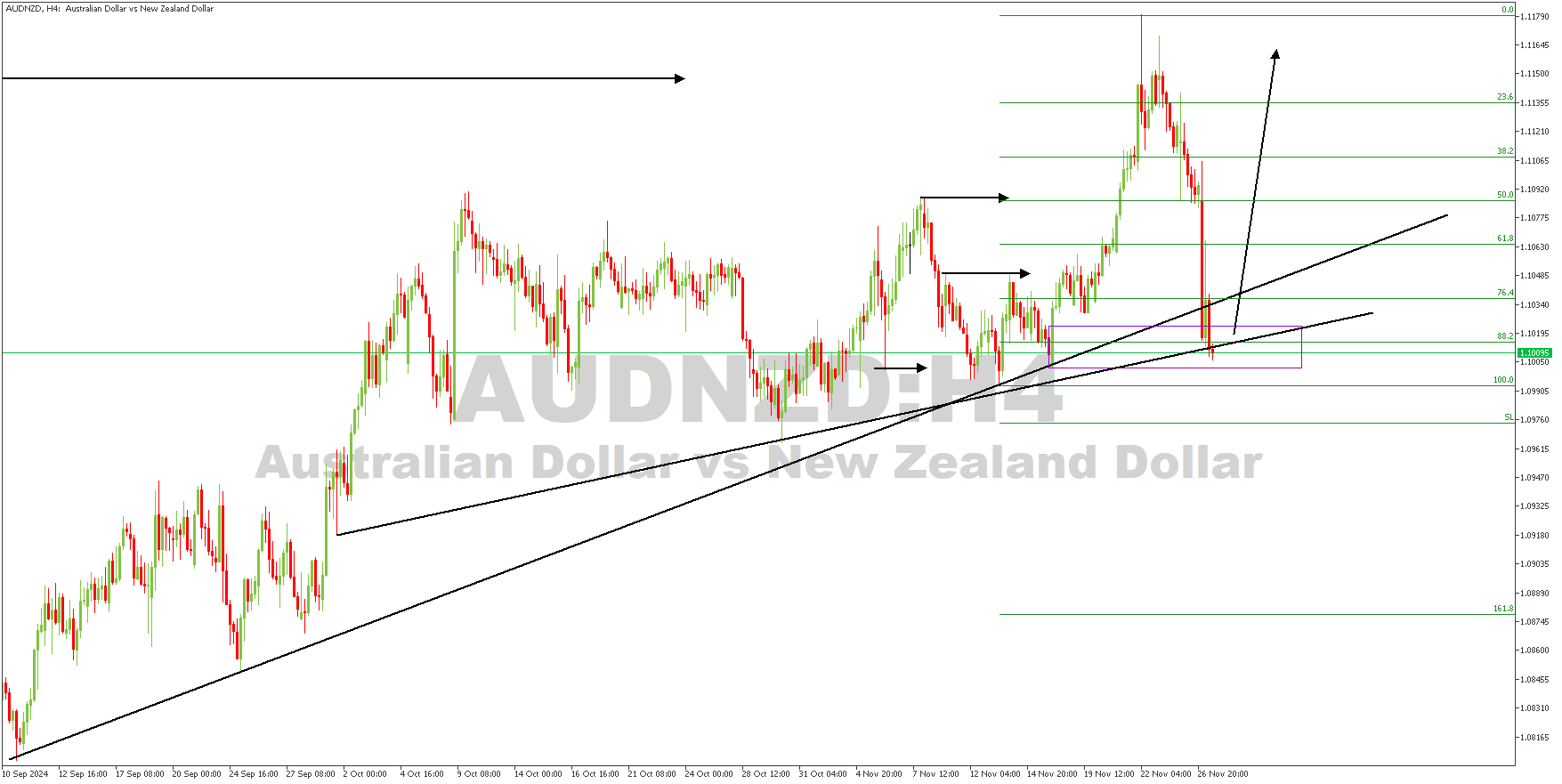

AUDNZD – H4 Timeframe

The 4-hour timeframe chart of the price action of AUDNZD shows a recent bullish break of structure, followed by a quick drop. The drop has since begun to stall, having encountered support at the drop-base-rally demand zone near the 88% Fibonacci retracement level. There is also a confluence of support trendlines within the price region and an inverted head-and-shoulder pattern, lending more credibility to the bullish sentiment. Again, the confluences are;

- Bullish market structure;

- Retest of the trendline support;

- The confluence of support trendlines;

- Drop-base-rally demand zone;

- 88% of the Fibonacci retracement.

Analyst’s Expectations:

Direction: Bullish

Target: 1.11345

Invalidation: 1.09833