#EURUSD مبدأياً دعونا نتفق علي الاتجاه الصاعد علي المدي البعيد لليورو دولار ليستهدف 2…

#EURUSD مبدأياً دعونا نتفق علي الاتجاه الصاعد علي المدي البعيد لليورو دولار ليستهدف 2…

#EURUSD مبدأياً دعونا نتفق علي الاتجاه الصاعد علي المدي البعيد لليورو دولار ليستهدف 2…

مستقبل النفط: ارتفاع في خام غرب تكساس الوسيط بسبب دعم لجنة "أوبيك" لتمديد القيود علي الإمدادات يرتفع خام غرب تكساس الوسيط للمرة الأولى منذ 7 أيام، حيث صرحت لجنة "أوبيك" انها ستدعم قرار تمديد قطع الإمدادات إلى ما بعد شهر يونيه، وعاد المستثمرون إلى أصول…

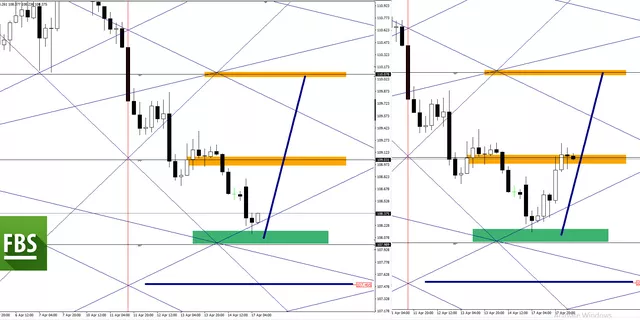

#EURUSD علي المدي البعيد مازلنا مع الاتجاه الصاعد حيث نتوقع الصعود علي المدي البعيد الي 1…

#EURUSD علي المدي البعيد مازلنا مع الاتجاه الصاعد حيث نتوقع الصعود علي المدي البعيد الي 1…

#EURUSD علي المدي البعيد مازلنا مع الاتجاه الصاعد حيث نتوقع الصعود علي المدي البعيد الي 1…

#EURUSD علي المدي البعيد والقريب مازلنا مع الاتجاه الصاعد حيث نتوقع الصعود علي المدي البعيد الي 1…

#EURUSD علي المدي البعيد والقريب مازلنا مع الاتجاه الصاعد حيث نتوقع الصعود علي المدي البعيد الي 1…

تحتفظ FBS بسجل لبياناتك لتشغيل هذا الموقع الإلكتروني. بالضغط على زر "أوافق", فأنت توافق على سياسة الخصوصية الخاصة بنا.

لقد تم قبول طلبك

الموظف سيتكلم معك قريبا

يمكنك طلب إعادة الاتصال بهذا الرقم مجددا

خلال

إذا كانت لديك أية مسألة طارئة، يرجى التواصل معنا عبر

الدردشة الحية

خطأ داخلي. الرجاء المحاولة لاحقا

لا تضيع وقتك - تتبع تقرير الوظائف غير الزراعية وتأثيره على الدولار الأمريكي لتتمكن من تحقيق الأرباح!