EURUSD, H4

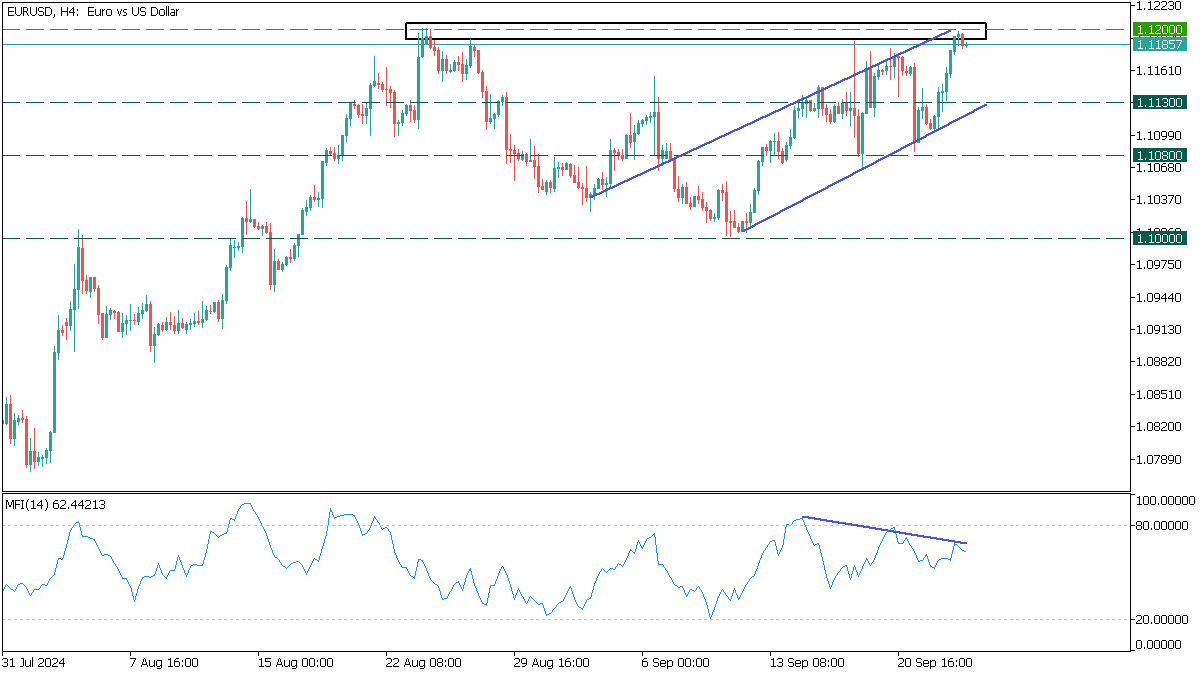

On the H4 timeframe, the EURUSD pair navigates within an ascending channel and faces the crucial resistance at 1.1200 and the upper border of the channel.

The MFI oscillator shows a bearish divergence with the price, putting pressure on the asset.

EURUSD, H1

On the H1 timeframe, there is a DeMArker strategy setup. the DeMarker Oscillator is emerging from the overbought zone, and the Parabolic SAR has shifted to above the price, giving a bearish sentiment.

However, two scenarios are possible:

- If the EURUSD breaks above the 1.1200 resistance it will continue the bullish trend to the 1.1320 and the 161.8 Fibonacci;

- If a corrective decline occurs, it will drop the price to 1.1130 and the golden Fibonacci pocket.