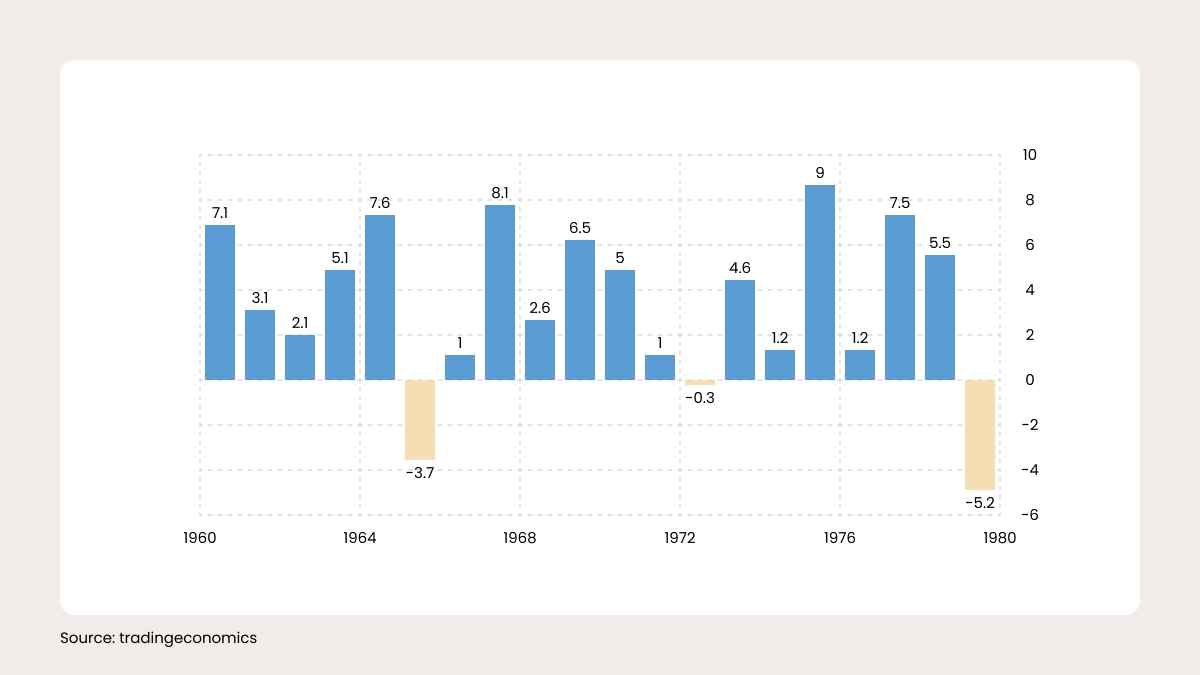

Source: tradingeconomics

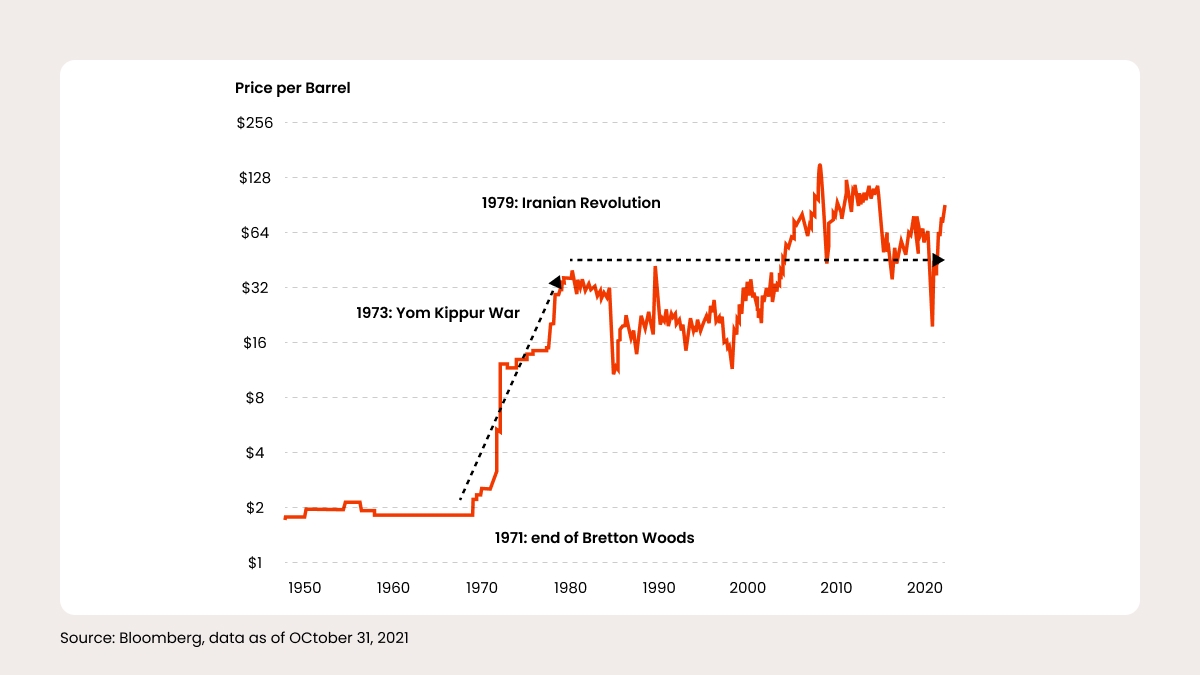

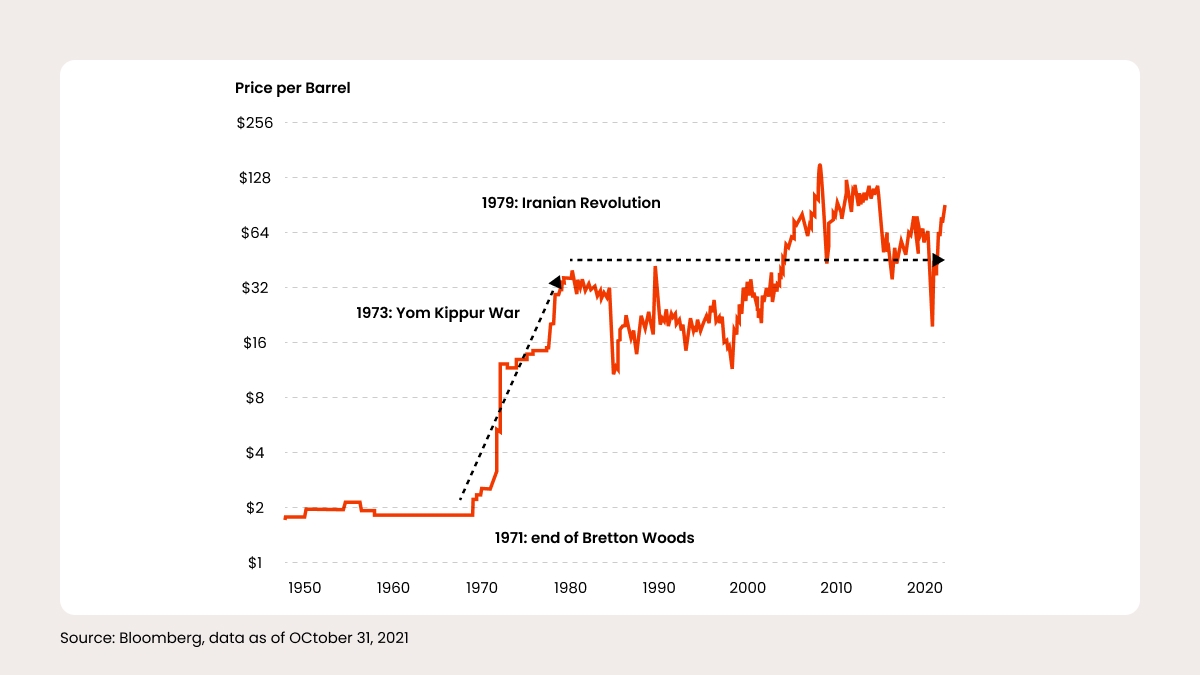

That’s not all that happened in the 1970s. The Bretton Woods Agreement pegged the USD to gold and played a significant role in post-World War II economic recovery. However, the system began to break down in the late 1960s due to increasing global economic imbalances and the inability of the US to maintain the fixed exchange rate between the dollar and gold. In 1971, the US abandoned the gold standard, and the Bretton Woods system effectively collapsed. The end of the agreement caused oil prices to skyrocket, making Black Gold the best investment of the decade.

