NAFTA or Brexit: what influences GBP/CAD the most?

Recent tensions between the US and Canada about the North American free trade agreement (NAFTA) renegotiations as well as Brexit uncertainties brought weakness to the Canadian and British currencies. As a result, GBP/CAD keeps struggling with turbulence following the speeches of government members, analytic reviews and banks’ statements. It is quite hard to project where the pair can go in the near future. That is why it is necessary to focus on the main dates for both of these events.

NAFTA talks

NAFTA problem occurred when the US president Donald Trump said that the current trade agreement between the three countries was unacceptable and had to be revised. Trump and Mexican president Peña Nieto reached an agreement on a NAFTA 2.0 on 27th of August and invited Canadian prime-minister Justin Trudeau to sigh the agreement. However, this week added uncertainties in the negotiations between the US and Canada, as Canada did not agree on the suggested conditions.

Key dates:

September 28 – publication of the full text of draft agreement between Mexico and the US. Some analysts say that the US Congress will not sign a pact unless it is trilateral.

September 30 - the deadline for Canada to make a deal under new conditions. Trudeau told that the country will negotiate only if conditions are suitable for Canada.

November 30 – If the negative scenario for Canada takes over, then this is be the deadline when Trump sends the papers for approval by the US Congress. This does not mean that Canada is going to be kicked out from NAFTA, though it can add uncertainties to the market and to the currency in particular.

October 21, 2019 – the national elections in Canada. Some experts expect Trudeau to sign a NAFTA deal before this date. That means the CAD might continue to be affected by NAFTA negotiations until the middle of the next year.

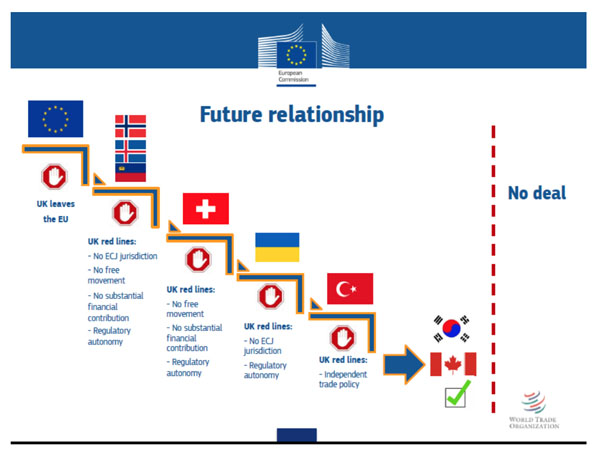

Brexit talks

Theresa May tries to stick to her course, fueling the economy on both the EU and Great Britain sides. No-deal Brexit could mean separation from the European Union, fall in the value of pound and increase of the food prices.

Key dates:

September 30 – October 3 – Conservative party press conference. It is known, that some members of the Cabinet do not support May’s decision on the no-deal Brexit.

October 18 – the deadline for Brexit deal. However, it can be extended until the middle of November.

December 13-14 – European Union council meeting. If there is no deal until December, this meeting will be the last chance for the both sides to decide on the new agreement. If they reach the consensus, there will be the UK parliamentary vote on Brexit deal and European parliament ratification.

January 21, 2019 – the deadline for the British government to make a statement if there is a no-deal outcome.

March 29, 2019 – Brexit. Britain will leave the EU. In case of “deal” situation Britain will have a transition period, which will help businesses from the both sides to adapt to the changing situation.

December 31, 2020 - the end of the transition period.

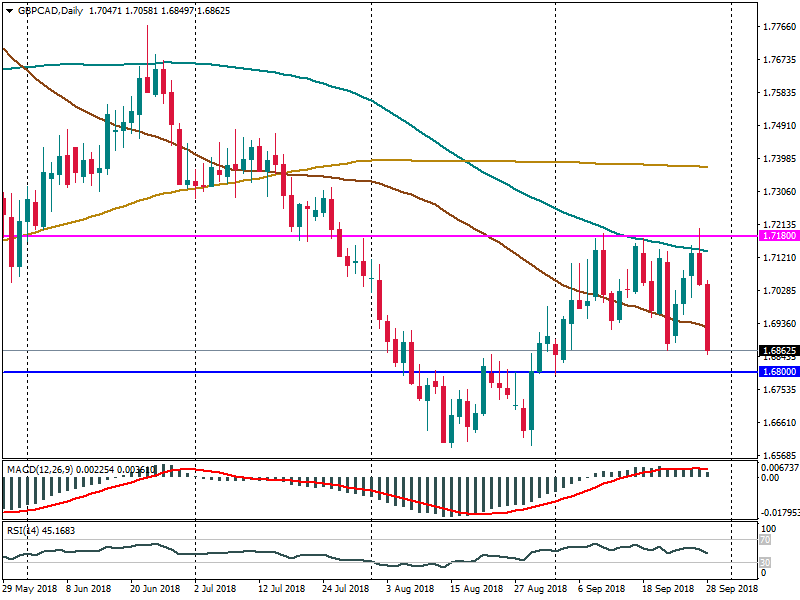

As we can see, the situation is unclear for both countries. However, Canada looked more confident in its position as the US Congress stated that there could be only a three-side agreement. This means that in the short-term period the loonie looks more stable against the British pound. The pair is trading in a ranging market between the support at 1.68 and the resistance at 1.718.

The GBP/CAD price move right now depends on how fast the countries will come to a “deal”. As many analysts see the “no-deal” scenario unlikely in both situations, we can expect clearer picture by the end of 2018.