A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

2023-06-07 • Atualizado

Let's take a closer look at Australia's recent economic performance. Brace yourselves for some interesting developments. The country's economy experienced its slowest growth since late 2021 in the first quarter, raising doubts about the Reserve Bank of Australia's rapid interest rate increases. Despite the bank's record-breaking 12 rate hikes in the last 13 months, the resource-rich economy only grew by a modest 0.2% in the quarter, falling short of economists' expectations. This slowdown challenges the government and central bank as they aim to avoid a recession. The RBA's decision to raise interest rates further reflects concerns about a deteriorating inflation outlook. RBA Governor Philip Lowe has repeatedly warned about stagnating productivity and increasing wage pressures, which could keep inflation higher than desired. Recent wage increases for low-paid and public-sector employees have fueled fears of broader wage gains. Despite solid private and government investment, consumer spending slowed in the quarter, with household spending contributing minimally to GDP growth. The data also revealed a household saving-to-income ratio decline, primarily driven by rising mortgage repayments and rents. On a positive note, wage indicators showed strength, with the compensation of employees increasing. A tight labor market and historically low unemployment rates stoke wage pressures. Stay tuned as these dynamics unfold, and watch how they may impact forex markets.

From the chart AUDUSD above, the overall trend is bearish - especially considering the direction of the Moving Average array. Therefore, the next action is to find a reliable entry point based on a confluence of technical analysis factors. My confluences, in this case, include the following;

The safe conclusion from all of these is that there is a high likelihood of a bearish continuation from the area of these confluences.

Analyst’s Expectations:

Direction: Bearish

Target: 0.65531

Invalidation: 0.68248

The weakening of the Australian economy is expected to impact positively on the GBPAUD pair. There are also a few interesting confluences to consider, namely;

Overall, bullish price action seems the most credible direction for price.

Analyst’s Expectations:

Direction: Bullish

Target: 1.89720

Invalidation: 1.83911

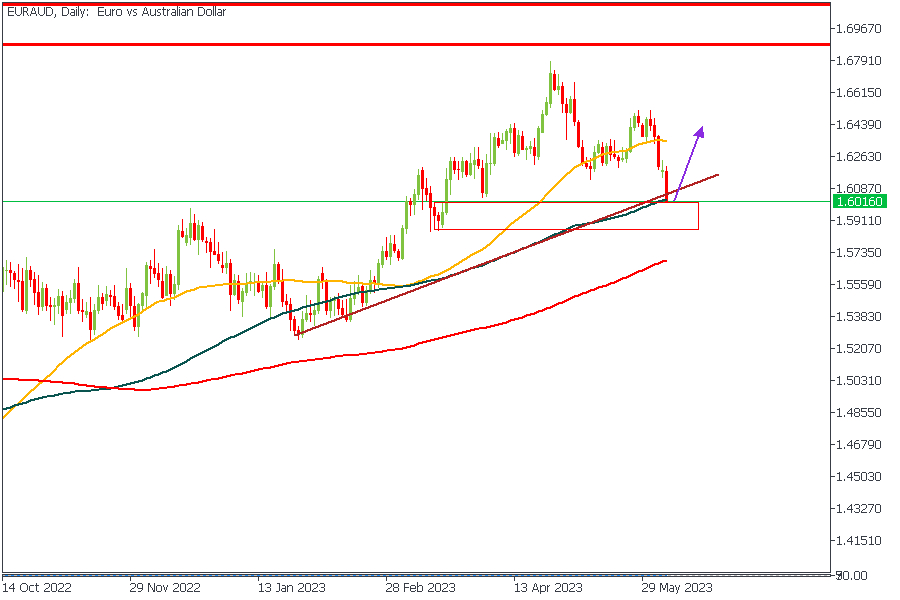

As I mentioned, the fundamental factors based on the GDP figures largely suggest a bullish sentiment on pairs against the AUD. This pleads an interesting case in favor of a bullish price action on EURAUD, akin to what we saw on GBPAUD. The confluences for this bullish price action include;

Analyst’s Expectations:

Direction: Bullish

Target: 1.63880

Invalidation: 1.58443

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

As especulações de que as autoridades do BOJ irão intervir para conter qualquer fraqueza adicional do JPY mantêm um limite para quaisquer ganhos adicionais

Opiniões divergentes dos oradores do Fed sobre cortes de taxas prejudica o desempenho do USD

Depois da queda no mês de março em cerca de 26 mil vagas de emprego, a expectativa do mercado é de nova queda para 8,790M para o mês de fevereiro do mesmo ano

Nesta segunda-feira, primeiro dia do mês de abril, os EUA liberam os números dos PMIs da S&P Global e do ISM para a indústria

Todas as atenções estarão nos preços básicos do PCE (núcleo) dos EUA, que excluem alimentos e energia para o mês de março, com a expectativa de que os números venham abaixo do mês anterior, que registraram um aumento de 0,4%

A FBS mantém registros de seus dados para operar este site. Ao pressionar o botão “Aceitar“, você concorda com nossa Política de Privacidade.

Seu pedido foi aceito

Um gerente ligará para você em breve.

O próximo pedido de chamada para este número de telefone

estará disponível em

Se você tiver um problema urgente, por favor, fale conosco pelo

Chat ao vivo

Erro interno. Por favor, tente novamente mais tarde

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA e ganhe dinheiro!