Choosing the volume of a trade is a big challenge for beginner traders. Let’s sort it through!

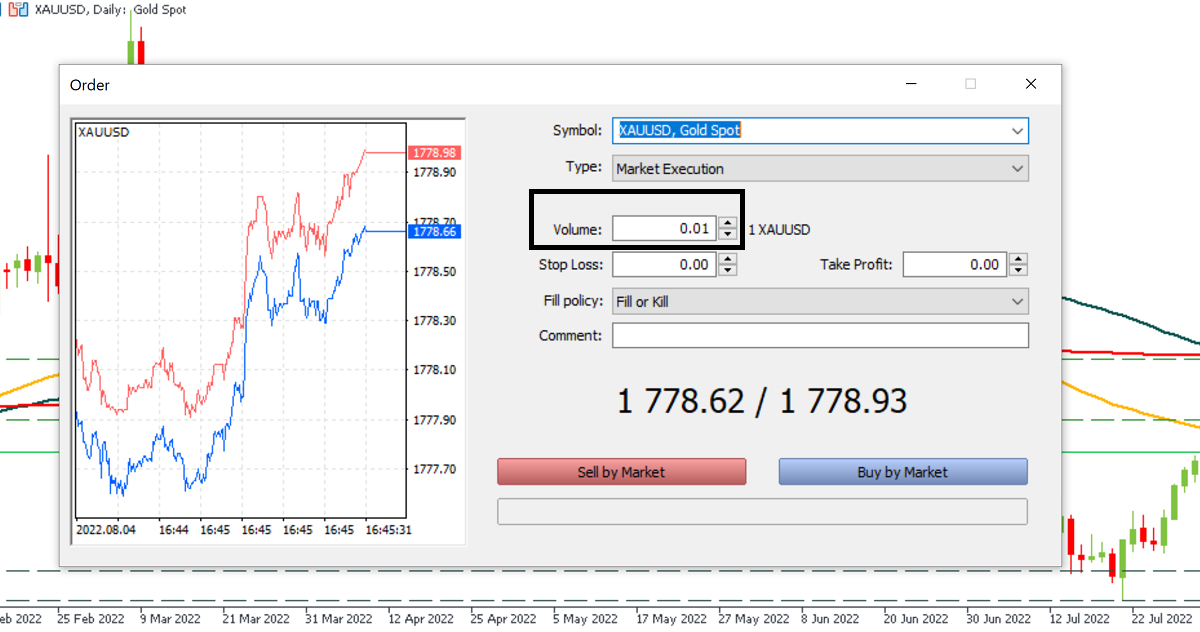

To open a trade in MetaTrader, you click on a new order button. In the window that appears, you choose the symbol (a currency pair, a metal, an index, or a stock you want to trade). You also need to decide on volume or, in other words, the amount of money you’ll spend on this trade.

Trade volume is important because it will determine how much money you will gain or lose in this trade.

There are several ways to choose the size of your position.

Fixed Forex lot size

The idea here is that a trader uses the same trade volume in lots for every trade. This way is simple to understand for those who have only recently started trading. It’s recommended to choose small trade sizes. It’s possible to change the position size if the size of your account significantly changes. The point value will be the same for you all the time.

Example

You have $500 on your account. With 1:100 leverage, this amount will be enough to make 50 trades of 0.01 lot each. Each trade will require a $10 margin.

If you use the same lot size every time, your account can show stable growth. This is a good option for those who can’t easily adjust to the exponential growth of their trade volumes because of the higher stress levels that are associated with it. More experienced traders, however, may want to have an approach with greater flexibility and bigger potential account expansion.

Trade volume as a percentage of equity

In this case, you choose the size of your position as the percentage of your equity. If your equity increases, so do your position sizes. This, in turn, can lead to the geometric growth of your account. At the same time, it’s necessary to remember that the declines of your account after losing trades will be bigger as well.

