September is often seen as a cautious or "risk-off" month for traders, influenced by factors like economic uncertainty, updates from China, and concerns about the rate cuts in the US. This generally means that traders might prefer safer investments, although this can vary depending on the asset. Here are two of my favorite trade ideas for the month of September.

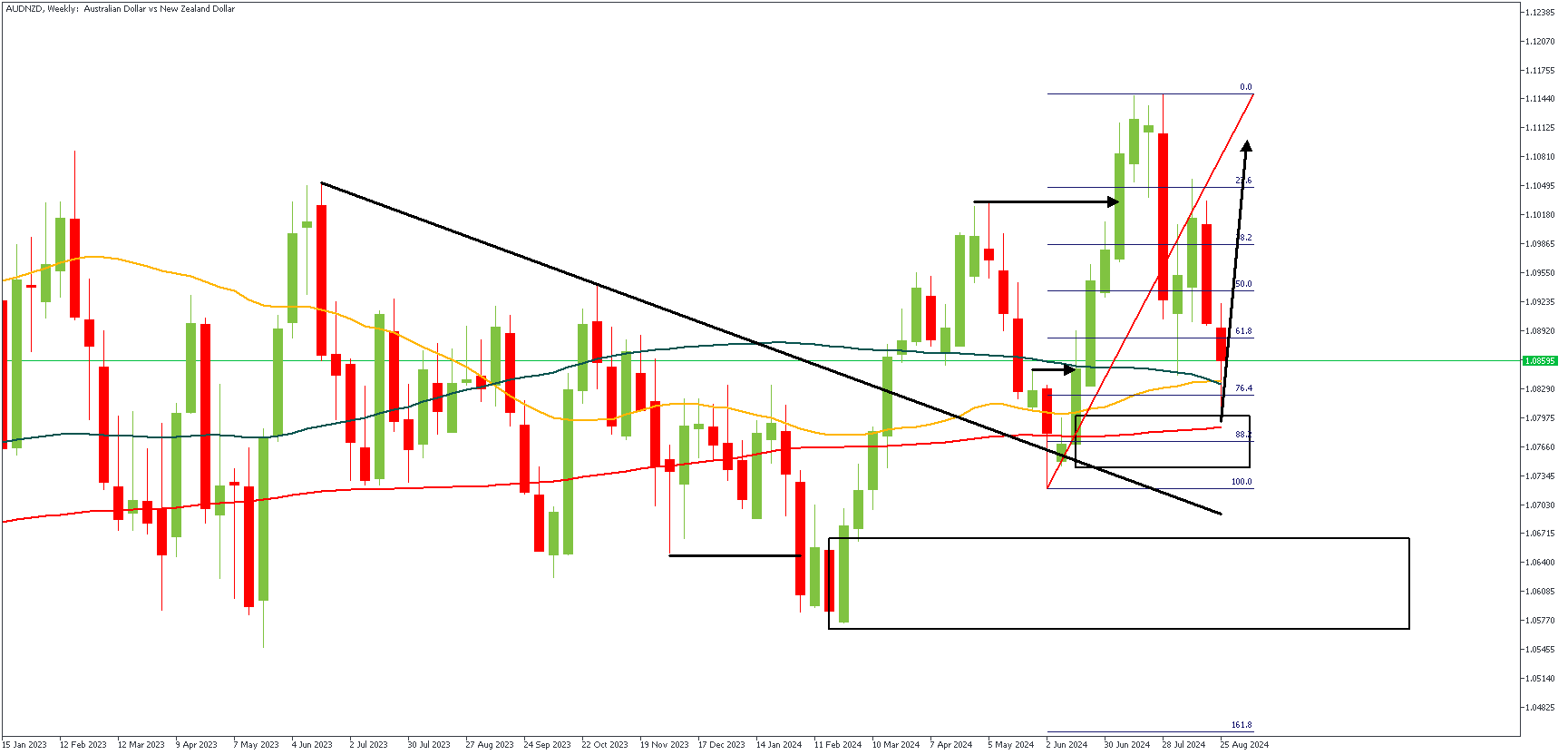

AUDNZD – W1 Timeframe

The weekly timeframe on AUDNZD has recently bounced off a critical area of support, leaving behind a considerably long wick near the 200-period moving average. The 76% Fibonacci retracement level also contributed to the bullish momentum. In line with this, I expect the lower timeframes to provide a proper entry confirmation over the first few days in the month of September.