Source: Bloomberg, data as of October 31, 2021

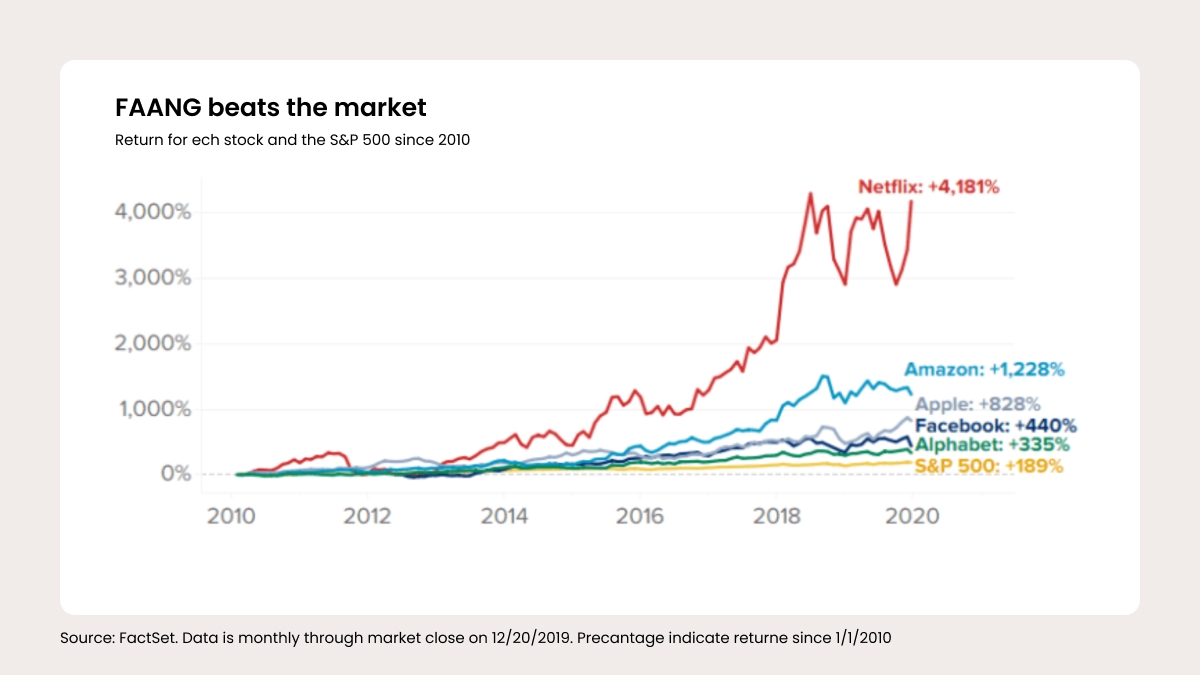

One of the greatest investment ideas of the last century was the emergence of the tech industry. Many tech companies, such as Apple, Microsoft, and Amazon, have grown to become some of the largest and most profitable companies in the world. Investing in these companies early on, during their growth phase, could have resulted in significant returns for investors.