The recommendation is not to use more than 1-2% of your deposit for one trade. This way even if some of your trades aren’t successful, you won’t lose all your money and will be able to keep trading.

Here’s a formula of the position size in lots:

Lots to trade = Equity * Risk(%) / Contract Size * Leverage

Example

You have $500 and decide that the acceptable risk level is 2% of your account. With 1:100 leverage, your need to choose ($500 * 0.02) / 100,000 * 100 = 0.01 lots.

With $1000 on your account, you will be able to trade ($1000 * 0.02) 100,000 * 100 = 0.02 lots.

This approach is not the best option for smaller accounts. It may happen that if you have a large loss, the risked percentage will be too small to act as a margin even for the smallest lot size. As a result, you’ll be forced to break your risk management rules and allocate more money to keep trading. Moreover, as this approach doesn’t take into account what’s happening on the price chart, the size of Stop Loss it allows may be too big.

As the position size depends on equity, the loss will make the position size smaller, so it will be harder for a trader to recover the account after a drawdown. At the same time, if the account becomes too big, the size of each trade may become uncomfortably big as well.

Trade volume as a percentage of equity with a Stop Loss

Here you base your position size not only on the predetermined percentage risk per trade but also on your Stop Loss distance. Let’s break this process in 3 steps.

Step 1. The recommendation stays the same: don’t risk more than 1-2% of your deposit/equity for one trade.

If your equity is $500, 2% risk will cost you $10.

Step 2. Establish where the Stop Loss should be for a particular trade. Then measure the distance in points between it and your entry price. This is how many points you have at risk. Based on this information, and the account risk limit from step 1, calculate the ideal position size.

If you want to buy EURUSD at 1.11000 and place a Stop Loss at 1.10500, your trade risk is 500 points.

Step 3. And now you determine position size based on account risk and trade risk. In other words, you need to determine the number of lots to trade that will give you the risk percentage you want with the stop distance that fits your trading system.

The important thing is to adjust your position size to meet the desired stop loss and not the other way round. Your risk will be the same in every trade, but the position size may be different because Stop Loss distances may vary.

Remember that a 1,000-unit lot (micro) is worth $0.01 per point movement, a 10,000-unit lot (mini) is worth $0.1, and a 100,000-unit lot (standard) is worth $1 per point movement. This applies to all pairs where the USD is listed second, for example, EURUSD. If the USD is not listed second, then these point values will vary slightly. Note that trading on a standard lot is recommended only for professional traders.

Use the formula:

Lots to trade = Equity * Risk% / (Stop Loss in Points * Point Value) / 100

Example

As it turns out, you will be able to trade $500 * 0.02 / (500 * $0.01) = $10/$5 = 2 micro lots. In other words, you should put 0.2 as the trade’s volume. The outcome is in micro lots because the point value used in the calculation was for a micro lot.

Your next trade may only have a 200-point stop. In this case, your position size will be $10/(200x$0.1) = $10/$20 = 0.5 mini lots, or 5 micro lots.

If you use this method, your position sizes will increase proportionally to the increase in your account (the opposite will happen if your equity decreases) and will be adjusted for the situation on the charts. As with the simple equity percentage technique, however, this option may also leave little room for maneuver if your account is small. In addition, this method won’t suit you if your trading strategy doesn’t involve knowing the exit levels in advance.

Conclusion

So, what is our ultimate recommendation for choosing a position size? It’s actually that you should pick the option you feel most comfortable with. As you can see, all techniques have their advantages and drawbacks, so the method that works well for one trader may not suit another. Much will depend on your trading strategy: does it imply big profit but the risk of big drawdowns as well or does it offer multiple opportunities for smaller profit? That will matter for your decision.

Although all these calculations related to position sizing may seem unpleasant, it’s in your best interest to get to the bottom of them. Knowing how to choose the right position size will make you a more disciplined trader and provide you with sound risk management. This is the way to maximize your profit and minimize your loss!