Advantages of using economic calendars

Knowing how to read economic calendars is an invaluable skill. Let's look at the benefits of economic calendars and how they can help you become a successful trader.

- Awareness. If you don't consult the economic calendar, you might be taken by surprise when a major release happens and affects the market. Learning about upcoming news may inform you of potential impacts in advance.

- Better planning. When you make a trading plan, you set specific rules for yourself to follow. When an important economic event occurs, your trading plan may become useless. But when you know about these events and how they might affect the markets in advance, you can prepare additional strategies and rules to take advantage of new developments.

- Comprehensive analysis. While technical analysis helps you better understand the current market sentiment, fundamental analysis gives insight into when and how the market sentiment may change. By combining various types of market analysis tools, you can get more data to make more reliable trading strategies.

Remember to be careful about economic calendar trading. If an event brings unexpected news, causing the price to move in the opposite direction of the anticipated one, you risk getting caught up in volatile markets. Always think about all potential outcomes before committing to only one strategy.

How to use the economic calendar for Forex trading

Forex trading is directly connected to the exchange rate of national currencies. Therefore, the economic releases and news related to the state of a country's economy, and affecting the value of its currency, will also impact the Forex market.

Main strategies

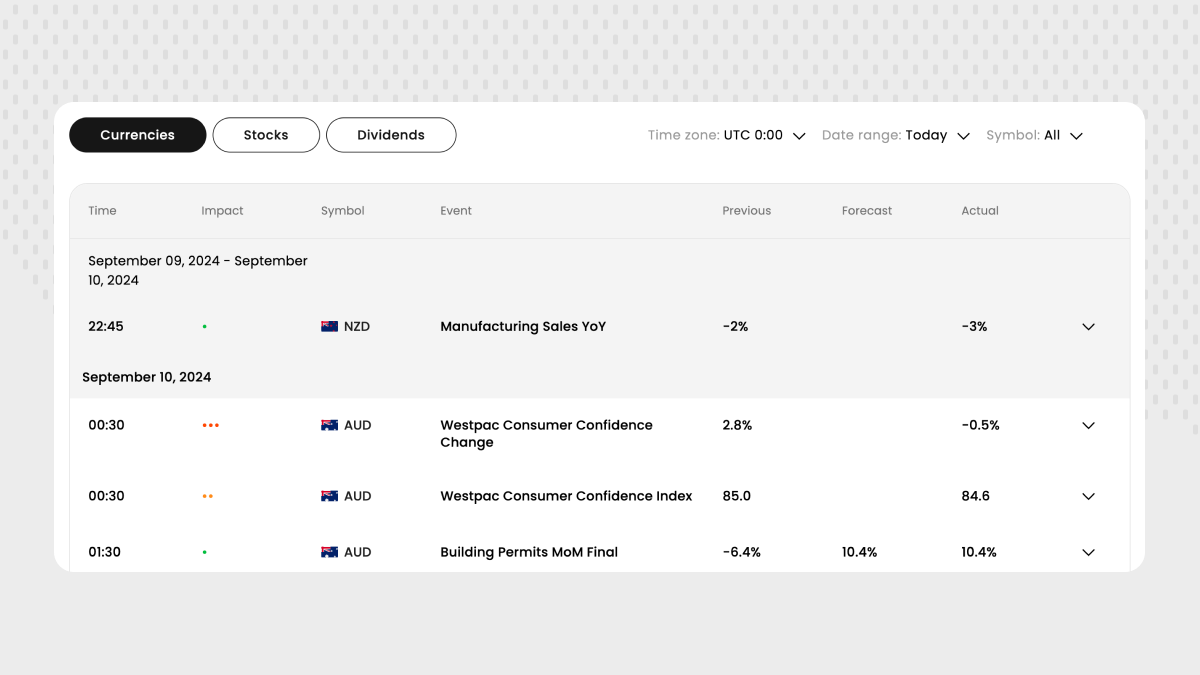

Most Forex traders use a Forex calendar to determine which releases may affect their preferred currency pairs. Generally, traders follow two main courses of action when these events occur: avoidance and price movement capitalization.

Because major economic news always causes upheavals in the financial markets, many traders prefer to avoid trading during such releases. As more traders join the market in an attempt to profit from the news, market volatility rises, making it difficult to find reliable entry or exit points.

At the same time, the volatility also attracts traders who like to capitalize on short-term price changes, e.g. by scalping. These strategies are considered exceptionally risky, so novice traders shouldn't try them.

Economic releases to follow

As mentioned earlier, Forex traders should pay close attention to news and events concerning the state of the local and global economies. Such events can include central bank announcements, inflation rate reports, labor market and GDP data, commodity prices and supply changes, etc.

It's also essential to follow news about major world currencies, especially the US dollar. USD has long been accepted as the global reserve currency, so the state of the US economy can impact all Forex and other types of financial markets.

Use a combination of tools

Knowing fundamentals is extremely important for successful trading, but using other methods to analyze the market is also necessary. While engaging in economic calendar trading, don't forget to use technical analysis tools to get more detailed information about the market and its potential.

Summary

Trading is a very challenging yet rewarding business that requires a lot of skill. But even if you build the most elaborate trading plan, you can lose money if you ignore the industry updates. The economic calendar is a great tool to help you keep up with all upcoming events related to your preferred trading assets. Easy to use, economic calendars will show you when a particular event is scheduled and how it can impact financial markets. So, to boost your Forex trading profits, check out the economic calendar on our website or in MetaTrader by clicking View – Add toolbox – Calendar and find ways to incorporate it into your toolkit.