AUD: the MAs pincers

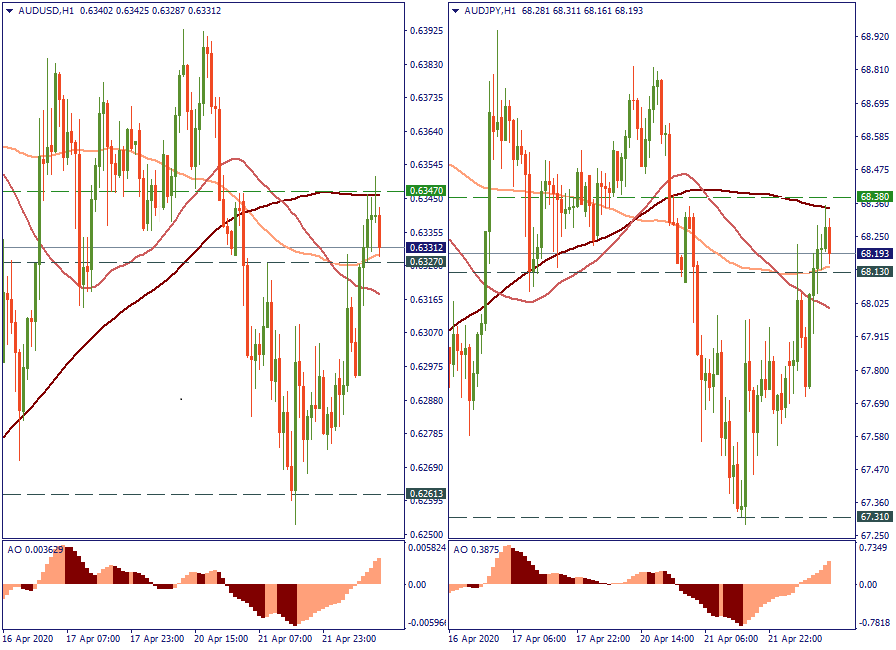

Short-term

The Australian dollar gives an unusually strong picture in the Forex market lately. On the H1, behaving almost identically against the USD and the JPY, the AUD recovered its losses after reaching its local low on Tuesday. Interestingly enough, the currency pair entered a channel right between the 100-MA and 200-MA as if it was “caught” there.

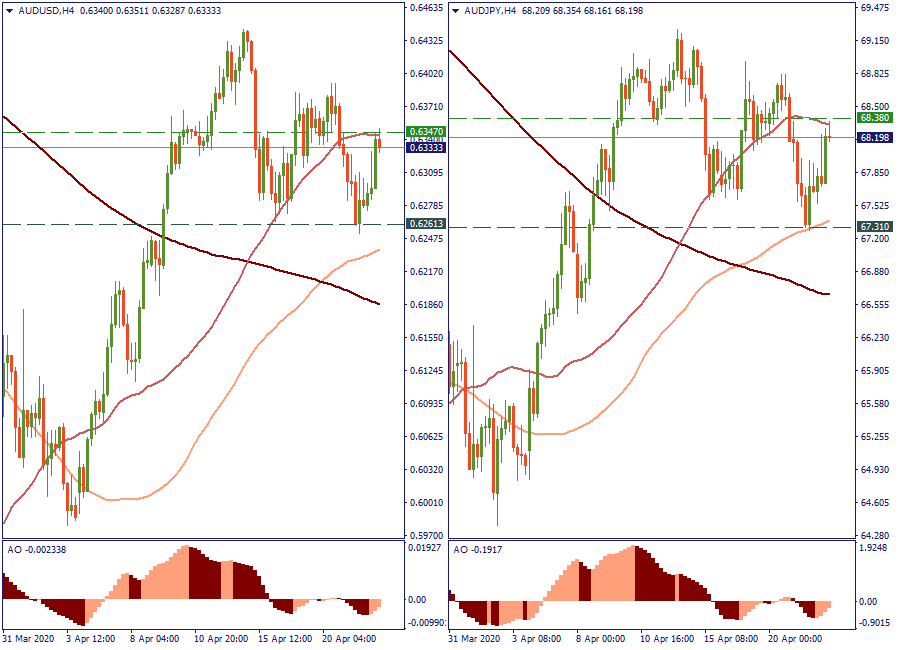

Mid-term

Switching to H4 timeframes gives the same peculiar formation: the currency pair trades between the 50-MA and 100-MA, showing an upward recovery after a recent drop. Technically, such a disposition makes it easy to evaluate the expected movement of the AUD: one it crosses the support or resistance of the respective Moving Average, it will confirm the taken direction.

Fundamental

The long-term outlook, however, offers no consolation for the AUD fans. The strategic picture has no support for the Aussie, even with the recovering China ahead of the rest of the world, as the country has little to put against the economic powers of the US or Japan in the Forex field. That’s why, betting on the AUD in the short-term or mid-term, keep in mind that in the long run, that’s a bearish current – which was confirmed a while ago when the AUD renewed its multiyear lows.