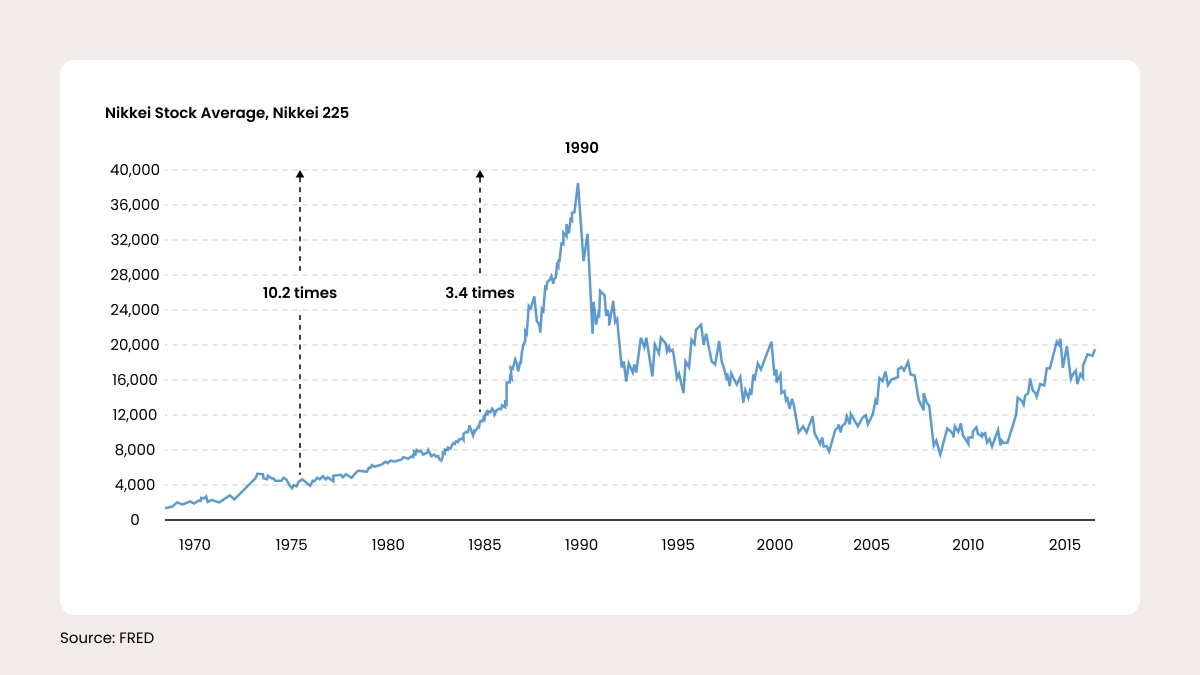

The 1980s: the rise and fall of Japan

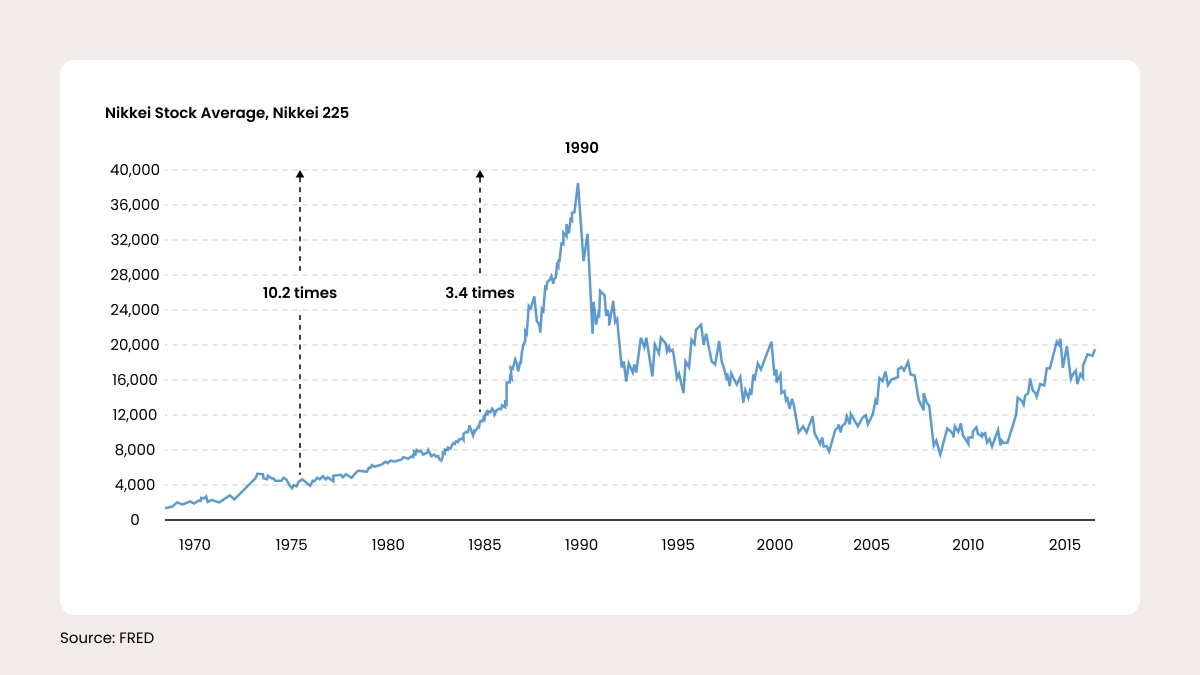

The Japanese stock market experienced a significant rise and fall in the 1980s, with the most dramatic events occurring at the end of the decade. In the late 1980s, the Japanese stock market underwent a rapid expansion known as the “bubble economy,” driven by economic growth and speculation. During this time, stock prices soared to record highs, and the value of real estate and other assets also rose dramatically.

However, this bubble eventually burst, leading to a sharp decline in stock prices and a recession in the Japanese economy. The stock market crash of 1990 wiped out billions of dollars in wealth and caused many companies to go bankrupt. Despite efforts to stimulate the economy, the stock market didn’t recover, and the Nikkei 225 (JP225) index is still lower than it was in the 1980s.

