Trading plan for July 4

- On Tuesday, the US dollar index couldn’t break the psychological level at $95 again and turned to the support at $94.50. On Wednesday, no important economic data will be released. As a result, there are risks of the further fall. If the index breaks the support at $94.50, the next one will lie at $94.20. If there is some positive news for the USD, the index will be able to return to the psychological level at $95.

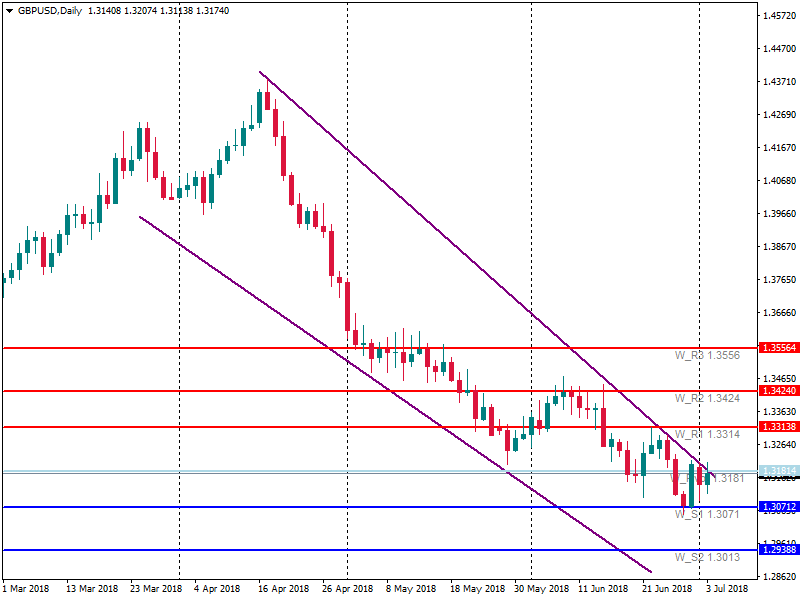

- On Tuesday, the pound strengthened because of the positive economic data. The construction PMI figure was greater than the forecast (53.1 vs 52.6). As a result, GBP/USD tested the resistance at 1.3180 (the pivot point and the trendline). To break the resistance, the GBP needs an additional support. On Wednesday, traders will look at services PMI data (11:30 MT time). The forecast is weaker than the previous data. However, if the actual one is greater than the forecast, the pound will strengthen. If the GBP/USD pair manages to break the resistance at 1.3180, the next one will lie at 1.3315. Otherwise, the pair will return to the support at 1.3070.

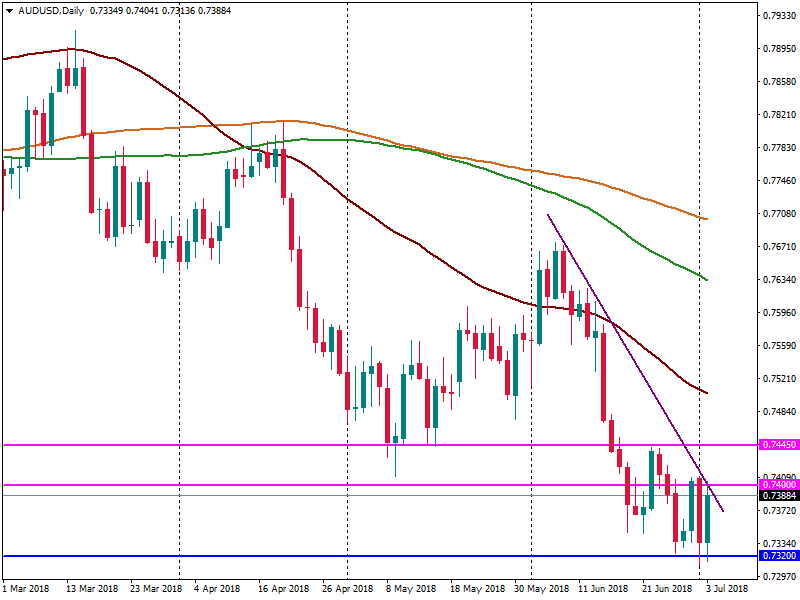

- Wednesday is an important day for the Australian dollar. Retail sales and trade balance data will be released at 4:30 MT time. The forecast is mixed. If the actual data are greater than the forecast, the Australian dollar will strengthen. O Tuesday, AUD/USD managed to rebound from the support at 0.7320 and reach the resistance at 0.74 (the trendline). Only positive economic data will be able to pull the pair above the trendline. If the pair manages to break the trendline, the next resistance is at 0.7445. Otherwise, the pair will reverse to the support at 0.7320 again.