Key Drivers in the Last Week of August

Powell opens the door to rate cuts

At Jackson Hole, Jerome Powell acknowledged rising risks to employment and signalled that monetary policy could be adjusted if the labor market continues to weaken. Investors interpreted this as confirmation that the Federal Reserve is ready to begin rate cuts in the short term.

Fed rate cut expectations

According to CME FedWatch, there is an 87.33% probability of a 25 bps cut in September and an 83.22% chance of another in December. This means markets are already pricing in two rate cuts before the end of 2025.

Waller and political pressure

Fed Governor Christopher Waller, historically a centrist-hawkish voter, now openly supports easing policy sooner. He argues that Donald Trump’s tariffs would only have a temporary inflationary effect, while growth risks justify preventive action. His stance has positioned him close to Trump’s circle as a potential successor to Powell at the Fed.

Key US economic data this week

Tuesday, Aug 26.- Consumer Confidence (Conference Board): 98.0 vs. 97.2 prior.

- Durable Goods Orders (July): –0.5% m/m vs. +0.2% prior

- Core Durable Goods Orders (ex-transport): +0.3% m/m vs. +0.2% prior

- Q2 2025 GDP (second estimate): 2.1% annualized, unchanged from the first reading

- PCE Index (July): +0.2% m/m after +0.2% in June

- Core PCE (July): +0.3% m/m vs. +0.2% prior; 2.9% y/y vs. 3.0% prior

These reports will be decisive to confirm whether the Fed delivers its first rate cut in September.

Equities and Nvidia earnings

Wall Street starts the week sideways after Friday’s rally. All eyes are on Nvidia’s earnings (Wednesday), with focus on:

- Data center revenue growth tied to AI

- Exposure to China restrictions

- Margin evolution

Energy and oil

Crude oil prices rise amid geopolitical tensions and expectations of solid seasonal demand. Market attention will be on inventory data from API (Tuesday) and EIA (Wednesday), which will reveal the supply-demand balance.

Bitcoin under pressure

Bitcoin drops 2%, trading around $113,000, following net ETF outflows. The digital asset remains highly correlated with the US dollar and global liquidity, making it sensitive to US macroeconomic data.

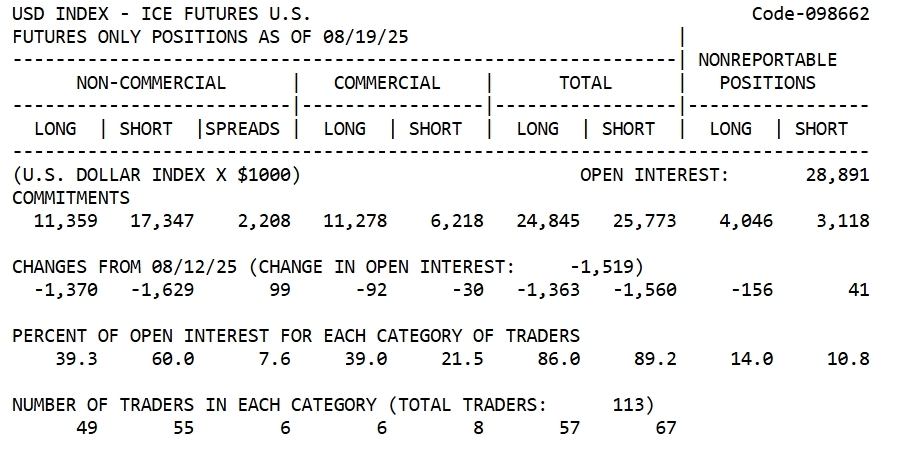

COT analysis: USD Index (Aug 19, 2025)

Non-commercial traders hold 11,359 long contracts vs. 17,347 short contracts, a net bearish position of –5,988. Last week, both longs (–1,370) and shorts (–1,629) decreased, with a larger reduction in shorts. This suggests that while sentiment remains negative, speculators are losing conviction in heavy USD selling.

In short, positioning is still bearish, but with weaker downside pressure, hinting at possible consolidation or even a corrective rebound if short covering continues.

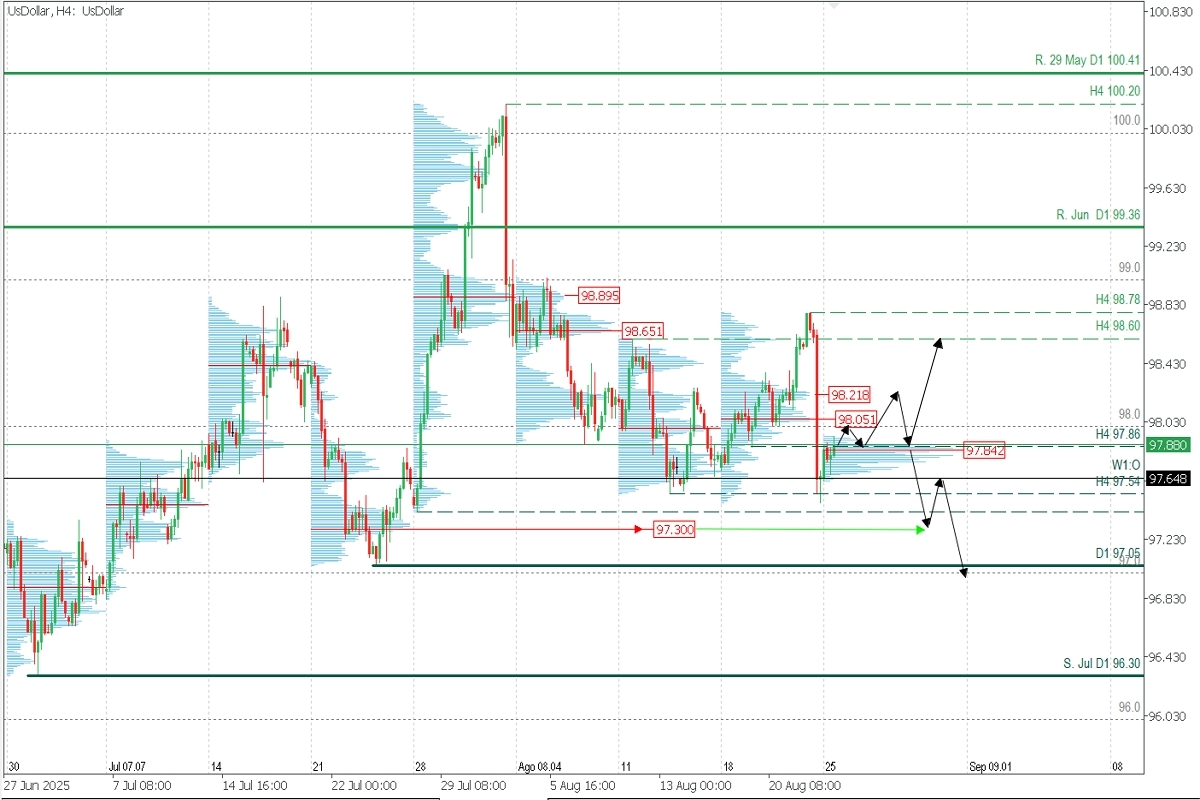

Technical analysis: DXY

After Powell’s speech, the Dollar Index shows a bearish reversal, with initial volume concentration at 97.84. A corrective move toward daily volume gaps is likely before another decline.

- Bullish scenario: Buy above 97.86, with targets at 98.00 and possibly 98.21.

- Bearish scenario: Selling pressure resumes from 98.21 or after a decisive break of 97.84, targeting the demand zone near 97.30

This setup points to a moderate USD recovery toward resistance levels, followed by renewed selling pressure during the week.