Source: FRED

The 1990s: the time before the dot-com bubble

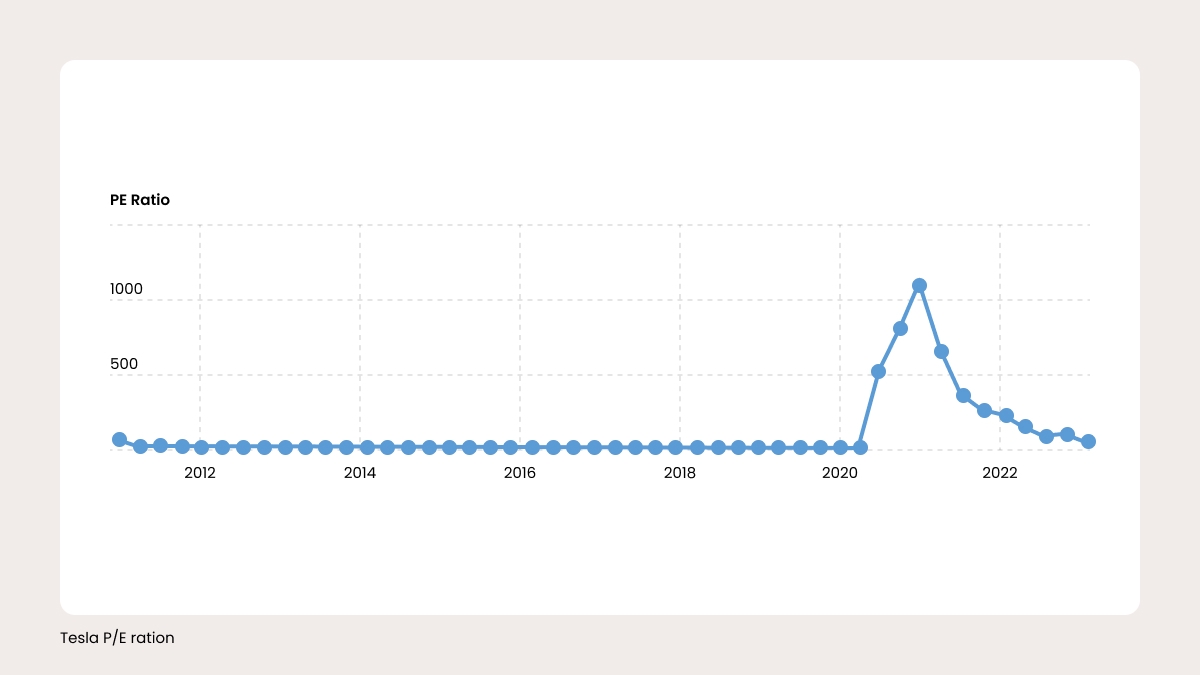

The internet came out of nowhere, creating hype and extolling internet companies, which people used to call “dot-com companies.” Investors started to overvalue any company that worked with the internet, and the world started to think internet companies were going to continue to grow incredibly fast and never stop. Driven by several other factors as well, including a robust economy and low interest rates, by the late 1990s, a bubble had formed.

However, this bubble eventually burst, leading to a significant decline in stock prices and a downturn in the economy. Some companies, like ATT, never fully recovered. Others, like Amazon, needed almost ten years to reach their previous all-time high. On average, the US100 index (NASDAQ) lost 83% of its market value. However, the index had gained almost 3000% over the decade.

