Yen price level due to the US interest rate advantage. Despite the Bank of Japan's interventions to slow the yen's decline, fundamental issues prevent a reversal of this trend. A break above 158.40 yen could trigger further buying, pushing the pair higher.

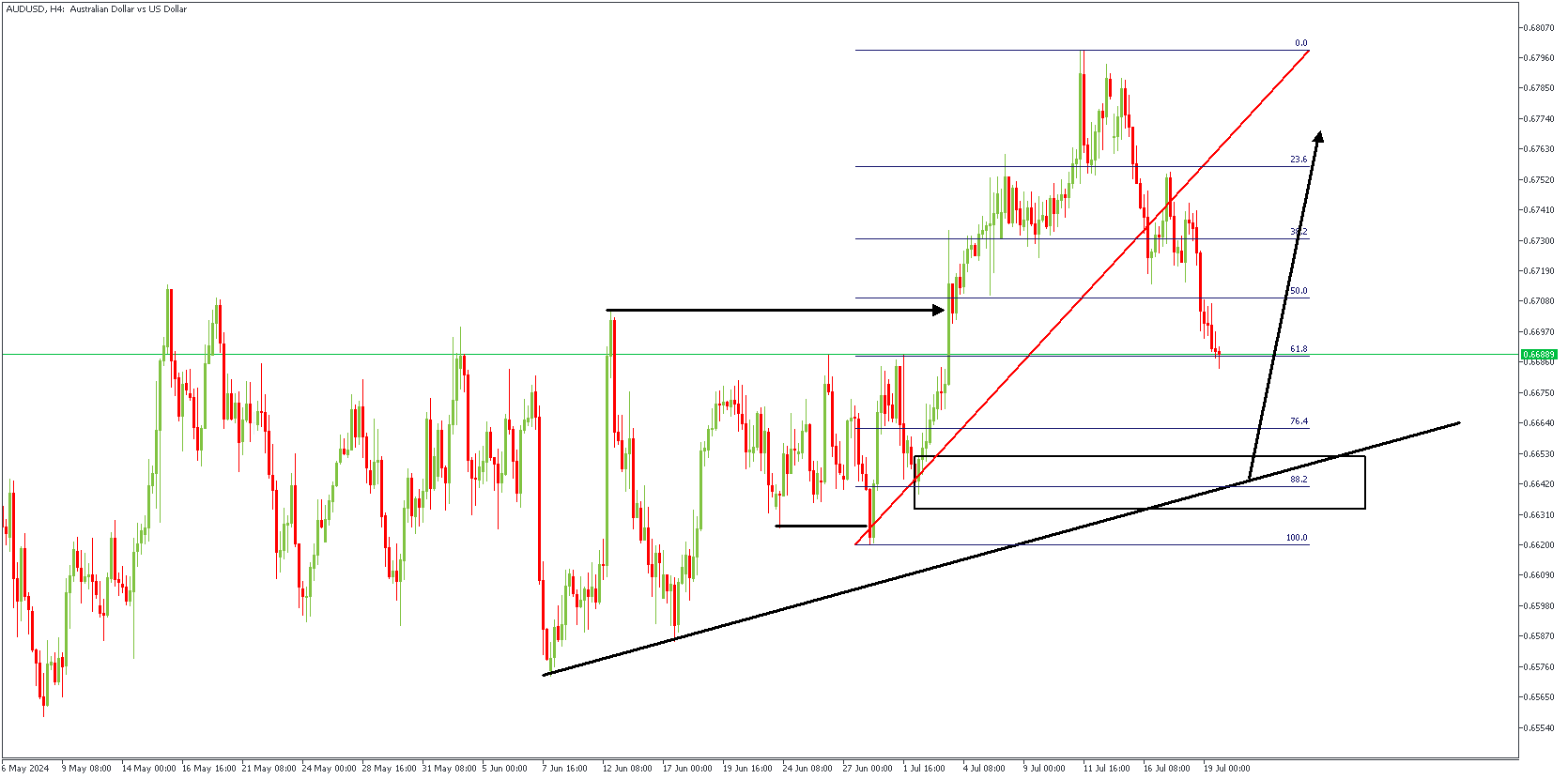

AUDUSD – H4 Timeframe

AUDUSD has so far fallen over 100pips from its swing high, hinting at the likelihood of a shift in market structure. The major barrier at the moment seems to be the demand zone and the trendline support. There’s also a Fibonacci retracement level and a SBR price action pattern that price would need to grapple with before the shift in trend could be considered. In the meantime, however, I expect to see a continuation of the bullish structure on AUDUSD from the highlighted confluences.

