The RBA Expects More Rate Hikes - Philp Lowe

"When I spoke at the Anika Foundation event last year, CPI inflation in Australia had been below 2 percent for a number of years and, in underlying terms, was just 1.6 percent. Today, CPI inflation has risen to 6.1 percent, and underlying inflation is 4.9 percent. These are the highest rates in many years." - Lowe.

Speaking at the Anika Foundation Fundraiser in Sydney, the governor of the Reserve Bank of Australia revealed that the current discrepancies between the annual inflation forecasts and the actual values have caught everyone by surprise. Last year, the RBA forecasted 2022 inflation rates to be just 1.75%, whereas so far this year, there are reasons to expect 7.75% CPI inflation rates - a big forecast miss! To counteract this, Mr. Lowe has established the need for the RBA to continue hiking interest rates in hopes of reaching the flexible inflation rate targets. He made it clear, however, that the pace of hikes would be much slower.

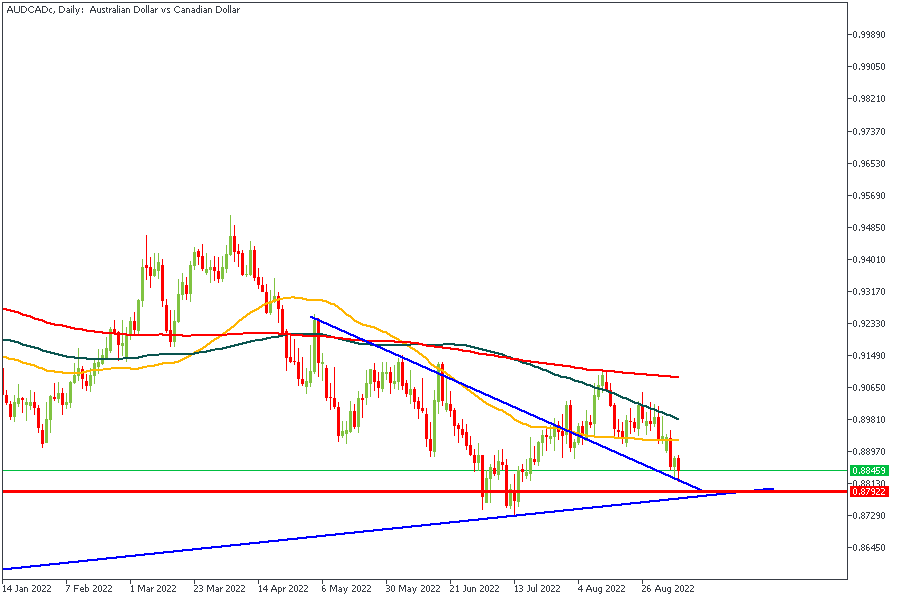

AUDCAD

As we expect continued hikes in interest rates from the RBA and forecasted increases in unemployment rates by the national statistical office of Canada (to be released Friday, 09th September), fundamental factors seem to support a bullish correction on AUDCAD. Technically speaking, the market is trading close to the Daily Support at 0.87922 and has retested a major trendline from 2020.

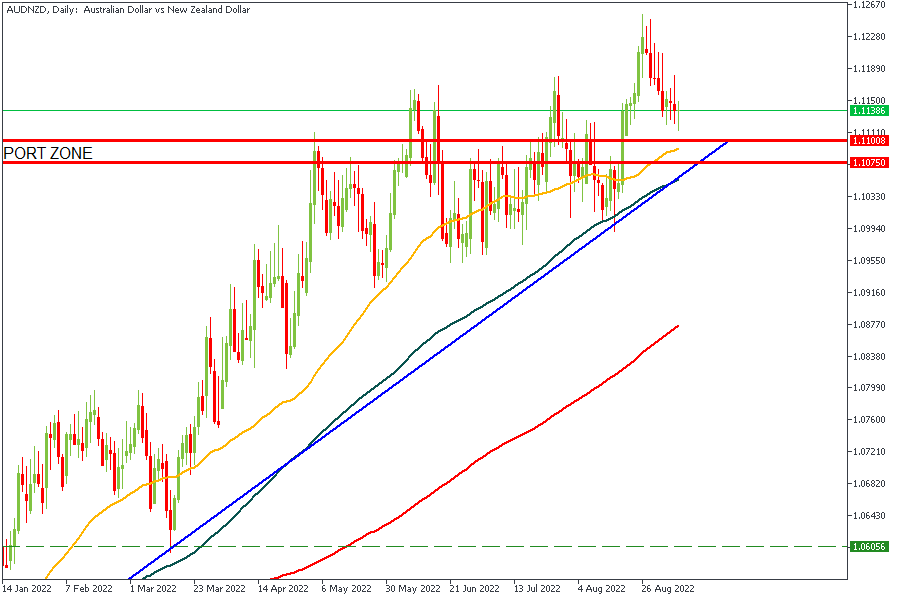

AUDNZD

The Daily Support zone between 1.11008 and 1.10750 is already within reach of the current price action on AUDNZD, and offers the Moving Average 50 and a major trendline as a confluence(img.02)

AUDUSD

The major trendline aside, price is also trading between the daily support zone at 0.67399 & 0.66633, thus increasing the chances of a bullish correction, possibly back to the 50-MA or even higher.