Brent crude (XBRUSD) is trading at $75.40, down 0.59%, struggling to rise above the key level of $76.38. The 50-day and 200-day moving averages, at $77.52 and $78.00, suggest a bearish trend, limiting any upward movement.

If prices break above $76.38, they could climb toward $77.83, possibly moving to $79.54. However, selling pressure may push prices down to $74.68 if they fail to rise, with further support at $73.73. The market remains under selling pressure for now, and a clear move above or below these levels will decide the next trend.

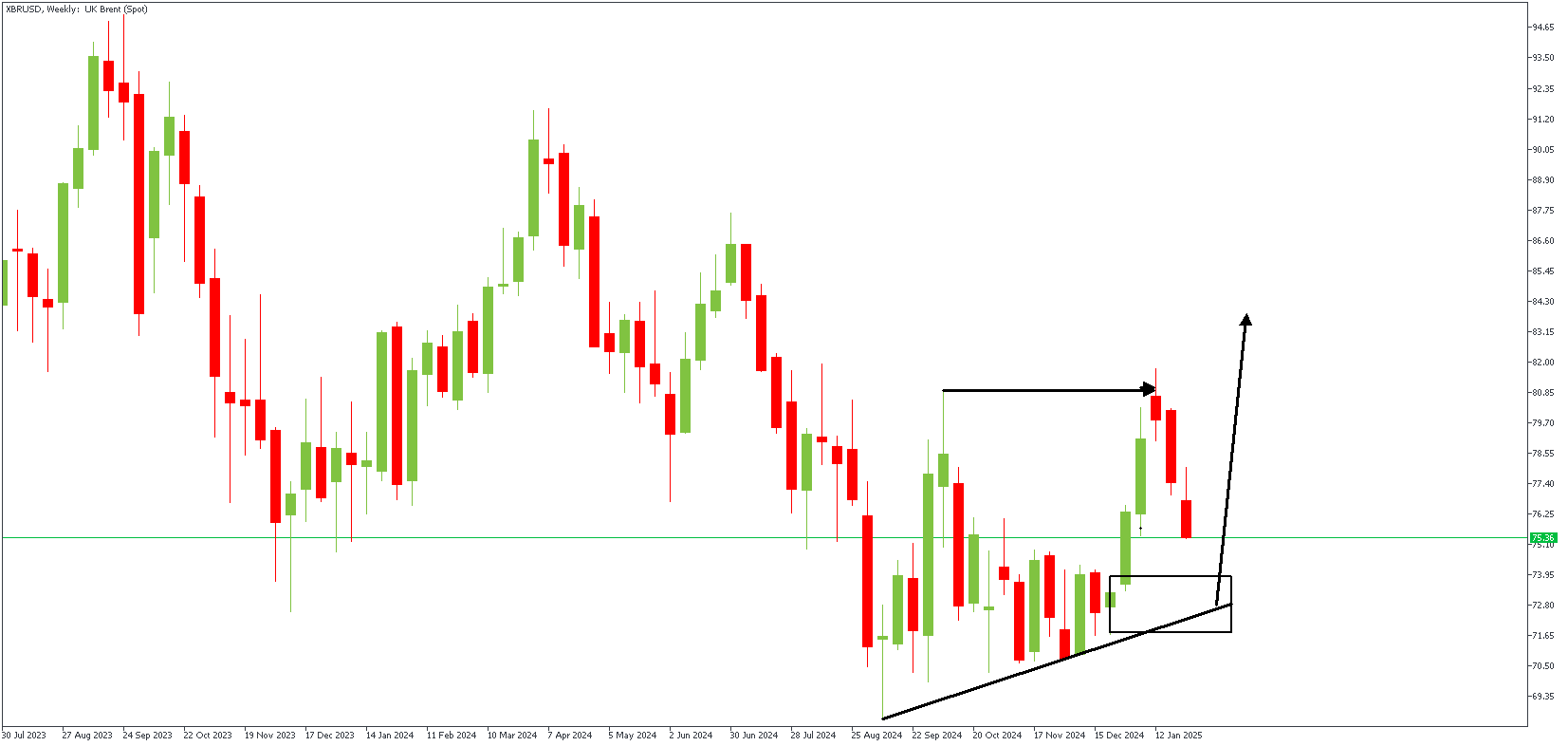

XBRUSD – W1 Timeframe

After the bullish break of structure on the weekly timeframe chart of XBRUSD, we see the retracement slide back towards the demand zone at the origin of the impulse move. The demand zone is, in this case, our area of interest, and the fact that it overlaps trendline support provides a crucial confluence in favor of the bullish sentiment.

XBRUSD – D1 Timeframe

.png)

The daily timeframe chart of Brent crude provides further detail regarding the highlighted weekly demand zone, including factors like the 76% Fibonacci retracement level, the SBR price action pattern, and the specific candle that serves as the Order Block. Considering the additional confluence from the trendline support, the odds favor the bulls.

Analyst’s Expectations:

Direction: Bullish

Target: 83.43

Invalidation: 70.24

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.