Analyst’s Expectations:

Direction: Bullish

Target: 0.67840

Invalidation: 0.66094

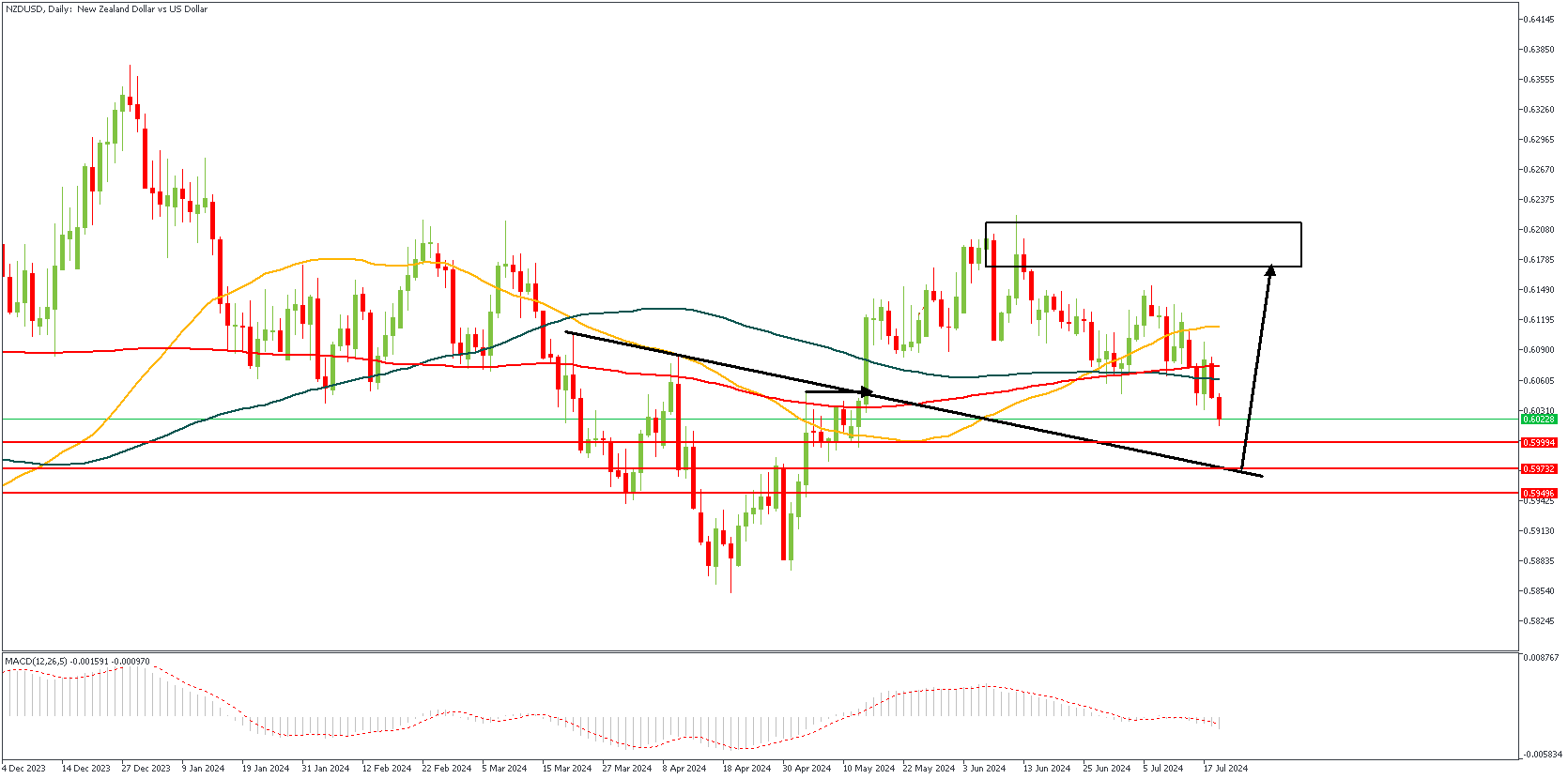

NZDUSD – D1 Timeframe

The horizontal arrow on the attached daily timeframe chart of NZDUSD highlights the recent break of structure above the previous high. The untested turncoat trendline also implies the likelihood for price to retest the trendline as a source of support for the bearish movement. Considering that the pivot zone and the 76% of the Fibonacci retracement level fall within the same area, I am tempted to flow with a bullish sentiment in the meantime.

Analyst’s Expectations:

Direction: Bullish

Target: 0.61730

Invalidation: 0.59217

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.