Between Inflation, Rate Hikes, and War: What's Next for EUR/USD?

EUR/USD fell to 1.0756, its lowest level since May 2020, as the European Central Bank's accommodative tone on monetary policy added more pressure to the euro. Where's the next stop?

Where the ECB stands on raising rates?

The ECB kept interest rates unchanged as expected and confirmed that it would end the bond-buying program in the third quarter. President Christine Lagarde said it is "too early" to discuss policy tightening and added that a rate hike could come "at some point" after the end of the asset purchase program (APP). The statement assured the ongoing dovish policies for several reasons:

- The consequences of the ongoing war between Russia and Ukraine hurt economies in Europe and abroad.

- The rise in energy and commodity prices affects demand and leads to a slowdown in production and increasing inflation.

- Disruptions in trade and supply chains cause a new shortage of materials and inputs.

ECB put pressure on the euro, and the Fed supports the dollar

The ECB is sticking to policy easing, that's why EUR is under downward pressure, and there could be more downside in the near term. The USD, on the contrary, regained strength from the Fed's hawkish comments.

Unlike the Fed, which is expected to raise rates by 50 points in the May meeting and by 25 points at each of the remaining five meetings during 2022, ECB is in no rush to raise rates. The Fed bought the last of its bonds in March and increased rates in the same month. But at the ECB, it will take some time. The first-rate hike in the Eurozone may come in September.

Why will the euro continue to decline?

- The accommodative stance of the ECB, even if it raises rates, won't be able to match the Fed.

- The alarming situation in Europe due to inflation rising to an all-time high of 7.5% and the slow growth rate amid the Ukraine crisis.

- Oil prices are preparing for the next bullish rally, and energy bills will be chasing households in Europe.

- Escalating fears about recession in the euro area.

- The strength of the US dollar, and the support it gets from everywhere: the Fed's sharpest tightening cycle in several years, the strong recovery in US Treasury yields, and continued uncertainty in global markets amid the Russian-Ukrainian war. The Dollar Index (DXY) is expected to extend gains after consolidating above 100.00, its highest level in nearly two years.

What is the next move for EUR/USD?

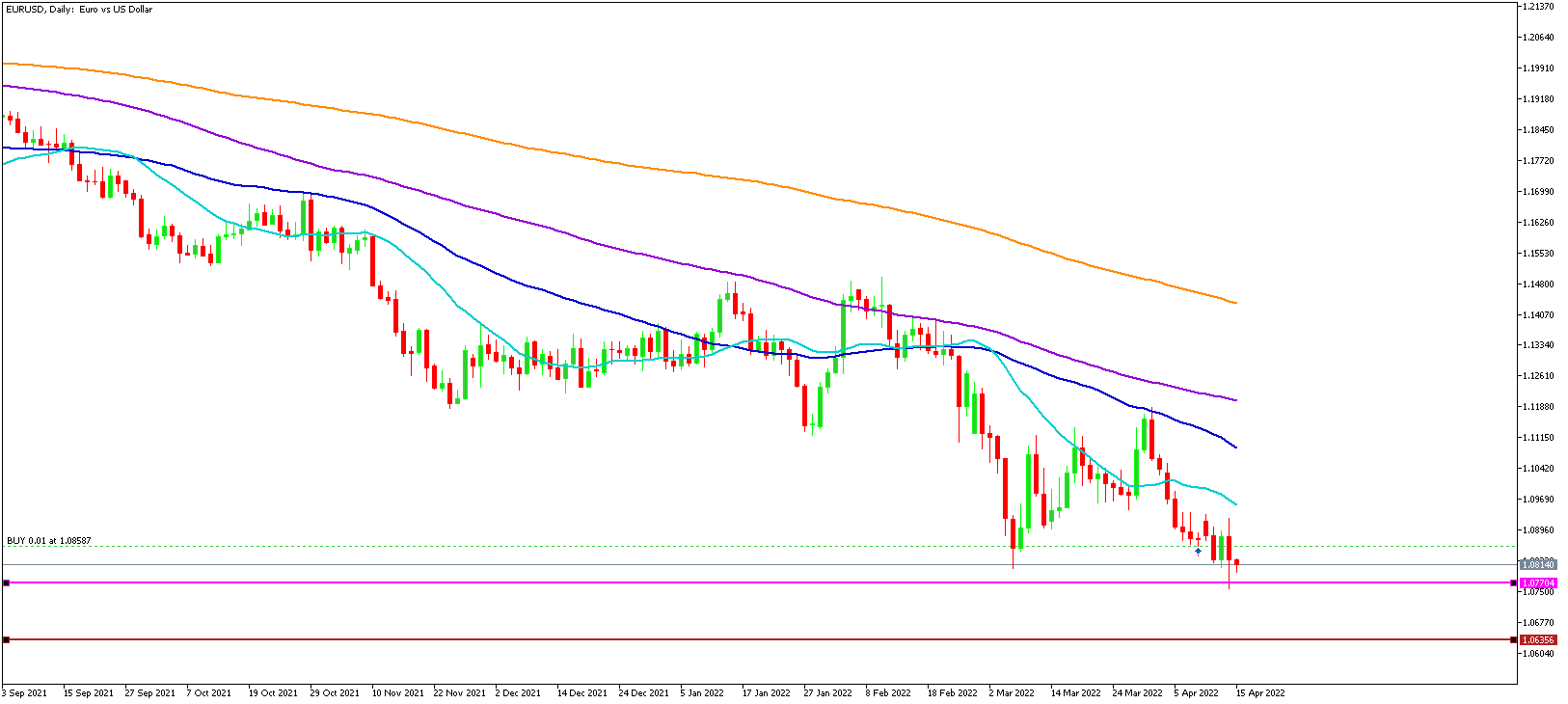

After EUR dropped below 1.0800 for the first time in April 2020, the chart shows that the bearish condition remains intact. If EUR/USD continues to fall below 1.0800 (the psychological level, lowest level in two years), the technical selling pressure may increase and pull the pair towards 1.0770, 1.0760, and 1.0730. The next big downside target is 1.0635, the lowest price since March 2020.

The near-term view is also bearish, with the pair holding below bearish moving averages.