Source: tradingview

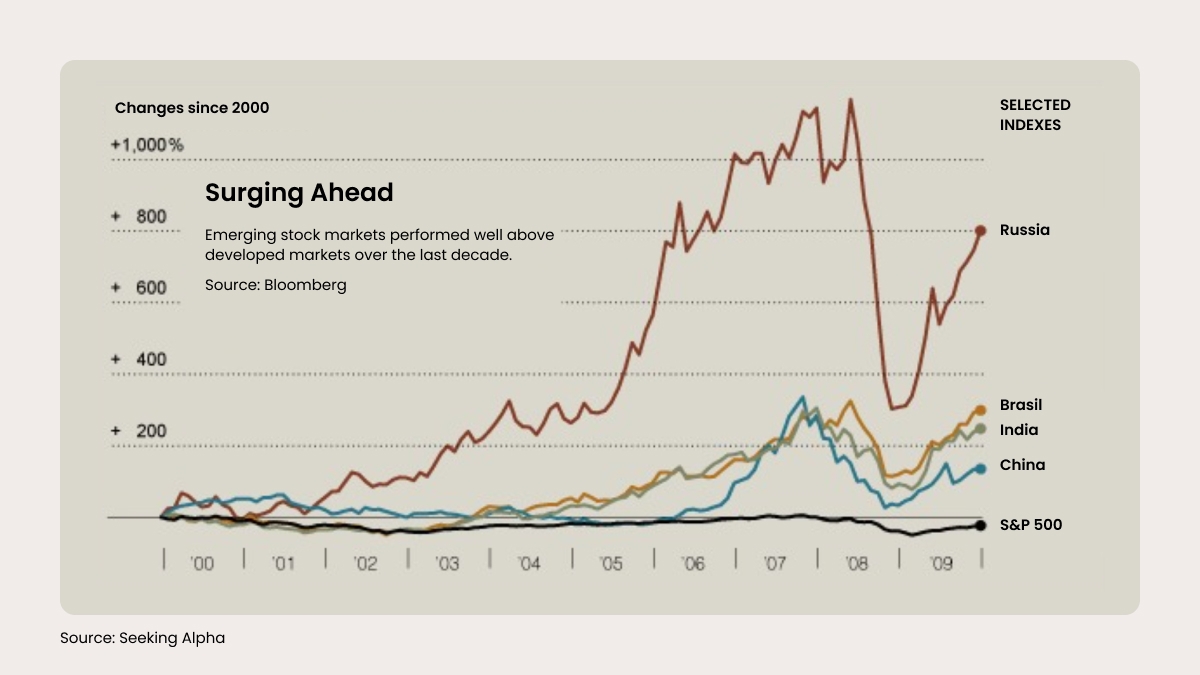

Emerging markets in the 2000s

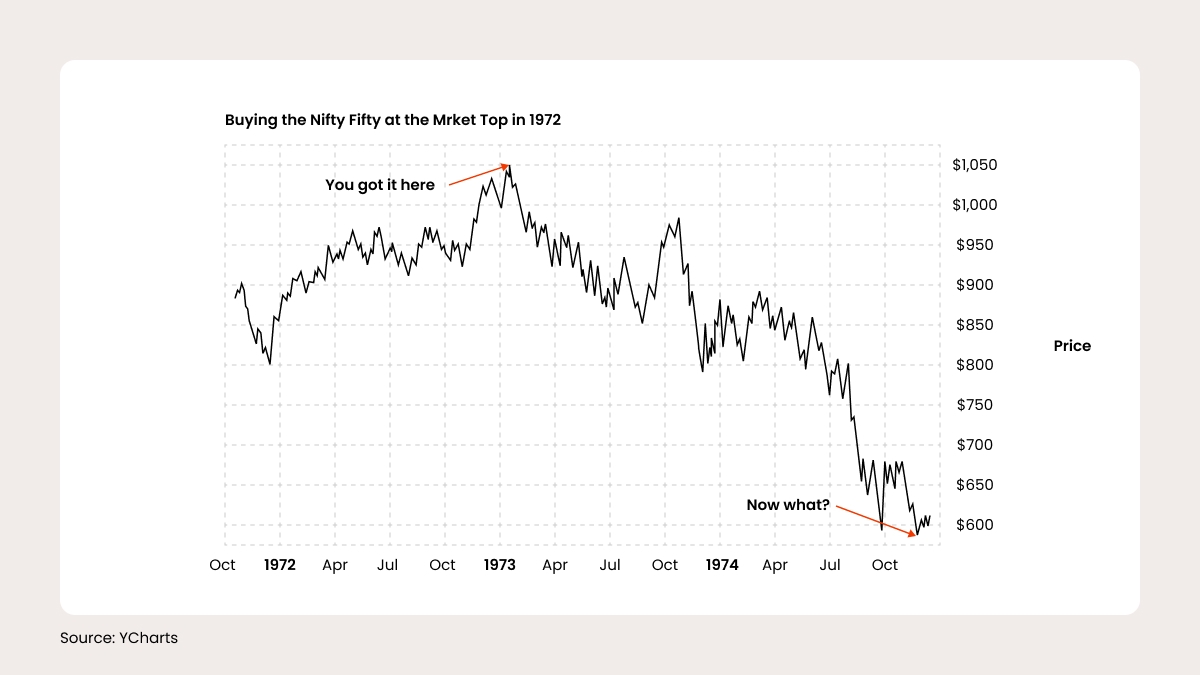

As you can see, overvaluation is a common problem that follows the market almost every decade, leading to high risks and huge losses. History repeats itself, and in the 2000s, we witnessed another round of overvaluation. This time, emerging markets were in the limelight.

Huge flows of foreign investments went to emerging countries with higher risks and rewards.