Analyst’s Expectations:

Direction: Bullish

Target: 1.11055

Invalidation: 1.06969

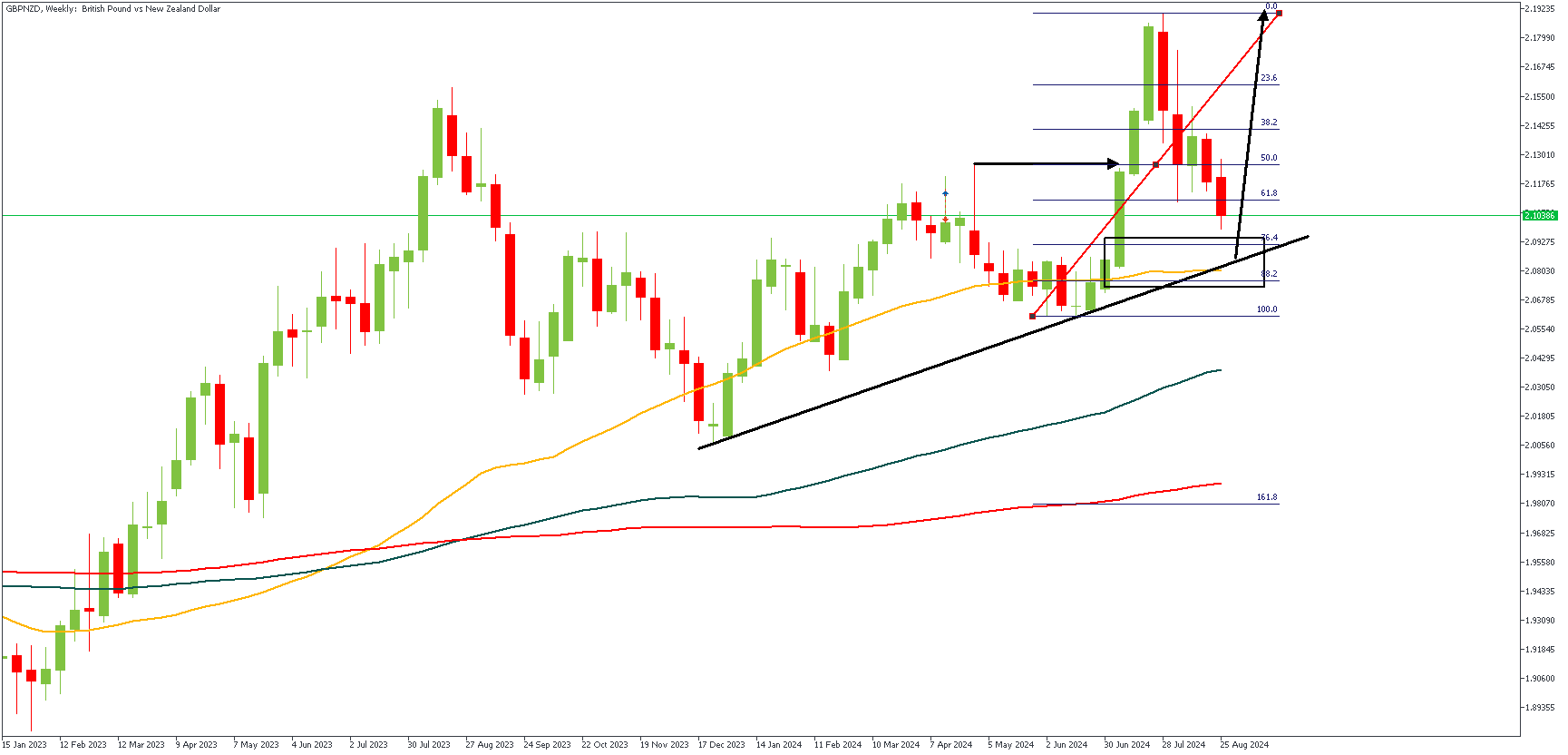

GBPNZD – W1 Timeframe

The weekly timeframe of GBPNZD broke above the previous high, and afterwards slipped downwards for a retest of the demand zone that originated the move. Notably, the demand zone overlays the 76% of the Fibonacci retracement, and aligns perfectly with the trendline support. The general outlook here is for a bullish outcome, since the 50-period moving average accents completely to this, lower timeframe confirmation for entries would be crucial nonetheless.

Analyst’s Expectations:

Direction: Bullish

Target: 2.19259

Invalidation: 2.05199

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.